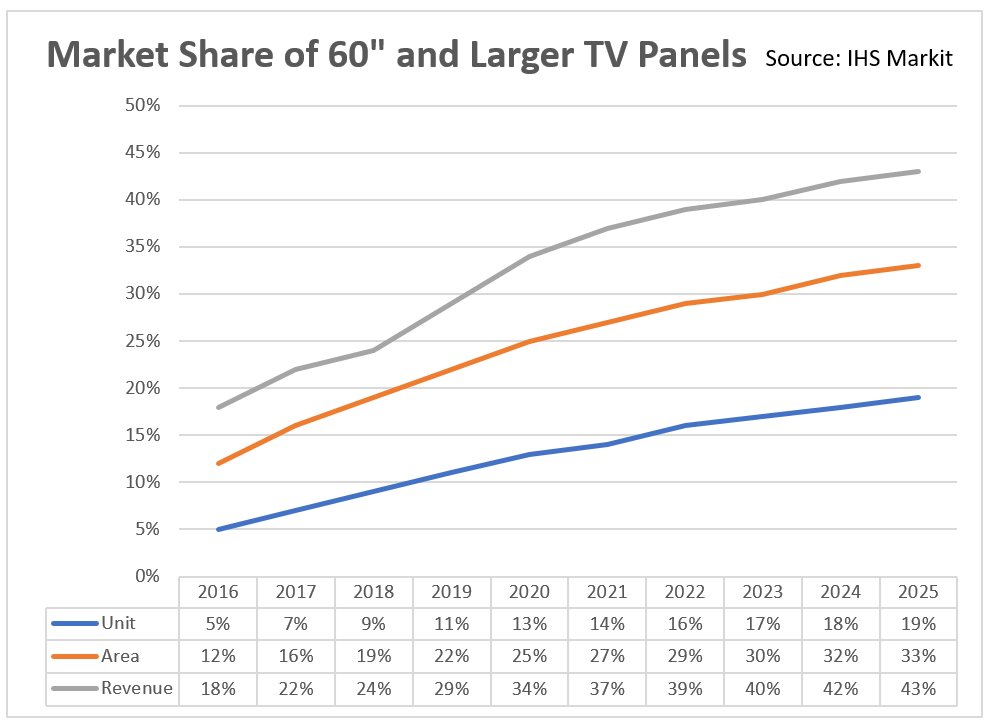

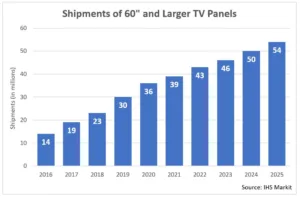

Demand for super-large TV panels (60″ and larger) is burgeoning and annual shipments will nearly quadruple, ten years after first topping 10 million units back in 2016, according to IHS Markit. Annual shipments of 60″ and larger TV panels, including LCD and OLED, are forecast to exceed 20 million units in 2018 and to reach 54 million units in 2025, accounting for 19% of the entire TV panel demand. Their combined share by shipment area is projected to almost triple to 33% in 2025 from 12% in 2016. IHS Markit’s Ricky Park commented:

“Growth

in the super-large TV panel market will be mainly driven by increasing investment in 10.5G fabs, which is capable of producing super-large TV panels with economy of scale. This will, in result, cut production costs and supply prices that will be translated into a drop in TV prices”.

BOE embarked on the mass production of panels at the 10.5G fab in the second quarter of 2018 for the first time in the world. Once the yield rate of super-large TV panels at the fab stabilises following production optimisation, production costs at the fab are expected to fall below those of 8.5G fabs.

To catch up to BOE, CSOT and Sharp are speeding up investment in their 10.5G fabs, with an aim to mass-produce super-large TV panels in 2019, a move that would rapidly increase panel supply of that size. The rise in capacity will intensify competition in the market, which will further cause a drop in TV set prices and help boost ultra-large TV set demand.

Such high demand for ultra-large TV sets is also expected to lead panel makers to further improve picture quality with the adoption of Ultra HD and 8K technologies. It will also contribute to the advancement in broadcasting systems and the content business, which would further spur consumers’ demand for super-large TVs. Park concluded:

“The ultra-large TV set market’s expansion will eventually help the panel industry digest fast-rising capacity and play a vital role in offsetting the fall in panel prices that could eat away overall revenue in the entire panel market”.