Perhaps it’s not news to some of you, since our trusted editor Bob pointed out last week that Nanosys has been rumored to be exploring an option to go public via a SPAC. I want to be crystal clear that this piece is, in part, based on public rumors and speculation along with announcements from Nanosys.

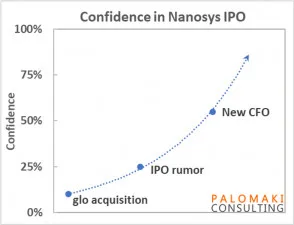

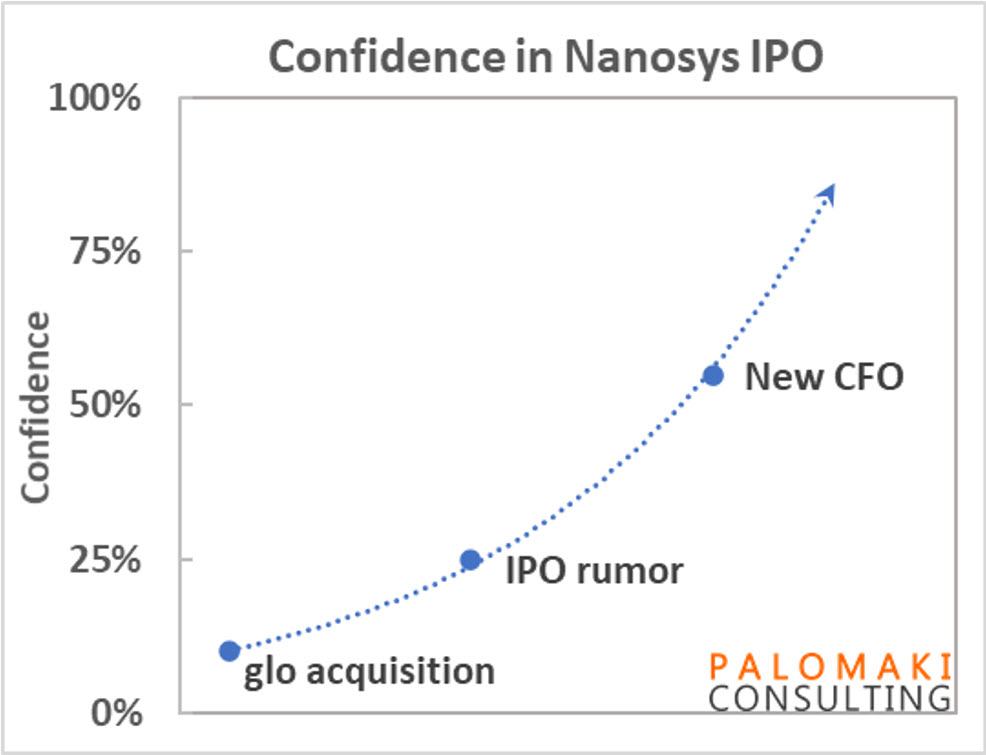

I’m a scientist though, and I don’t particularly like reporting on things that I am not confident about. However, when I see a trend emerge (let’s call them data points), I tend to be a bit more confident. Let’s look at three data points that have materialized recently and how they might indicate that a Nanosys IPO is on the horizon.

For completeness on this story, I did reach out to Nanosys for comment, and they politely declined, as expected.

Data point #1: Acquisition of glo

Only a few months ago during SID 2021 Nanosys announced the acquisition of micro-LED company gl? which I covered in here. I speculated that IP may be one potential reason Nanosys would acquire gl?, but along with that also comes a more attractive (valuable) position for future acquisition… or IPO. I can only imagine it would be a positive sign for potential investors to see both microLED and QD expertise under one roof. It should reduce the concern from investors that microLED takes over the display industry and a company that focuses exclusively on QDs suddenly becomes obsolete.

I have no visibility into the financial transaction that occurred between Nanosys and gl?, but it is reasonable to expect that Nanosys may be low on cash after the transaction, which fits well into the IPO story.

Data point #2: Rumored IPO

Of course I would probably not even be writing this piece if it weren’t for a report from Bloomberg that Nanosys is rumored to be in talks with GigInternational1 SPAC about going public. SPAC’s have become an increasingly popular investment vehicle in the past few years, in part due to the rapid nature in which a company can go public. Perhaps that’s just the thing Nanosys and its current investors are looking for.

Data point #3: New CFO

The final data point that actually makes this a trend and not a fit between two data points is that Nanosys recently announced a new CFO. Bill Roeschlein has considerable experience in M&A on both sides of the table, leading one to believe that he has been hired to do the same at Nanosys. In addition, his experience is mostly as CFO of public companies, which Nanosys is not (yet).

I did my best to capture this data in a graphical way that all scientists and non-scientists might appreciate. And for those of you that are wondering, it’s an exponential fit with R2 = 0.998.

Collection of data points that have led me to higher confidence that Nanosys is, in fact, headed towards an IPO.

Collection of data points that have led me to higher confidence that Nanosys is, in fact, headed towards an IPO.

I’m expecting over the course of the next few weeks/months to hear more on this topic. My understanding is that SPAC acquisitions can go very fast but can also fall apart quickly as investors in the SPAC can easily say, “pass” and move on to the next opportunity. One thing is certain… there is no certainty when it comes to things like acquisitions or IPOs until everyone has signed on the dotted line. Probably if I had consulted with an attorney before writing this piece, they would tell me to include a disclaimer. I am not a financial professional and you should not consider this to be financial advice.

So what does it mean for the display industry?

I don’t think much will change if Nanosys goes public. They will potentially have more cash to work with which could help them accomplish many different goals. We’ll start to see financial statements that all public companies are required to report, so that could be interesting to look at. We may finally be able to financially compare a QD materials company to the successful OLED materials company UDC. I expect they will continue to grow their customer base and material sales as QD-enabled displays expand in the market. With QD-OLED on deck, and things like color converted micro-LED, QNED, and EL-QLED, there is still room to grow well-beyond the QD films we all know and love. (PP)

Peter Palomaki is the owner and chief scientist at Palomaki Consulting, a firm specializing in helping companies solve big problems at the nanoscale. His utilizes his expertise in quantum dots and materials chemistry to solve challenging problems with clients large and small.