Sales for AMOLED stack materials for all applications are expected to grow at a 17% annual rate from $928 million in 2019 to $2.06 billion in 2024, according to the latest update of DSCC’s Quarterly AMOLED Material Report. The report details all aspects of AMOLED materials, including multiple applications, supplier matrices and cost comparisons.

This quarter’s report incorporates the latest update to DSCC’s capacity and utilization outlook for AMOLED, and we expect that the growth of AMOLED in TV and phones, as well as other applications, will continue to drive material sales. This quarter’s outlook on material sales growth is reduced from last quarter, because of reduced AMOLED capacity growth in the forecast, particularly with OLED TV capacity. Compared to last quarter, we expect a slower capacity ramp for LGD’s Guangzhou fab in 2020-2021, and we have removed LGD’s Gen 10.5 fab from our forecast.

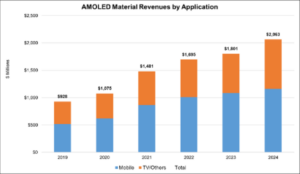

Our forecast for AMOLED material revenues by application is shown in the first chart here. Because of slower growth in OLED TV, we expect that revenues from small and medium panels in mobile applications will continue to generate more than 50% of all AMOLED material revenues. We expect materials revenue from Mobile applications to increase at an 18% CAGR to $1.16 billion, while revenue from AMOLED TV and other large-screen applications will increase at a 17% CAGR to $904 million.

AMOLED Material Revenues by Application, 2019-2024

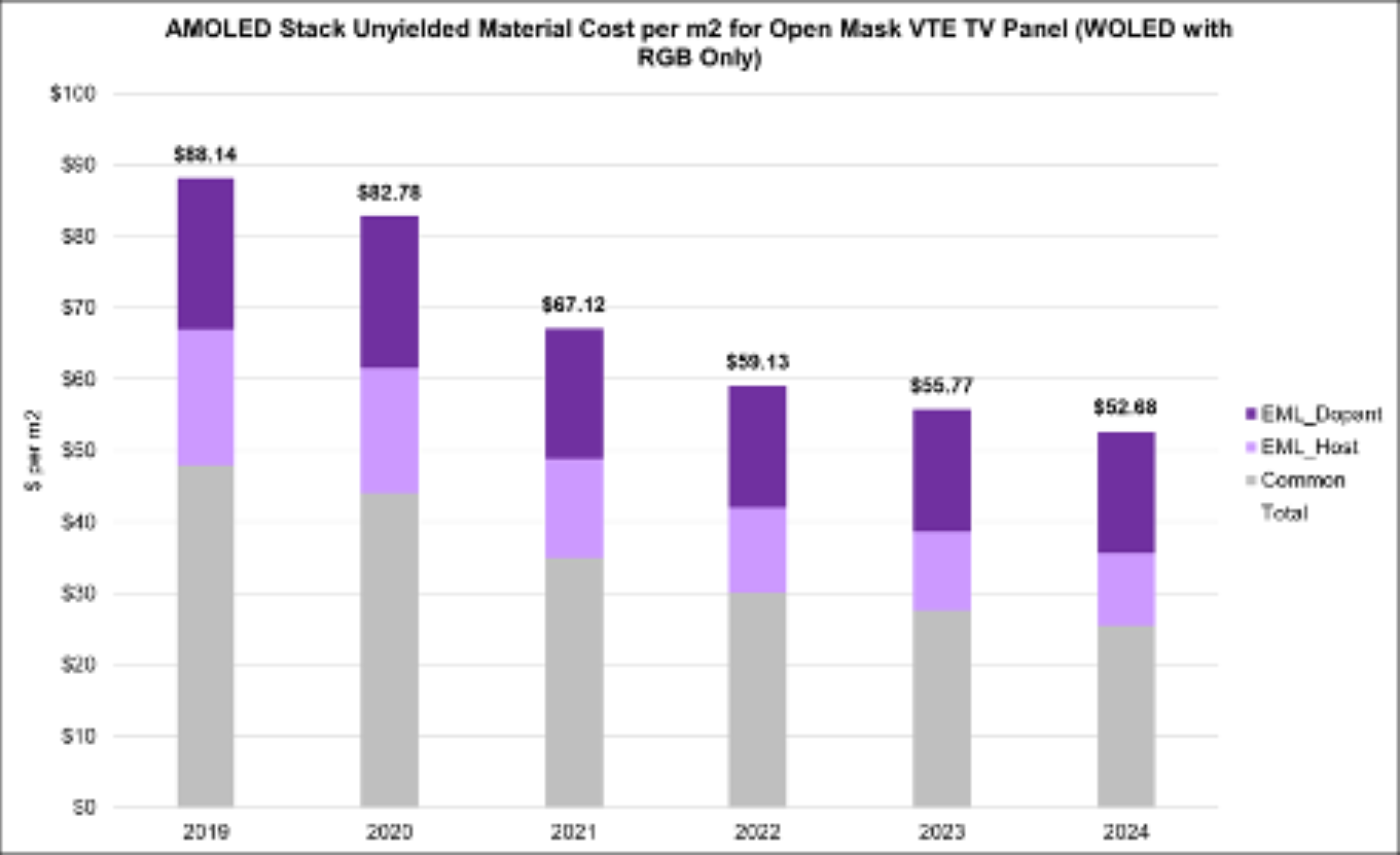

The report details the OLED stack configurations of all the major AMOLED product architectures, including Small/Medium panels with RGB pixel structure, White OLED (WOLED) by LGD for TV panels and QD-OLED by Samsung. The stack profiles, along with estimates of material thickness, material utilization and material prices, form a picture of the unyielded stack cost for each AMOLED product architecture; the stack cost for WOLED is shown in the next chart. Based on steady, incremental improvements in material utilization and material price reductions, we expect that unyielded stack costs per square meter for WOLED will decline from $88.14 in 2019 to $52.68 in 2024, which will be a meaningful contributor to cost reduction required for LGD to keep OLED TV competitive with aggressively priced LCD TV. For LGD the yielded cost is more important, and yield improvements at both its Korea and China fabs will be critical to bringing overall panel costs down.

Unyielded OLED Stack Material Cost per Square Meter, 2019-2024

This quarter’s update includes a major re-work of our cost profile for AMOLED with Inkjet Printing technology. JOLED has commenced mass production of inkjet printed AMOLED panels on a Gen 5.5 line, and has signed a technology development agreement with CSOT. DSCC now expects that CSOT’s T9 Gen 8.5 fab will start mass production in 2024 with inkjet printing of AMOLED panels.

Our report provides an estimate of AMOLED stack material costs for IJP panels, which are expected to be as much as 50% lower than unyielded WOLED stack costs in 2024. Similarly, we expect that the OLED stack costs for QD-OLED will be substantially lower than those for WOLED. When QD-OLED is introduced starting in 2021, its unyielded stack costs are expected to be 30-40% lower. Of course, for both QD-OLED and IJP OLED the unyielded stack cost is only a part of the picture, because the yields on the mature WOLED technology will certainly be higher than those for QD-OLED and IJP OLED in their initial stages, and the color converter in QD-OLED will be substantially more expensive than the color filter used in WOLED. While we expect the OLED stack cost of QD-OLED to be lower than that of WOLED, we expect the total product cost of QD-OLED to be higher.

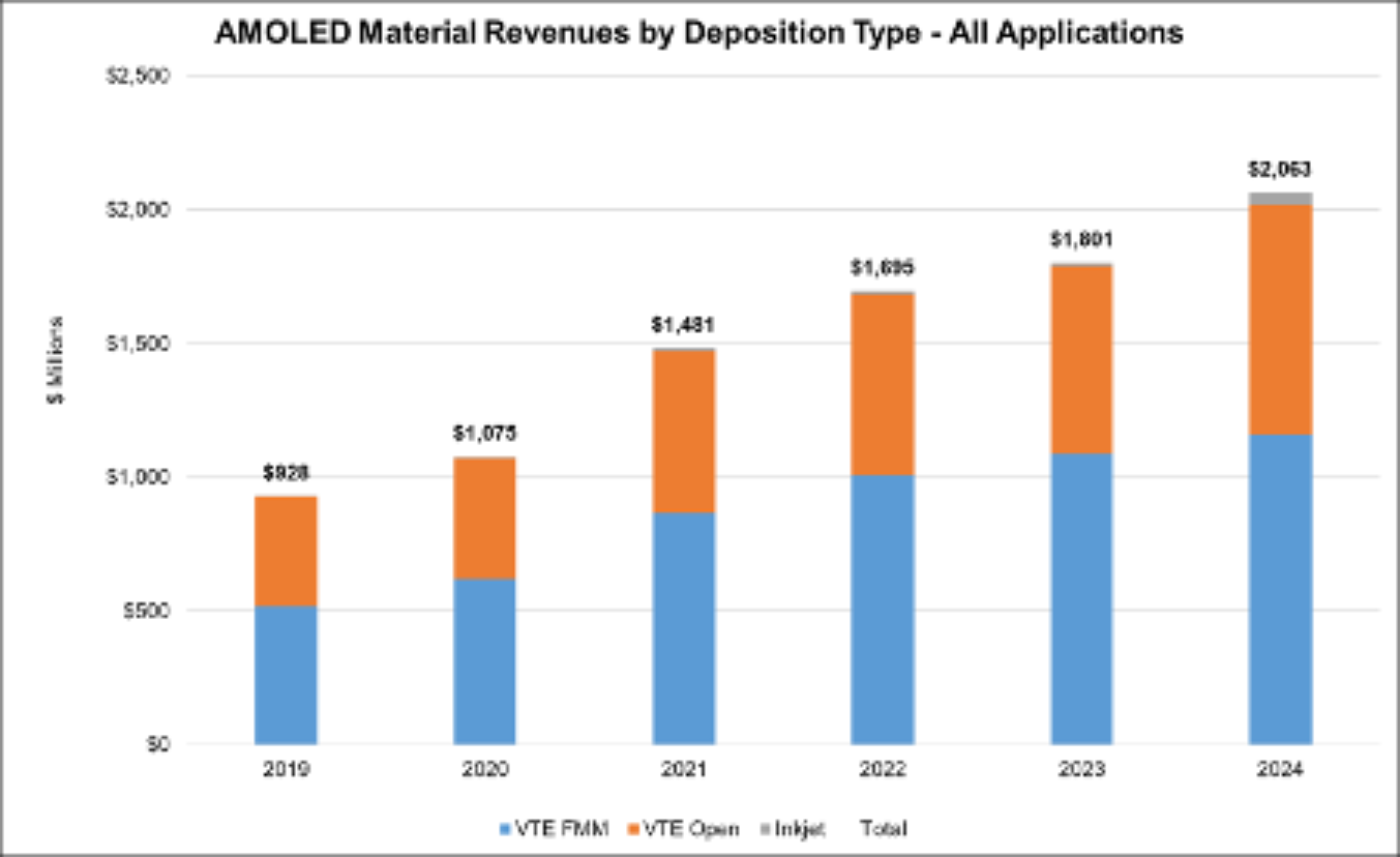

While inkjet printing with soluble AMOLED materials promises improvements in both performance and cost, almost all of the recent and upcoming investment in AMOLED has been for evaporative deposition. Therefore, we expect that evaporated materials will continue to dominate the market, as shown in the next chart, whether via fine metal mask for small/medium displays or via open mask for TV sizes.

Material Revenues by Deposition Type, 2019-2024

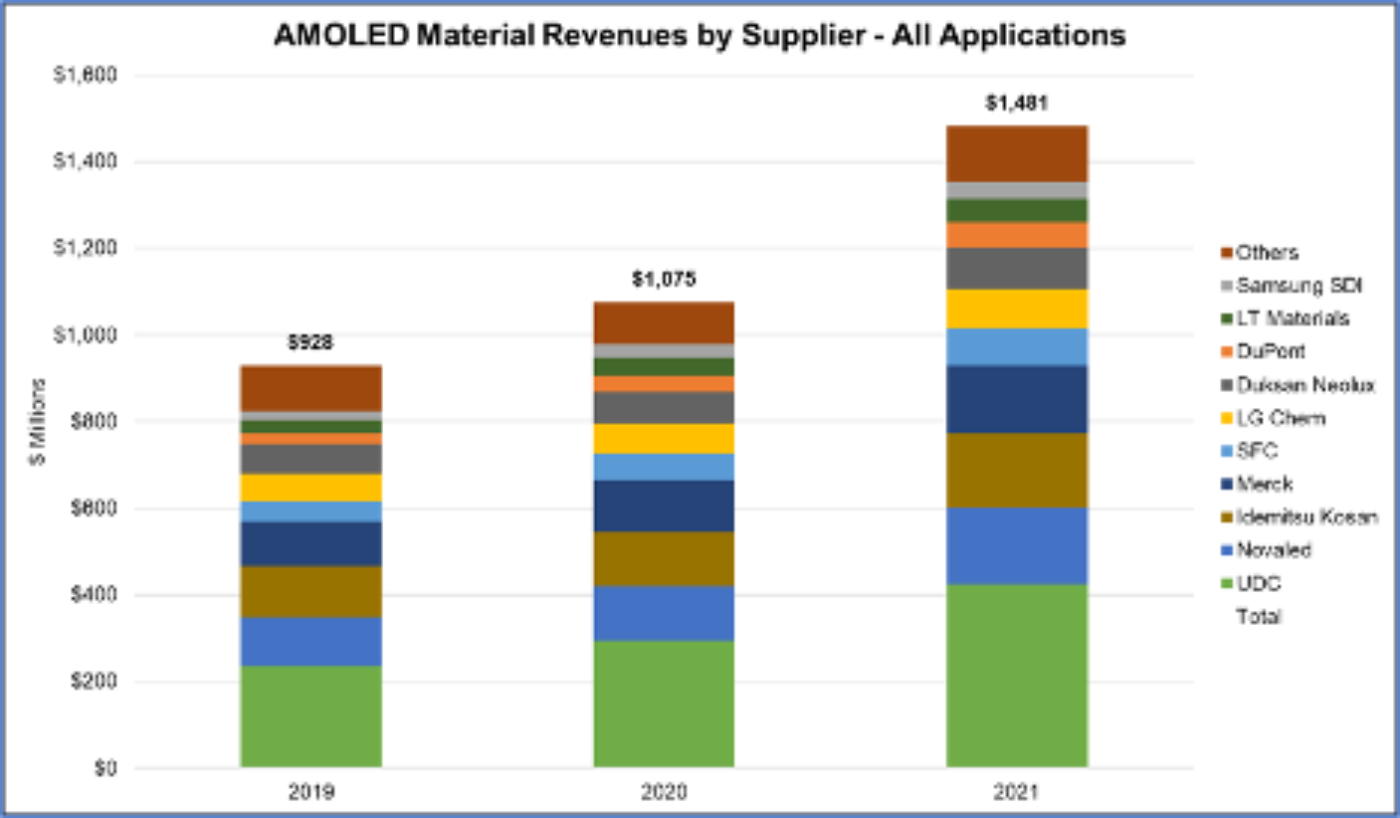

Based on the existing supplier matrix, the report includes a projection of AMOLED material revenues by supplier, as shown on the next chart. Starting this quarter we have restricted our projections for AMOLED revenues to 2020 and 2021, recognizing that supplier relationships can change more frequently than the underlying material market.

Universal Display Corporation (UDC) has been the #1 supplier in revenues for the industry, and we expect that to continue. Idemitsu Kosan, Novaled and Merck hold the number two through four positions among materials suppliers. These four companies are expected to capture 63% of industry revenues in 2021, but as the chart indicates there is a long tail of companies supplying materials into the industry.

AMOLED Materials Revenues by Supplier, 2019 – 2021

The DSCC Quarterly AMOLED Material Report includes profiles for all major AMOLED stack architectures, supplier matrices for the main OLED panel makers and revenue projections for 17 different material types and 20 material suppliers. For more information about the report, please contact Gerry McGinley at 770-503-6318, e-mail [email protected], or contact your regional DSCC office in China, Japan or Korea.