According to a new research report from the analyst firm Jon Peddie Research, unit shipments in the add-in board (AIB) market increased by 1.4% in Q1’22 from last quarter and saw an impressive 32.2% gain year-to-year. Meanwhile, AMD increased its market share by 4% from a year ago.

Over $8.6 billion in AIBs shipped in the quarter, which represents a decrease in revenue from $12.4 billion in Q4’21 due to falling ASPs. The AIB market reached $46,169.4 billion in the last four quarters. JPR forecasts it to be $57 billion by 2025. Intel’s entry into the market, due to the strength of its brand and position with OEMs, will create an increase in unit shipments and TAM. This increase will start to materialize in mid-2023.

Market share changes quarter-to-quarter and year-to-year

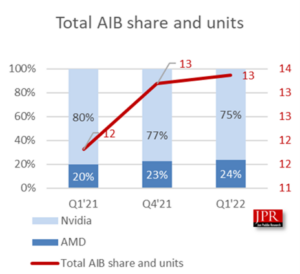

AMD’s market share increased to 24%, while Nvidia still has a dominant position in the market with a 75% market share. The relative changes from quarter to quarter are illustrated in the following chart.

Add-in boards (AIBs) use discrete GPUs (dGPUs) with dedicated memory. Desktop PCs, workstations, servers, render farms, mining farms, and scientific instruments use AIBs. Consumers and enterprises buy AIBs from resellers or OEMs. They can be part of a new system or installed as an upgrade to an existing system. Systems with AIBs represent the higher end of the graphics industry. Entry-level systems use integrated GPUs (iGPUs) in CPUs that share slower system memory.

For four quarters in a row, AIBs have shown double-digit growth year-over-year, and AIB unit sales were up 1.4% in Q2 over the previous quarter—a quarter in which we see a drop in sales historically. This is a positive sign for the industry; ASPs are finally falling after experiencing eight quarters of price increases. This is good for consumers, who have had to pay over 50% of MSRP in some cases.

Quick Highlights

- JPR found that AIB shipments during the quarter increased from the last quarter by 1.4%, which is above the 10-year average of -4.9%.

- Total AIB shipments increased by 32.2% this quarter from last year to 13.4 million units and were up from 13.19 million units last quarter.

- AMD’s quarter-to-quarter total desktop AIB unit shipments increased 6.0% and increased 43.9% from last year.

- Nvidia’s quarter-to-quarter unit shipments decreased -0.3% and increased 27.4% from last year. Nvidia continues to hold a dominant market share position at 75%.

- AIB shipments from year-to-year increased by 32.2% compared to last year.

Dr. Jon Peddie, president of JPR, noted, “Despite unprecedented simultaneous global disturbances from COVID, supply-chain disruptions and shortages, the war in Ukraine, and the resulting inflationary spiral, the first quarter of AIB shipments posted a record year-to-year gain and a very respectable quarterly gain. However, the second quarter is usually down, and the world events will catch up with us, so we do not foresee a very robust second quarter and expect shipments could drop 20% or more.”

Robert Dow, Analyst for Jon Peddie Research, added, “Falling ASPs contributed to the growth of sales in Q1’22, a quarter that is historically down. Looking forward, we anticipate a down Q2, with the market rebounding late in the year with the rollout of new product lines and Intel’s entry into the market.”

JPR has been tracking AIB shipments quarterly since 1987—the volume of those boards peaked in 1998, reaching 116 million units. In 2020, 42 million shipped. In 2021, over 50 million AIBs shipped throughout the year.