According to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker, global shipments of personal computing devices (PCDs) – composed of traditional PCs (desktop, notebook, and workstation) and tablets (slate and detachable) – are expected to decline 3.5% year over year in 2018, which is an even steeper decline from the 2.7% in 2017.

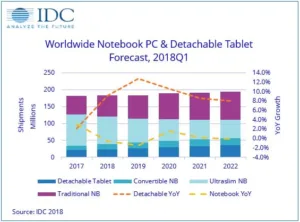

Looking forward the category is expected to drop at a five-year compound annual growth rate (CAGR) of -1.8%. Convertible and ultraslim notebooks, as well as detachable tablets continue to be bright spots in a challenging market. All three product categories are expected to grow year over year throughout the forecast.

“Overall the challenges for traditional PCs and tablets remain the same as in past years,” said Ryan Reith, program vice president with IDC’s Worldwide Quarterly Mobile Device Trackers. “However, we continue to see pockets of opportunity and growth when you peel back the onion. With notebook PCs it’s clear that marketing and development resources are being poured into premium/gaming, convertibles, and thin and light devices. All OEMs, some of which are new to the space, seem to be laser focused on these areas. Detachable tablets are another area that has seen growth, however it currently feels like the trends around notebook growth opportunities have overshadowed detachable developments.”

Slate tablets, which peaked as a market segment in 2014 and has been in decline since, is expected to contract over the five-year forecast with a CAGR of -6.2%. The overall decline has improved, but the category remains challenged by consumers spending more time on smartphones, as well as having life cycles that are more in line with traditional PCs.

Desktop PCs are also expected to decline at a five-year CAGR of -2.6%. Commercial demand remains stronger than consumer but given the saturation of that market segment it isn’t expected to grow at any point during the forecast. On the consumer side, gaming has certainly provided some hope for desktops, although many gamers are still doing manual upgrades or moving toward gaming notebooks. Both continue to pose challenges on the segment.

“Despite the continuous decline of desktops, it’s clear that not all are created alike as the growing demand for gaming PCs is bringing with it plenty of changes to the design and form factor of desktops while opening up opportunities for brands,” said Jitesh Ubrani, senior research analyst with IDC’s Quarterly Personal Computing Device Tracker. “Consumers are increasingly valuing small and ultrasmall form factor desktops along with smaller components like low-profile graphics cards. Combine that with the progressively diverse base of gamers and it translates to a shift in gaming PCs from the gargantuan, RGB-lit towers of yesteryear to smaller, sleeker, and subtler boxes in the future.”

|

Personal Computing Device Forecast, 2018-2022 (shipments in millions) |

|||||

|

Product Category |

2018 Shipments* |

2018 Share* |

2022 Shipments* |

2022 Share* |

2018-2022 CAGR* |

|

Desktop + DT & Datacenter Workstation |

95.4 |

23.4% |

86.6 |

22.4% |

-2.4% |

|

Notebook + Mobile Workstation |

160.9 |

39.4% |

161.7 |

41.9% |

0.0% |

|

Detachable Tablet |

23.9 |

5.9% |

35.0 |

9.1% |

9.8% |

|

Slate Tablet |

128.0 |

31.4% |

102.9 |

26.6% |

-6.2% |

|

Grand Total |

408.3 |

100.0% |

386.2 |

100.0% |

-1.8% |

|

|

|

|

|

|

|

|

Traditional PC |

256.3 |

62.8% |

248.4 |

64.3% |

-0.9% |

|

Traditional PC + Detachable |

280.2 |

68.6% |

283.4 |

73.4% |

0.1% |

|

Total Tablet (Slate + Detachable) |

152.0 |

37.2% |

137.9 |

35.7% |

-3.4% |

|

Source: IDC Worldwide Quarterly Personal Computing Device Tracker, May 31, 2018 |

|||||

* Forecast data

IDC’s Worldwide Quarterly P ersonal C omputing Device Tracker gathers data in more than 90 countries and provides detailed, timely, and accurate information on the global personal computing device market. This includes data and insight into global trends around desktops, notebooks, detachable tablets, slate tablets, and workstations. In addition to insightful analysis, the program delivers quarterly market share data and a five-year forecast by country. The research includes historical and forecast trend analysis.

For more information, or to subscribe to the research, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of IDG, the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.