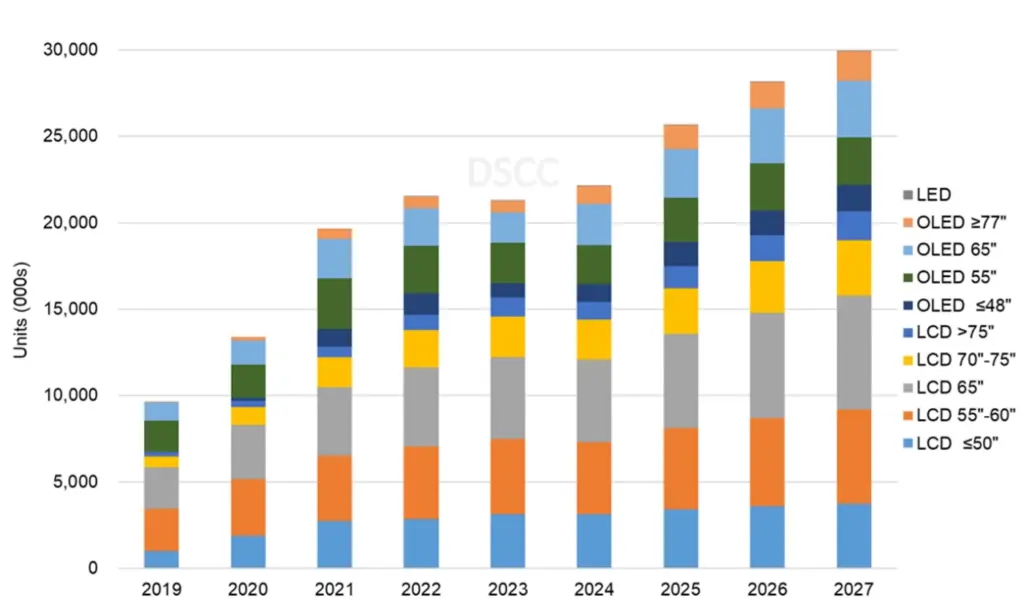

In its latest update, DSCC anticipates a decline in advanced TV shipments for 2023 both in terms of units (1% YoY) and revenue (9% YoY). However, in 2024, there is an expected increase of 4% YoY in units, totaling 22M units, and a 6% YoY growth in revenue, reaching $25.4B. Advanced TV is defined by DSCC as any TV with an advanced display technology feature, including WOLED, QD display, QDEF, dual cell LCD and MiniLED with 4K and 8K resolution.

For 2023, the OLED TV sector is expected to experience a considerable downturn. Shipments are projected to drop 19% YoY, while revenues will likely decline by 21% YoY. On the other hand, Advanced LCD TV units present a more optimistic picture with a predicted increase of 7% YoY in units. Yet, revenues for this segment are expected to decrease by 6% YoY due to a 7% YoY decline in blended average selling prices (ASP).

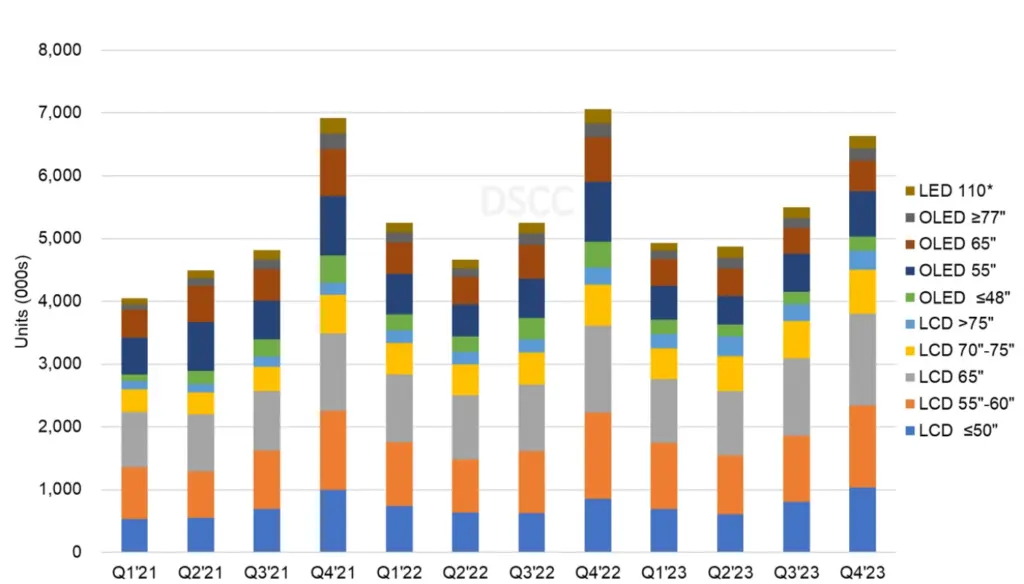

Shipment patterns expected in the latter half of 2023 are expected to grow by 5% YoY in Q3’23 following a 4% YoY increase in Q2’23. However, Q4’23 is predicted to see a decline of 6% YoY. During Q4’22, brands ramped up their volumes, gearing up for post-pandemic re-openings in China coupled with the Chinese New Year promotions. Conversely, in Q4’23, brands are expected to adopt a more conservative approach. This results in projections of an 18% YoY decline in OLED TV units in Q3’23 and a further decline of 29% YoY in Q4’23. This decline is attributed to ongoing price reductions and holiday promotional activities.

In contrast, advanced LCD TV units are forecasted to rise by 16% YoY in Q3’23 and 6% YoY in Q4’23 due to aggressive seasonality, attractive pricing, and festive discounts. The quicker ASP decline in advanced LCD TVs when compared to OLED TVs is also noteworthy. For instance, in 2023, ASPs for advanced LCD TVs of sizes 65” and 75”/77” are projected to drop by 4% YoY and 6% YoY respectively. In comparison, a 65” OLED TV will likely see a 9% YoY decline in ASP, while a 77” OLED TV will experience a 14% YoY increase.

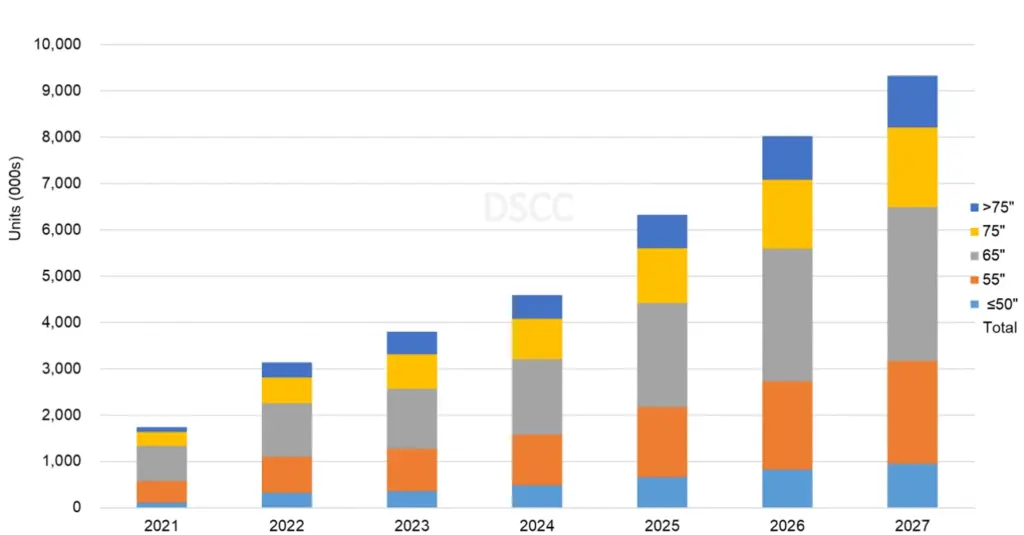

Looking ahead, the long-term forecast until 2027 presents a promising outlook for advanced TV shipments. There’s an expected 9% compound annual growth rate (CAGR) reaching up to 30M units. Out of this, OLED TV units are projected to grow at a 13% CAGR, reaching 9.2M units, while advanced LCD TV units are expected to see a 7% CAGR, culminating in 20.6M units. If we factor in QD-OLED, it’s anticipated that OLED TV will account for 31% of the advanced TV market share by 2027.

From a revenue perspective, the advanced TV sector is anticipated to grow at a 5% CAGR between 2023 to 2027, totaling $29.3B. Breaking it down, OLED TV revenues will likely grow at a 7% CAGR, reaching $11.3B by 2027, whereas advanced LCD TV revenues are projected to grow at a mere 1% CAGR, amounting to $16.3B. Notably, the market share for advanced LCD TV revenue will shrink to 55% in 2027, a significant decrease from 64% in 2023.

There is also evidence of an emerging dominance of MiniLEDs in the LCD camp. Introduced by TCL in 2019 and adopted by major brands like Samsung, LG, Sony, and others in subsequent years, MiniLED TVs are becoming pivotal players in the premium TV market. The report indicates a fierce competition brewing between MiniLED, White OLED, and QD-OLED. A decisive factor in this competition is the cost and price advantage of MiniLED, especially for larger screen sizes, made possible due to Gen 10.5 LCD fabrication facilities. MiniLEDs also seem to be the preferred choice for 8K TVs, with the majority adopting this technology from 2022 onwards.