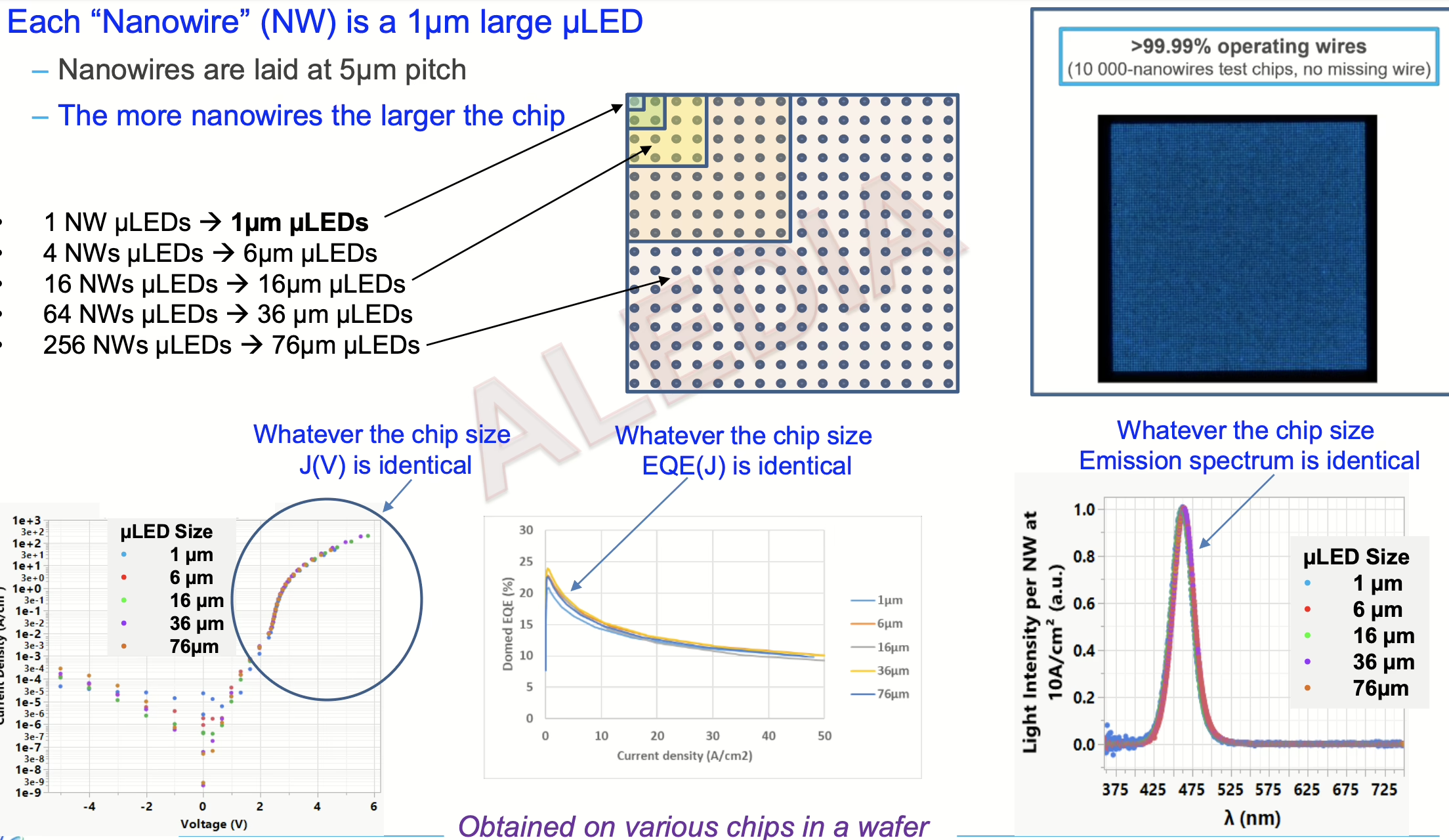

Aledia, a spin-out from CEA Leti, came to DisplayWeek 2025, specifically the Business Conference, claiming to have a new business plan and a new CEO. The new CEO showed up, but it was the same business plan just turned upside down. Aledia has equity funding of $500 million and invested $200 million in an 8″ LED fab. What has attracted the large investment given the surplus of MicroLED capacity is the unique formulation using nanowires (NW) to establish the size of the MicroLED chip, which creates the opportunity to create multiple emitters per chip. Aledia claims the following advantages by using this process:

- Reduction or elimination of the drop in efficiency as the size of the emitter decreases

- The capability to use GaN for all colors

- The capability to produce a wafer containing R,G,B emitters

These achievements would give Aledia the solution to the key issues facing the use of MicroLEDs in the see-through AR application, the most demanding and the highest volume of the XR trio applications. The next figure shows how the nanowire (NW) is used and the EQE stability over various sizes.

Aledia claims that technology will solve many of the issues constraining the growth of AR including:

- Reducing the size and weight of batteries by the use of high-efficiency NW MicroLEDs – Target green at 70cd/W by 2027

- Eliminating the cost of color conversion through the use of RGB MicroLEDs

- Producing the luminance needed to operate in high ambient conditions

- Adopting 12″ wafer and pricing 2 high-resolution panels (MicroLEDs + CMOS backplanes) at ~$150

- Growing micro display capacity from 1 million in 2027 to 30 million in 2030

Aledia has issued press releases about their use of GaN for all colors, a distinct departure from the current practice, and they projected that the three colors could be interspersed on the same wafer, which would enable a full-color panel to be cut without any transfer activity. This breakthrough technology was not addressed in the Aledia presentation at the Business Conference.

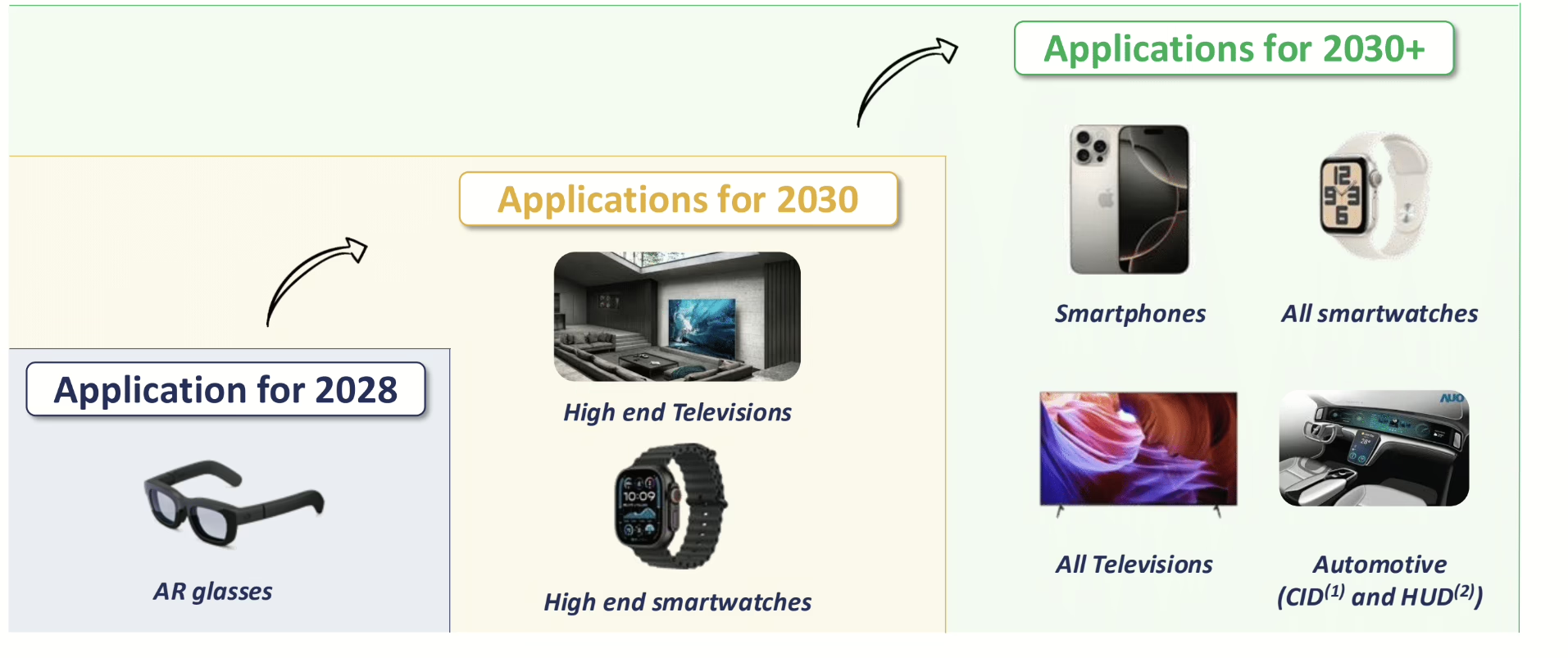

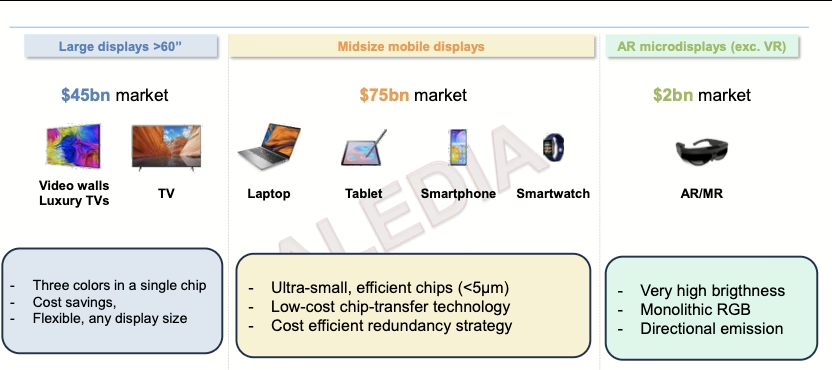

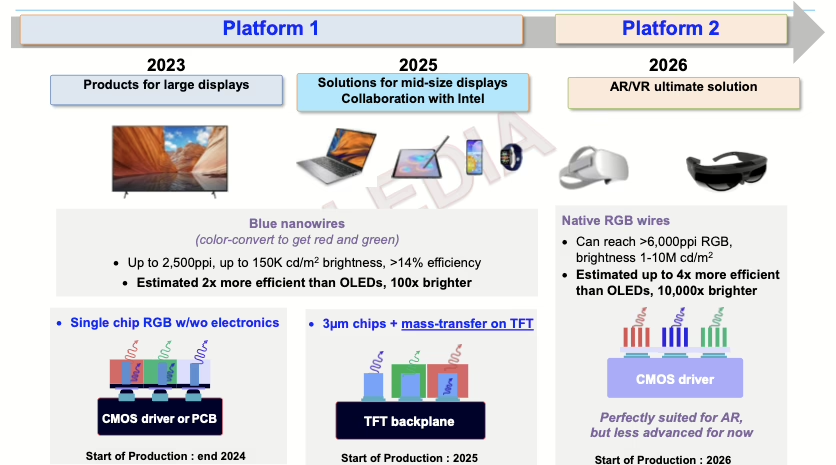

If Aledia is successful in the AR market, they plan to target the entire display industry as shown below:

Aledia’s 2025 strategy is a complete U-turn from their last public presentation when they were going to target the standard display industry first and, if successful, move into AR. Much has changed since 2023, including swapping out CEOs and a small increase in AR devices, which Aledia claims is now 700K annually. But the projected market size of AR devices, even in 2030, would not justify the investment, even if they were the only supplier, which they are not.

Aledia’s business plan is now dependent on participating in a market which, for all intents and purposes, exists in name only, aside from Magic Leap, after being abandoned by Google and Microsoft. But these CE giants along with Meta, Apple and Samsung are still believers. The challenges are making the user comfortable, eliminating jitter and solving optics issues that prevent the eyes from adapting digital imagery similar to real images.

In addition, by 2028 OLEDoS will be a five-year mature product with multiple suppliers, and the Sony $236 advanced panel is likely to cost $100, or less, which is the typical price of less advanced OLEDoS today. As to the ability of MicroLEDs to compete in the larger display market, even if Aledia hits their targets, the prices of MiniLED TVs will limit the market size, the OLED cost portion of smartphones is too low (~$5) for MicroLEDs, smart watch market is saturated with $30 OLEDs, half the price that Aledia suggests, leaving autos, notebooks and tablets as a priority for a high-end differentiated display.

Aledia’s technology could help enable AR and if the consensus among the CE companies is just 10% of the smartphone market, it would reach 240 million panels, but all of this is pure speculation and some companies like Meta have already written off the use of MicroLED technology, in favor of laser constructs. The consensus market research forecasts of the entire MicroLED market in 2030 is ~$0.5 billion.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.