Television makers that had been planning to significantly boost their display panel purchasing in the second quarter now may be forced to curb their ambitions as concerns rise over a potential coronavirus-driven recession.

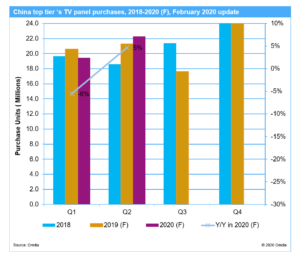

South Korean and Chinese TV makers were hoping to take advantage of improving panel availability conditions in the second quarter to build up their inventory in advance of increased consumer demand. China’s top-tier TV makers currently are expected to increase their unit purchases of display panels by 5 percent sequentially in the second quarter, following a 6 percent decrease in the first quarter.

However, these plans are now in serious doubt.

“TV makers had been anticipating increased demand later this year, with consumers set to purchase new sets in advance of upcoming sporting events, such as the 2020 Summer Olympics in Tokyo,” said Deborah Yang, director of display supply chain at Omdia. “Now these companies are growing increasingly apprehensive that the coronavirus pandemic will spur a global recession—an event that would impact television demand. As a result, TV makers need to revise their purchasing plans to accommodate potentially drastic changes in the level of demand.”

Such revisions will require TV makers to examine the multitude of factors that could impact supply and demand. In the very short term, TV makers must first deal with coronavirus-related supply-chain disruptions, including labor and component shortages, logistical problems and rising manufacturing costs.

However, in April, these companies will have to take action to mitigate the impact of the demand downturn.

“By next month, TV makers must evaluate how badly their sales outlook will be impacted by the coronavirus,” Yang said. “In particular, these companies must determine how much European demand will be affected during the months of May and June and during the entire third quarter. As a result, April will be the time when the panel market is likely to experience a major demand correction.”

Chinese top tier TV makers reduce panel demand in Q1

Most Chinese TV makers had reduced their inventory levels by the end of 2019, and had planned to replenish their stockpiles in the first half of 2020. TV makers all sensed that panel supply would be tight in 2020 due to reduced production and the impact of coronavirus on manufacturing in China in February.

Moving into the second quarter, supply conditions had been expected to improve, as China began to manage the crisis more effectively. Moreover, the demand situation was looking up, with demand in North America remaining solid, according to a sales forecast from regional retailers, as reported by the Omdia TV Display & OEM Intelligence Service.

Chinese TV makers were planning to increase their panel-purchasing volumes in the second quarter as conditions in China returned to a more normal state. Most television production in China is expected be completely resumed in the second quarter. With production losses in the first quarter, Chinese TV makers had hoped to make up for the shortfalls by increasing purchasing and manufacturing the second quarter.

Korean TV makers aim to refill panel inventories to meet shipment targets

Leading Korean TV brands are moving more confidently to mitigate supply-chain disruption risks compared to their rivals from other regions. As a result, the Korean companies are rapidly increasing panel demand in the first quarter to bolster their stockpiles.

Korean TV brands have aggressive shipment plans for 2020 as they strive to maintain their revenue and profits. Some of these companies want to gain market share from industry rivals who may be more negatively impacted by the pandemic. With reduced availability from their own captive sources, the leading Korean TV brands need displays from other panel suppliers to meet their shipment targets.

However, the unexpectedly fast spread of the coronavirus—particularly in European countries—now is attracting the intense attention of the Korean TV brands that have a major presence in the region. Omdia believes these companies will have to cut panel demand in the second quarter to reduce the risk of rising inventory as more and more cities and countries go into lockdown.

“The question for TV makers is whether the market will recover quickly, or if it will face a persistent downturn,” Yang said. “TV display supply chain participants will need to prepare countermeasures for potential worse case scenarios now. Coronavirus has now become the most important swing factor influencing everything from demand, to supply, to the evolving TV competitive landscape.”