The Europe, Middle East, and Africa (EMEA) tablet market is projected to increase 3.6% YoY in 4Q20, according to International Data Corporation (IDC). The full year 2020 is anticipated to grow at 10.1% YoY in EMEA, the highest YoY performance for the tablet market in EMEA since 2013.

Education will continue to generate important volumes in the forthcoming quarters as tenders are put in place by local governments to address the possibility of new lockdowns.

“The whole region will be driven by substantial school digitization projects reaching volumes of hundreds of thousands in some cases,” said Nikolina Jurisic, senior program manager, European Personal Computing Devices.

Among the countries behind the expected education tenders include Germany, the United Kingdom, France, Greece, Romania, Kazakhstan, and Hungary.

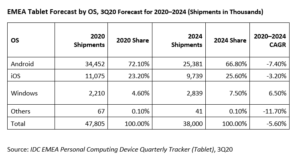

“Android-based devices are expected to be a recurrent choice in emerging markets and southern Europe, with a mix of A-brands and local players supplying the deals, while in north-western Europe, iOS-based tablets tend to be the go-to solution,” said Daniel Goncalves, research manager, Western Europe Personal Computing Devices

After two quarters of strong double-digit growth when demand for tablet devices skyrocketed in response to the confinement measures adopted by governments, the consumer segment is now expected to show some signs of a slowdown. Nevertheless, the consumer market is expected to remain positive in late 2020 and early 2021, with forecast YoY growth of 5.1% and 7.6% in 4Q20 and 1Q21, respectively.

“Consumer demand will contribute to maintain the tablet market in positive territory, as restrictions and lockdowns applied to countries in addition to ongoing notebook availability problems and the rescheduling of Prime Day to October will be behind the rise,” said Jurisic.

A downturn is expected in 2021, when the EMEA tablet market is forecast at -13.7% YoY.

“A correction to this abnormal year is likely to happen in 2021, said Goncalves. “The huge demand for home entertainment or home learning, which has also been addressed by other categories such as notebooks, is not expected to have this large scale next year. The economic impact of COVID-19 and a possible return to a close to normality scenario in which people spend more time outdoors could also negatively impact demand for tablets,” said Goncalves.

Note: Tablets are portable, battery-powered computing devices inclusive of both slate and detachable form factors. Tablets may use LCD or OLED displays (epaper-based ereaders are not included here). Tablets are both slate and detachable keyboard form factor devices with color displays equal to or larger than 7in. and smaller than 16in.

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.