I am always fascinated by disruptive changes in our display landscape: (i) players moving in new directions (such as Tianma’s announcement that it plans a large panel fab, broadening its market scope from being a small panel specialist), (ii) the overturning of preconceived notions (like the role of Mattrix technology in using a a-Si backplane and priorietary technology to make OLED possible with a-Si) or (iii) new players moving onto our landscape from other industries.

It is these changes that inform how the market might develop and who may win. I use the analogy of chess pieces being added to or removed from the chess board

While the role of Taiwan inc, especially PlayNitride, AUO and Innolux in MicroLED has been fairly extensively reported, it is the role of Taiwan as the centre of activity for MiniLED LCD backlight production that is my topic for today. While I have been very aware of the role of TCL and Apple in driving the use case for MiniLED LCDs in TVs and iPads respectively, the names of many new Taiwanese players to the display market from the LED test and packaging markets, from semiconductor equipment and from flex PCBs have been much less transparent.

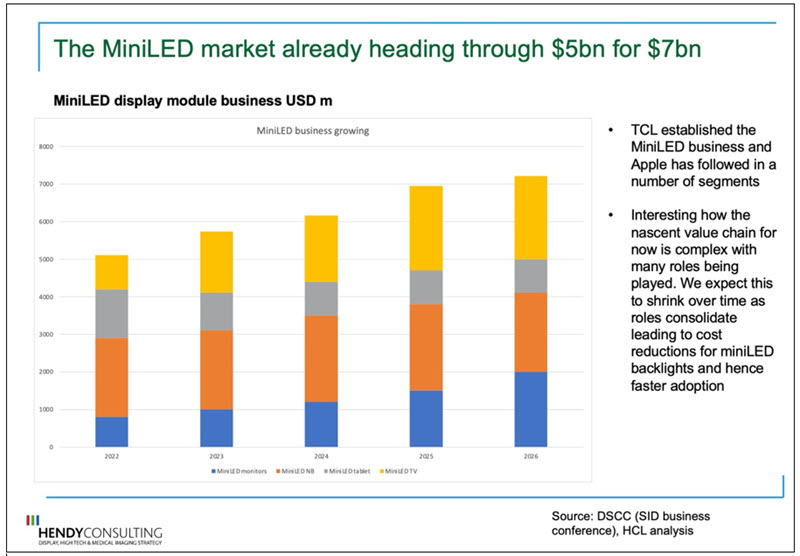

Now Ross Young’s SID presentations plus some analysis get us to a very striking conclusion: the MiniLED market at a display module level is already a $5 billion market moving towards $7 billion or more in the coming years. This is already a pretty major market application (given a total display industry size of $150 billion, so that we are talking about almost 5% of the market value) and a large number of the participants that deliver this market are Taiwanese.

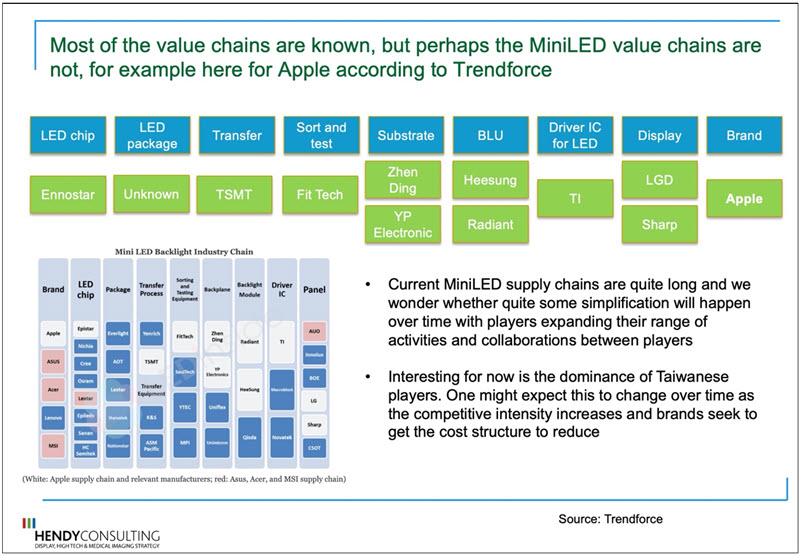

TrendForce, a research company in Taiwan, ably covers the new players emerging to serve this application and we have highlighted the reported Apple supply chain here and list of other participants.

What fascinates me is the Taiwanese dominance of these chains, and in fact the number of new players into our industry. Ennostar (LED, Taiwan), TI (Drivers, USA), LGD (Display, KR), Sharp (Display, JP) and Apple are well known. Heesung (Backlight units, Korea) and Radiant (Backlight units, Taiwan) are also long-standing display participants and have been participants in the display market for at least 2 decades.

But the vast majority of the other players are new names, with a couple of Koreans and Singaporean firms but otherwise dominated by the Taiwanese: FitTech, ZhenDing, YP Electronics, Yenrich, TSMT, ASM Pacific, SaulTech, YTEC, Uniflex, Unimicron and Macroblock. Some of these players are from the flex PCB industry, others from semiconductor equipment or processing. And yet more have moved from established LED processing into MiniLED. This new application is bringing in new players.

For now, the market is in a period of experimentation with MiniLED: What architectures will dominate? How many zones is enough? Which substrates will win as backplanes and based on which driving approaches? The supply chain is long and complex and ripe for shake-out. With companies such as Apple and Samsung and other firms at the top end of these supply chains then no doubt the players and roles in these chains may look very different in 24 months’ time compared to today.

The other big question – will these players also win out in MicroLED?

And the other strategic question raised by these entrants to the business is the extent to which some of these players now will be eventual winners in MicroLED markets later: my own belief is that this will split by value chain function. For some areas, perhaps sorters and testers, then these may apply to both Mini and MicroLEDs.

Established MiniLED players may follow the business into MicroLED using their scale and experience to guide them into smaller dies. But for others, and here this may include those developing mass transfer methods, then I believe there may be distinct discontinuities and there will be a new battle between companies that have sought to specialise in very small MicroLED dies from the start and those that seek to incrementally move down from the business of MiniLEDs. Some mass transfer methods may be able to span the divide between the markets and others not

Yet, already the implication is clear: Taiwan is a hotbed of innovation for MiniLED at this point in time, and any company with interest in either Mini or MicroLED may want a scouting post or business or alliance in Taiwan. While some relationships will indeed be established in Korea for SEC or the LG Group, and Korean firms may get their turn to also develop ecosystems for this new business, the current ecosystem is in Taiwan and we all should take notice. (IH)