Shipments of Western European personal computing device (PCD), including traditional PCs (a combination of desktops, notebooks, and workstations) and tablets (slates and detachables), will total 76.0 million in 2018, a -3.7% YoY decline (-3.3% in 2019 with 73.5 million shipments).

The anticipated commercial renewal cycle will experience an extra drive amid the expanding mobile workforce and necessity of security.

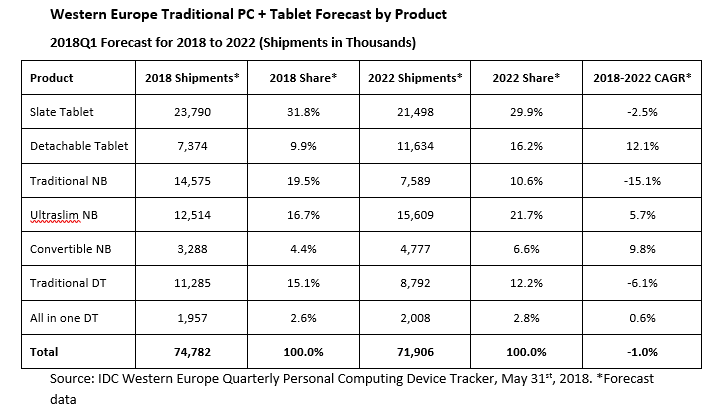

After the large renewal cycle in the public and corporate sectors in the first quarter of 2018, a proportion of the fulfillment of these deals is expected to spill into subsequent quarters. Mid-market will follow suit, and ramp up throughout the rest of the year, while small office and small business refreshes are expected to occur towards the end. On the desktop side, small and ultrasmall form factors are expected to generate the strongest growth, as companies opt to upgrade their older towers to the more spaciously convenient devices during the renewal cycles; while the ever-growing mobile workforce will continue to drive demand for the more thin and light notebook form factors. Resultantly, ultraslim notebooks are expected to outweigh traditional notebooks in the commercial mix by the end of 2018; while convertible notebooks will continue to outshine detachables – solidifying their position as the dominant hybrid solution.

Security concerns will continue to act as an additional catalyst for device renewals. Data breaches and exploitation of hardware vulnerability have emphasized the critical importance of up to date hardware and operating systems. Windows 10 security features can support companies against these threats, and newer devices with more sophisticated hardware are less susceptible to exploitation.

“The end of Windows XP support led to a wave of renewals back in 2014,” said Liam Hall, research analyst, IDC Western Europe Personal Computing. “As these devices are approaching the tail end of their expected lifecycle, the growing prevalence of the more mobile workforce, combined with ever-present security concerns, will act as an incentivizing push for companies to upgrade their ageing devices to a more mobile and secure range.”

On the consumer side, declines are expected to occur through to 2022, as extending product lifecycles combined with high stock levels in multiple countries will impact overall demand. Desktop performance will be impacted by the growing consumer preference towards ultramobile solutions. However, they will continue to experience strong traction in the gaming subsection of the market, as multiple major OEMs push more exciting premium devices. Slower refresh cycles continue to impact the overall consumer market for notebooks, but ultramobile form factors, gaming notebooks, and convertibles at premium price points will continue to stimulate sufficient intrigue in consumers to generate growth in this shrinking market.

The outlook for the consumer performance of tablets has been revised downwards slightly, but there are still opportunities for both form factors. In response to the maturity of the market and weak consumer demand, detachable manufacturers are increasingly putting the focus on profitability at the expense of market share. On the slate side, sluggish renewals by consumers have resulted in Android slates experiencing a steeper than anticipated decline, which is likely to continue throughout 2018. The outlook for iOS slates remains optimistic, however, as the iPad announced in late March had its price point adjusted, which is expected to trigger further renewals of old iPads within the consumer installed base.

Note: Tablets are portable, battery-powered computing devices inclusive of both slate and detachable form factors. Tablets may use LCD or OLED displays (epaper-based ereaders are not included here). Tablets are both slate and detachable keyboard form factor devices with color displays equal to or larger than 7.0in and smaller than 16.0in.

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.