LG Display just released their quarterly results as we have reported already. I thought it may be a good idea to take a closer look on the development of LG Display over the last two years in terms of business and product mix development.

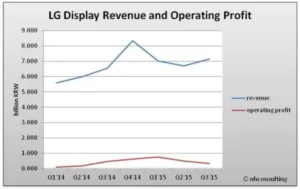

As LG Display reported, revenue has been growing quarter over quarter as well as over the same quarter last year. This seems to be all great news at first glance. In addition they stressed that this was their fourteenth straight quarter with an operating profit. This equates to three and a half years or in other words, the last quarterly loss dates back to 2012.

Unfortunately, the operating profit has slipped for the third quarter in a row, threatening their profitability streak. The first chart shows the development of the quarterly revenue and operating profit since the beginning of 2014.

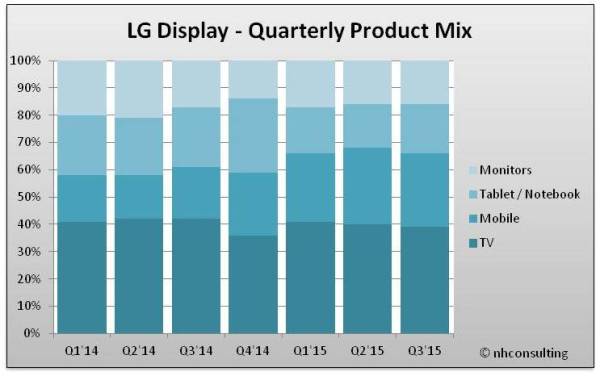

One of the obvious effects is the revenue spike in the 4th quarter of 2014, which, by the way, did not lead to a spike in operating profit. This revenue spike is clearly related to a shift in the product mix as shown in the second chart.

When looking at the breakdown by product category, you can see that the tablet / notebook category made up 27% during that quarter, while this percentage typically hovers around 17%. This indicates that at least in 2014 LG Display benefited from the holiday run on tablets. Since then the overall product mix has slightly favored displays for mobile devices. Since tablets are counted together with notebooks, that means basically smartphone panels.

Other than this development, everything seems pretty stable. Since LG Display does not break down its sales between tablets and notebooks anymore, one can only assume that tablets are still the larger part of this category. Interestingly, in the first quarter of 2014 they still sold more notebook panels than tablet panels.

In the press release they stated that the continued positive results are due “to its continuous differentiated strategy efforts in response to reduced demand among TV set manufacturers and price declines for displays”. Besides the fact that their product mix is surprisingly stable apart from the tablet/notebook holiday frenzy in 2014, one has to wonder what diversification strategy they are using at the moment?

Even stranger is the second part of the sentence in their press release. How did the price decline for displays increase their revenue and contribute to the operating profit? Well, there is always the possibility that their efforts to decrease production cost were very successful, however with declining operating margins it looks more likely that they bought market share by means of more competitive panel pricing.

They continued saying that “despite weaker market demand due to uncertainty in the global economy, LG Display was able to report its fourteenth straight quarterly operating profit because of a continued market trend towards large-sized TVs and increased demand for differentiated products such as Ultra HD and IPS displays”. Sounds wonderful. However, if indeed the UHD TV category is the driver for increased revenue, one would expect that the product mix would support that by an increase in the TV category. As a matter of fact, the TV category decreased 1% from the 2nd quarter of 2015. If they are correct in saying that they sold more UHD panels in larger sizes, they must have lost some market share in smaller panels to balance the higher average sales price per TV panel they are achieving now.

The only category that increased its share was the tablet/notebook category with an increase of 2%. This means that the increase in higher resolution IPS panels together with a potential increase in unit shipments for this category is the main driving engine for LG Display at the moment.

As most market research firms still expect to see a stable or even slight increase in global TV sales for 2015, the mobile and tablet space seems to be the main driver for LG Display. If the tablet has some sort of resurrection as a holiday gift item, LG Display may be well positioned to report great revenue numbers for the 4th quarter in 2015. (NH)