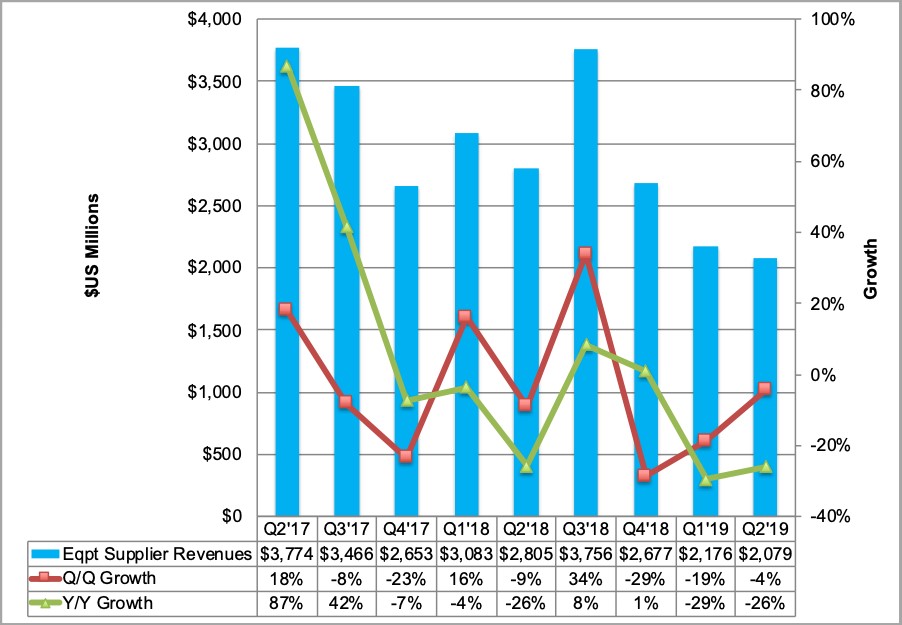

In Quarterly Display Supply Chain Financial Health Report, DSCC compare the financial results of all panel and equipment suppliers. DSCC covered the panel supplier results 2 weeks ago; here DSCC will cover the equipment supplier results. Looking at display equipment revenues for the 22 suppliers we are tracking, revenues were down 4% Q/Q and 26% Y/Y. It was the lowest quarter since Q2’16 and the 4th straight quarterly decline.

Q2’19 was also the second straight quarter with at least a 25% Y/Y decline. We expect to see a rebound in Q3’19 based on the capex and display equipment spending data for Q2’19. Canon overtook Nikon, AMAT and TEL to jump from #4 to #1 helped by the recognition of a FMM VTE system in China. YTD through Q2’19, AMAT is leading followed closely by Canon and Nikon. Of these 22 companies, share is concentrated at the top with the top 5 accounting for 65% of the total. SFA enjoyed the highest Q/Q revenue growth after the largest decline last quarter. Canon enjoyed the 2nd highest growth on its lumpy Tokki VTE business. AP Systems, SNU, Wonik and V-Technology also had impressive double-digit Q/Q growth. Wonik IPS enjoyed the highest Y/Y growth at 186% thanks to its acquisition of Tera Semicon. If Tera Semicon’s results are included, its Y/Y growth falls to 15%. Philoptics also saw impressive Y/Y growth of 53% on increased demand for laser cutting thanks to hole punched displays. Only 6 suppliers saw Y/Y revenue increases with SFA, SCREEN and ICD seeing the largest declines.

Display Equipment Revenues for 22 Suppliers

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

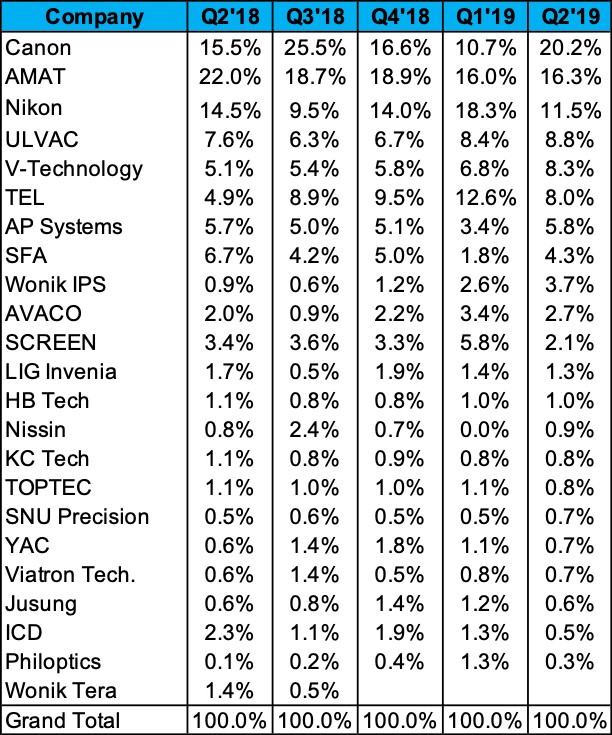

Display Equipment Supplier Market Share for 22 Companies

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

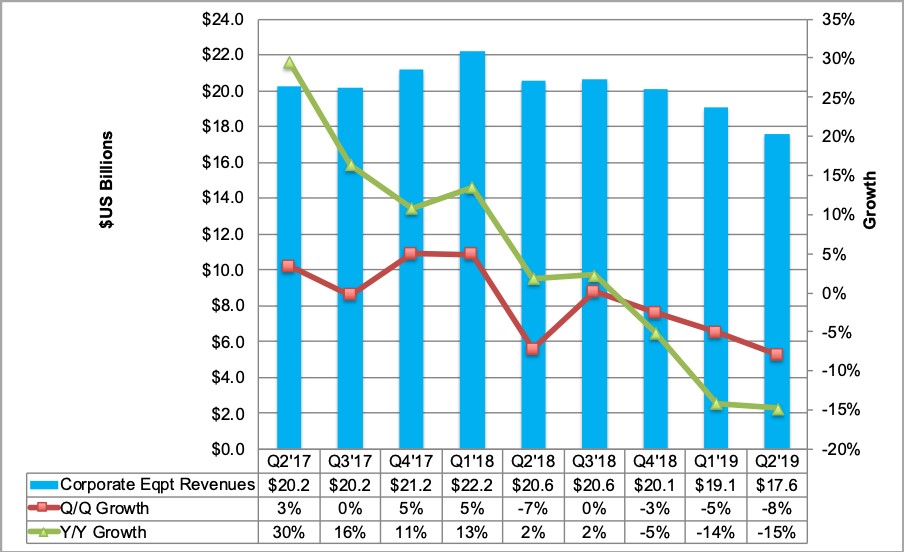

Looking at total company revenues for these 22 equipment suppliers, we see a similar trend with total revenues down 8% Q/Q and 15% Y/Y with weakness in both semiconductor and display equipment revenues. It was also the 4th straight quarterly decline and lowest revenue total since Q3’16. The Y/Y decline is not as great as in just displays, but becoming more significant. On a sequential basis, only 9 suppliers experienced growth. The top 4 fastest growing companies were all in Korea led by AP Systems, SNU Precision, Wonik IPS and KC Tech. ICD and Philoptics had the largest declines. On a Y/Y basis, Nissin, Jusung, V Technology, Philoptics and SNU had the fastest growth with ICD, Toptec, Invenia having the largest declines.

Total Equipment Revenues for 22 Suppliers

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

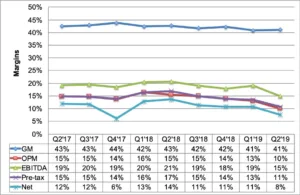

As both semi and FPD revenues decline, equipment supplier margins are also trending lower.

- Gross profits fell for the 5th consecutive quarter to $7.2B, the lowest total since Q2’16. Gross margins were flat at 41% led by Jusung at 46%, up from 43%, on higher revenues and a higher semiconductor mix. Other companies seeing higher gross margins included SNU Precision, Wonik IPS, V Technology, KC Tech, YAC, AP Systems and Toptec. The companies with the lowest gross margins included HB Tech, ICD and Philoptics.

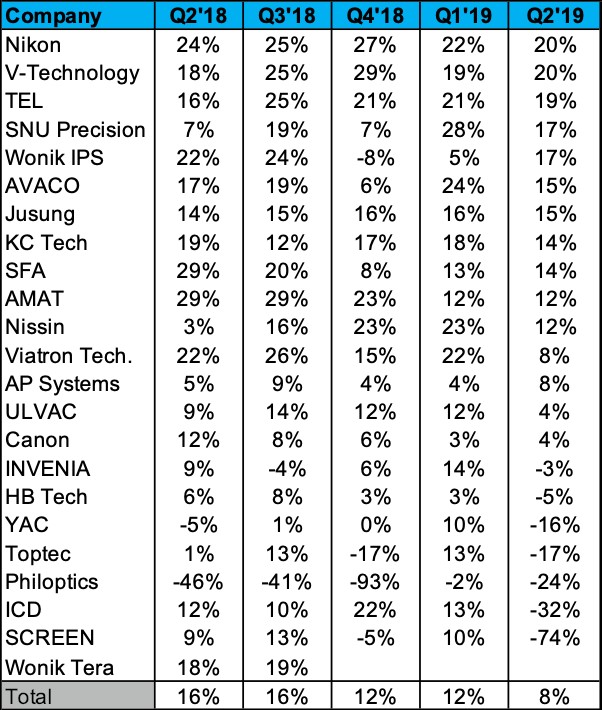

- Operating income was down for the 5th consecutive quarter, falling 28% Q/Q and 43% Y/Y. Operating income at $1.8B was the lowest value since Q2’16. Operating margins of 10% were the lowest since Q1’16. AMAT had the highest operating margins overtaking SNU Precision, AVACO and TEL. V Technology rose to #2 with TEL at #3. There were 8 companies with negative operating margins led by ICD at -32%, Philoptics at -24% and Toptec at -17%, definitely a tough quarter for these companies.

- EBITDA was the lowest since Q1’16. TEL saw its EBITDA fall the most in $US at -$530M followed by SCREEN at -$204M and Nikon at -$177M. AMAT rose from #4 to #1 in EBITDA margins at 25%, down from 26%, with V Technology falling from #1 to #2 as its EBITDA margins slipped from 34% to 20%. TEL maintained the #3 position as its EBITDA margins fell from 32% to 20%. Invenia had the lowest EBITDA margins followed by ICD and Philoptics.

- Pre-tax income fell for the 5th straight quarter, dropping a significant 27% Q/Q and 46% Y/Y to $1.9B, the lowest since Q1’16. Pre-tax margins fell from 13% to 11%, the lowest since Q1’16. AMAT rose from #4 to #1 in pre-tax margins rising from 21% to 22% followed by TEL which fell from 25% to 21% and V Technology which rose from 18% to 20%. There were 6 companies with negative pre-tax margins. ICD, Philoptics and SCREEN had the worst pre-tax margins.

- Net income fell for the 5th straight quarter, dropping a significant 35% Q/Q and 53% Y/Y to $1.3B, the lowest since Q4’17. Net margins fell from 11% to 8%, also the lowest since Q4’17. AMAT had the highest net margins on its strong Q2 results, overtaking TEL. TEL fell to #2 with Jusung at #3. Six suppliers had negative net margins led by Philoptics and ICD at -28% and -23% respectively.

Aggregated/Weighted Equipment Supplier Margins

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

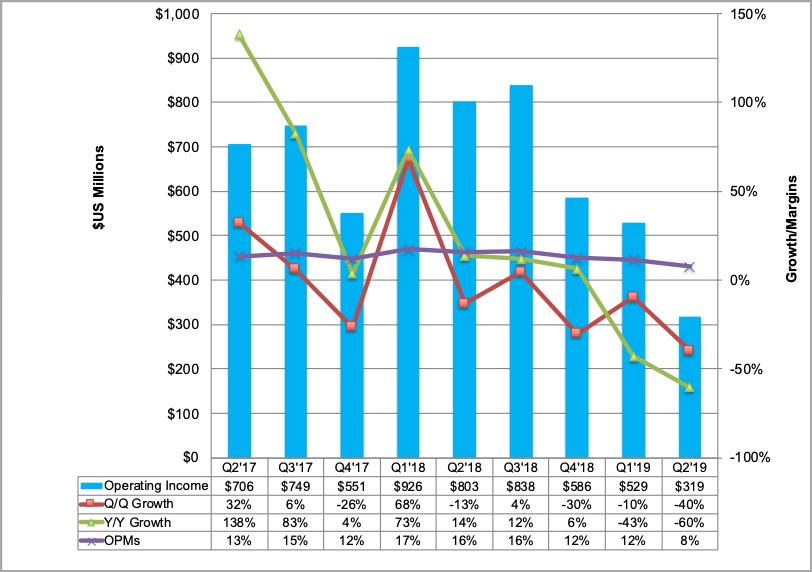

But what about just the display equipment business? We looked at the performance of just the display equipment pisions for larger equipment suppliers along with pure-play/majority display equipment company results to provide a better sense of performance in just the display market. We found an even more pronounced decline with display equipment operating income falling 40% Q/Q and 60% Y/Y to $319M, the lowest since Q2’16. Operating margins fell from 12% to 8%, the lowest since Q1’16.

Display Equipment Operating Income Results

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

The top performers in display operating margins were Nikon, V Technology, TEL, SNU and Wonik IPS. Nikon benefits from a monopoly position at G10.5 and a duopoly in other segments. V Technology has 80%+ share in many of its segments such as CF exposure, UV alignment, CD/Overlay, Total Pitch, CF AOI, CF repair, etc. TEL enjoys a strong position in coater/developers and dry etch, particularly at G10.5 which is higher margin. Wonik IPS saw a large jump in its operating margins after absorbing Tera Semicon.

Display Equipment Operating Margins

Source: DSCC’s Quarterly Display Supply Chain Financial Health Report

Some good news is that we saw bookings rise for the dozen companies who reveal this data. Bookings rose 11% Q/Q to $870M, which was down 16% Y/Y. SCREEN, SFA, Viatron, Toptec and AP Systems all had at least 30% Q/Q growth in bookings. V Technology had the largest decline, down 74%, losing the CF exposure business at HKC H4 to LG PRI which is a big loss given the size of this fab and reduced number of color filter opportunities going forward.

However, FPD equipment backlog was down for the 5th straight quarter, falling 4% Q/Q and 29% Y/Y. Philoptics, Toptec, SCREEN and SFA all saw impressive increases in backlog with 6 other companies seeing declines.

Free cash flow fell 12% Q/Q and 44% Y/Y to $1.05B. AMAT remained #1 followed by TEL which remained #2. AMAT and TEL accounted for >100% of the industry free cash flow. ULVAC and APS showed nice improvements in free cash flows, with most of the others showing a decline.

Other parameters examined in the report include operating cash flow, debt, debt/equity, net debt/equity and inventories All of this data is conveniently provided in a pivot table as well. For more information on this report, please contact [email protected].