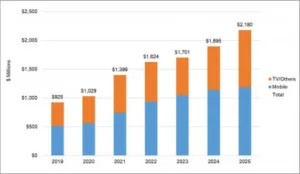

Sales for AMOLED stack materials for all applications are expected to grow by 36% in 2021 and to grow at a 15% annual rate from $927M in 2019 to $2.18B in 2025, according to the latest update of DSCC’s Quarterly AMOLED Material Report. This quarter’s report incorporates the latest update to DSCC’s capacity and utilization outlook for AMOLED.

We expect that the growth of AMOLED in TV and phones, as well as other applications, will continue to drive material sales. This quarter’s outlook includes an update of material pricing and some changes in our long-term forecast for pricing.

Our forecast for AMOLED material revenues by application is shown in the first chart here. We expect that revenues from small and medium panels in mobile applications will continue to generate more than 50% of all AMOLED material revenues through 2025. This is mainly because the new capacity for OLED TV, such as QD OLED and Inkjet Printed OLED will have lower material revenue per panel. While OLED Evo goes in the other direction by adding cost to the OLED stack, we expect that OLED Evo will represent only a small fraction of LGD’s output, rising to 10% in 2025, so the added revenue contribution from OLED Evo will be modest.

We expect materials revenue from Mobile applications to increase at a 15% CAGR to $1.19B. In comparison, while revenue from AMOLED TV and other large-screen applications will also increase at a 15% CAGR to $992M.

AMOLED Material Revenues by Application, 2019-2025

Source: DSCC Quarterly AMOLED Material Report

The report details the OLED stack configurations of all the major AMOLED product architectures, including Small/Medium panels with RGB pixel structure, White OLED (WOLED) by LGD for TV panels, QD-OLED by Samsung and OLED Evo by LGD. The stack profiles, along with estimates of material thickness, material utilization and material prices, form a picture of the unyielded stack cost for each AMOLED product architecture.

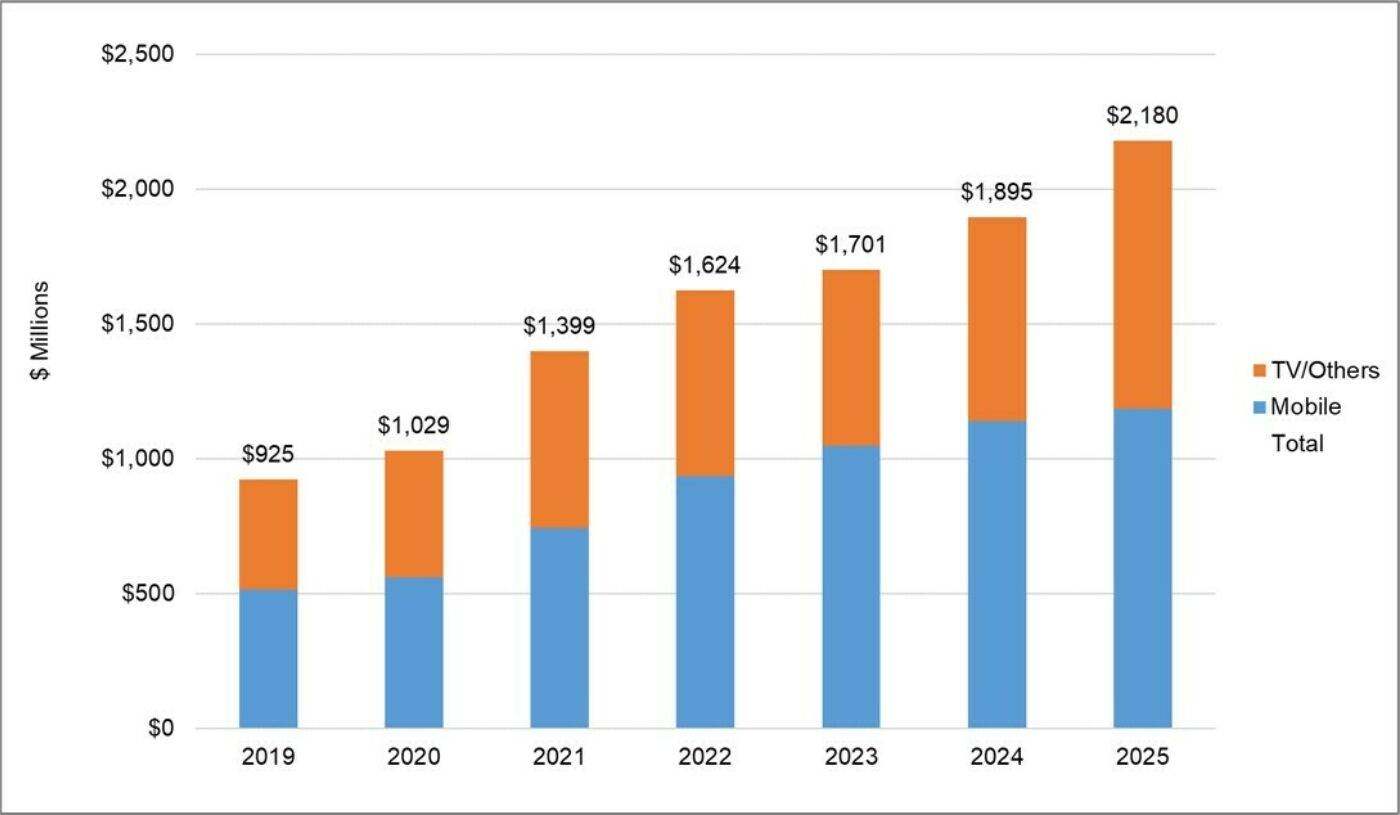

The following chart here shows our outlook for the material cost for LGD’s White OLED panels. We expect that steady, incremental improvements in material utilization and price will help LGD drive the unyielded stack cost of its standard WOLED panels from $88.14 per square meter in 2019 to $47.19 per square meter in 2025. With the additional emitting layer, we estimate that the unyielded stack cost of the OLED Evo panel adds almost $20 per square meter in cost. Although this figure also declines over time, we estimate the cost adder in 2025 remains more than $15 per square meter. With this continuing cost adder, we expect that OLED Evo will continue to be positioned as a premium product, and that the additional green layer will not be used on LGD’s mainstream products.

Unyielded Material Cost per m² for WOLED Panels

Source: DSCC Quarterly AMOLED Material Report

Our report provides an estimate of AMOLED stack material costs QD-OLED, which we expect will be substantially lower than those for WOLED. When QD-OLED is introduced starting later this year, its unyielded stack costs are expected to be ~25% lower than the standard WOLED. Of course, for QD-OLED the unyielded stack cost is only a part of the picture. The yields on the mature WOLED technology will certainly be higher than those for QD-OLED, and the color converter in QD-OLED will be substantially more expensive than the color filter used in WOLED. While we expect the OLED stack cost of QD-OLED to be lower than that of WOLED, we expect the total product cost of QD-OLED to be higher.

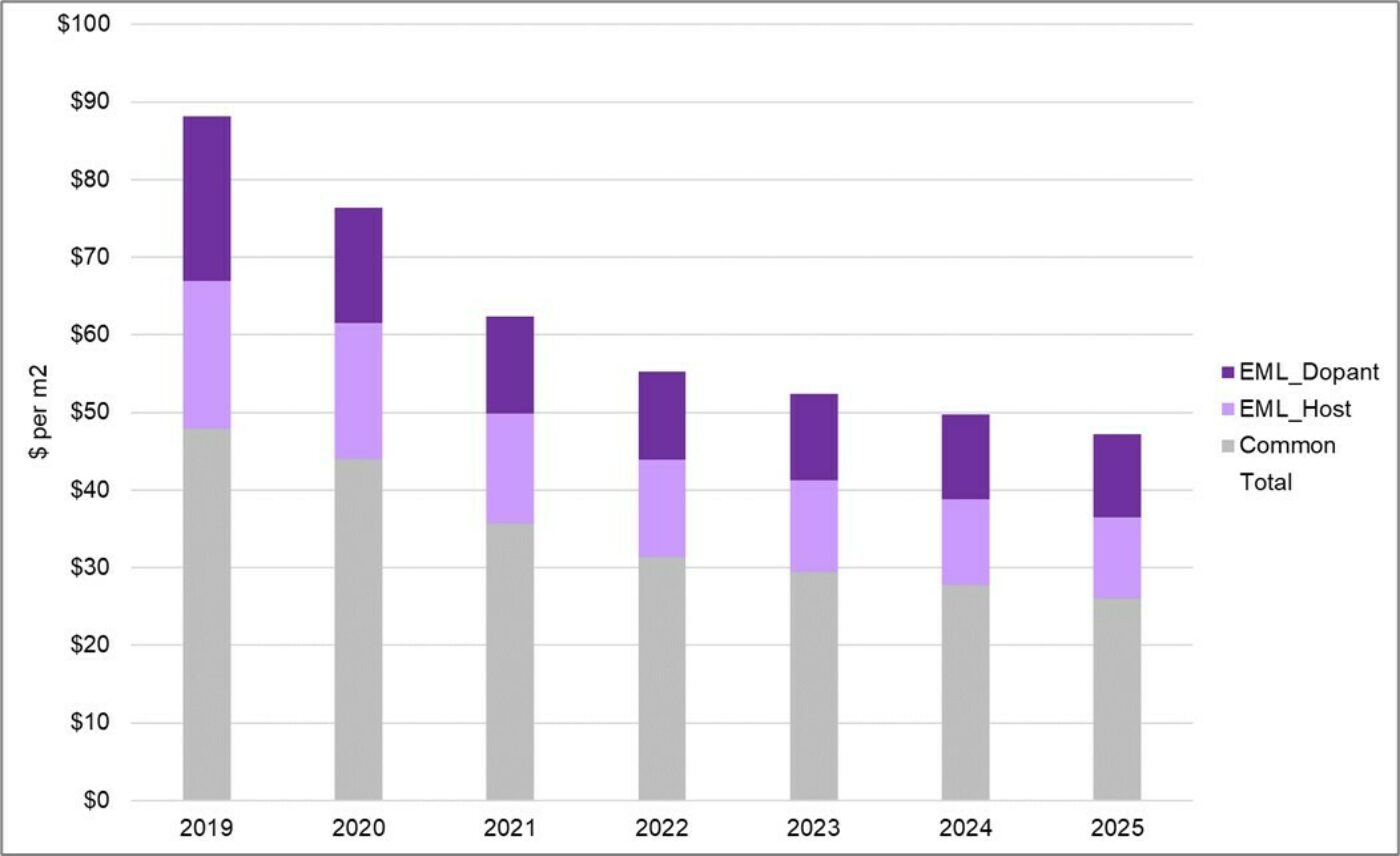

With CSOT’s planned investment in a Gen 8.5 AMOLED fab using inkjet printing with production starting in 2024, the revenues for soluble materials for inkjet-printed OLED will grow rapidly in 2024-2025. Nevertheless, the AMOLED materials market in terms of overall revenues will continue to be dominated by evaporated materials. Evaporated materials will remain the only type used for smaller AMOLED panels for smartphones and will continue to dominate the market for OLED TV panels. We expect that revenues from soluble materials for inkjet-printed OLED will grow from less than $1M in 2019 to $171M in 2025, when they will represent 17% of the TV/Other segment but still only 8% of the overall AMOLED materials market.

Material Revenues by Deposition Type, 2019-2025

Source: DSCC Quarterly AMOLED Material Report

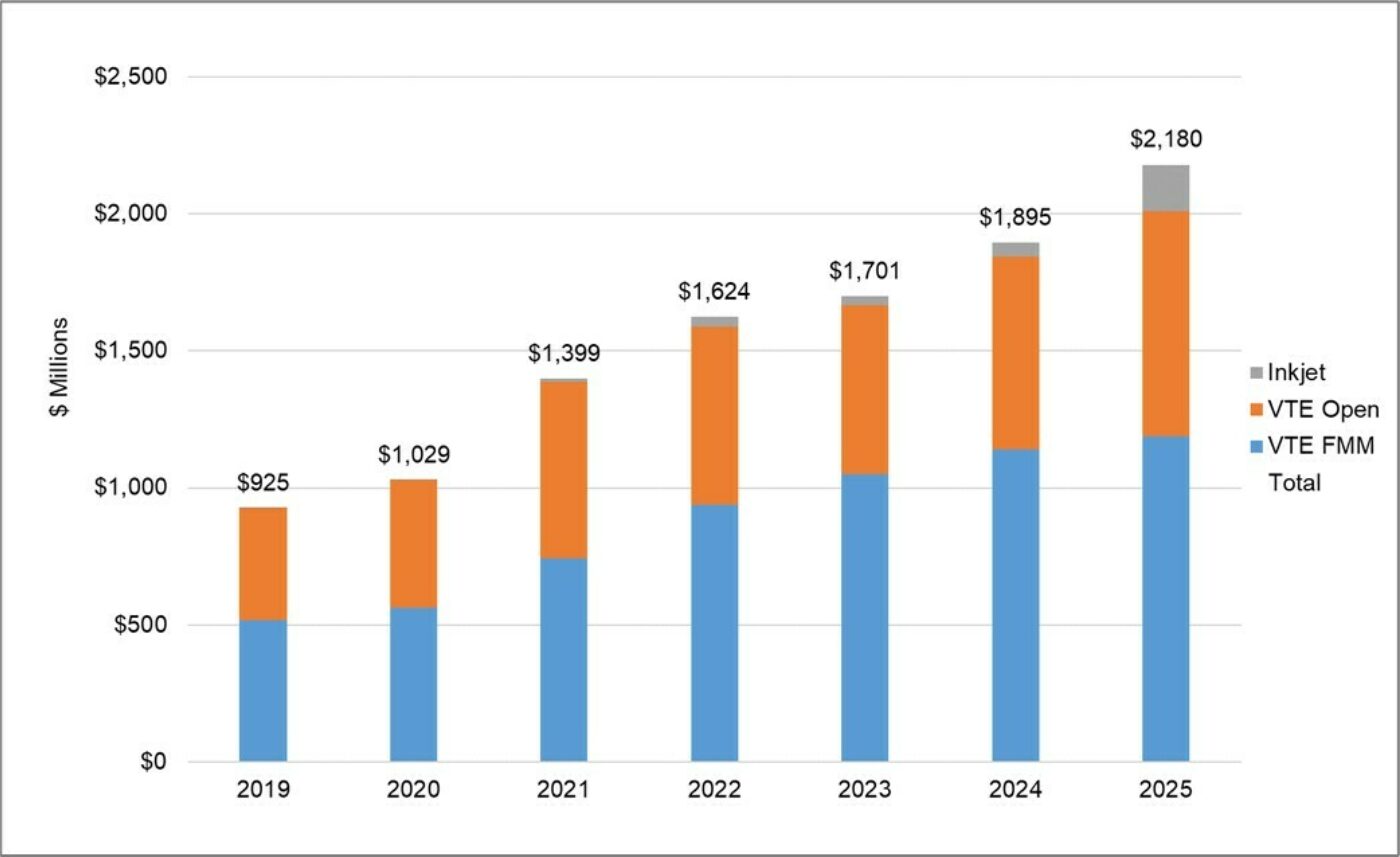

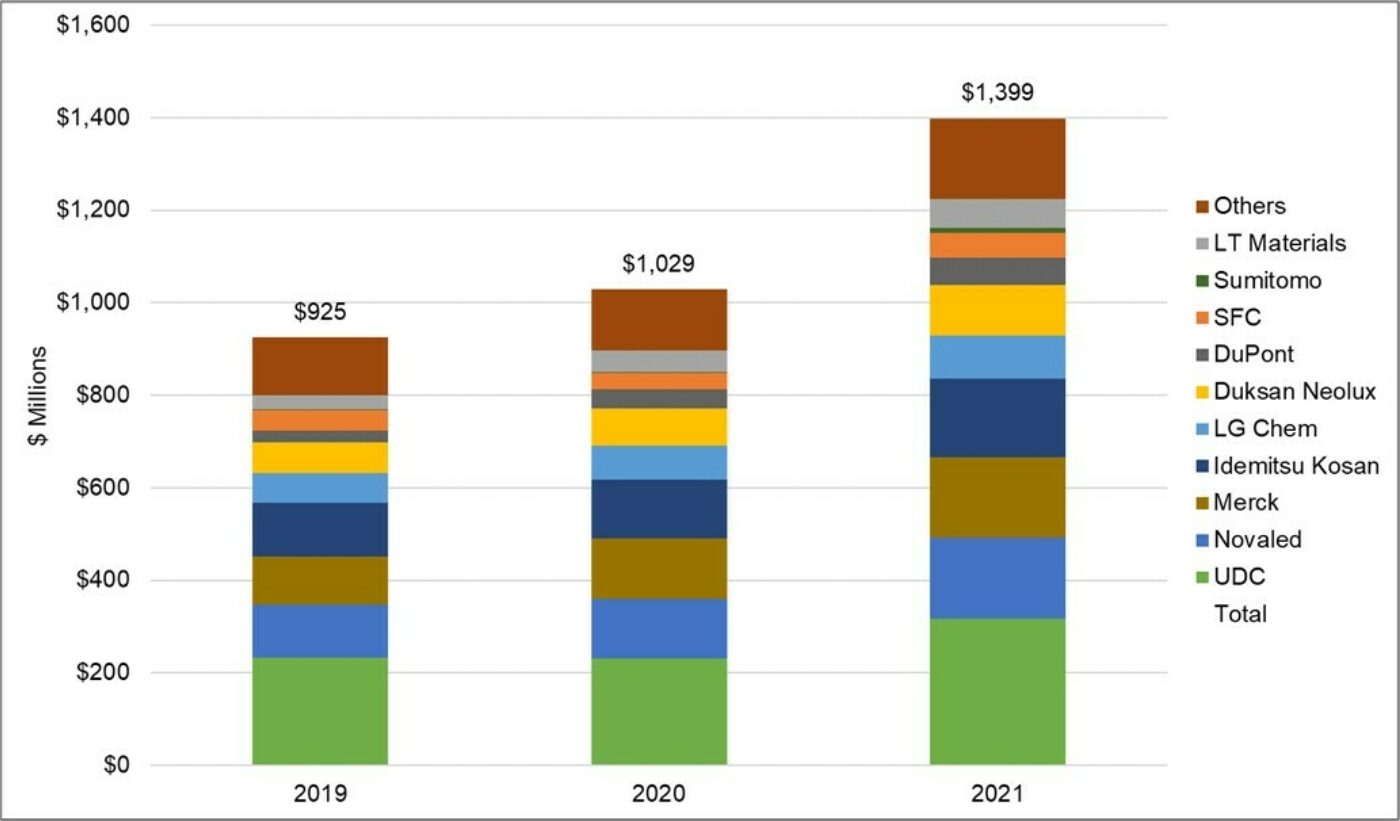

Based on the existing supplier matrix, the report includes a projection of AMOLED material revenues by supplier, as shown on the next chart. Universal Display Corporation (UDC) has been the #1 supplier in revenues for the industry, and we expect that to continue. Idemitsu Kosan, Novaled and Merck hold the number two through four positions among materials suppliers. These four companies are expected to capture 60% of industry revenues in 2021, but as the chart indicates, there is a long tail of companies supplying materials into the industry.

AMOLED Materials Revenues by Supplier, 2019 – 2021

Source: DSCC Quarterly AMOLED Material Report

The DSCC Quarterly AMOLED Material Report includes profiles for all major AMOLED stack architectures, supplier matrices for the main OLED panel makers and revenue projections for 18 different material types and 20 material suppliers. (BOB)

Robert J (Bob) O’Brien is Co-Founder, Principal and CFO of DSCC

This article was first published on the DSCC blog and is re-published with kind permission.