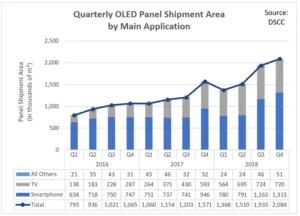

Strong growth in TV units as well as 98% year-on-year growth in OLED TV area grew the OLED panel market in the first half of 2018 by 30% year-on-year, according to Display Supply Chain Consultants. Meanwhile, smartphone panel growth paused as the industry absorbed excess inventory built in 2017. OLED smartphone panel growth will resume in the second half of the year, with 47% area growth forecast for the last six months of the year in this segment.

The report covers OLED shipments for eleven applications, eight panel makers and screen sizes up to 77″. The latest release added a two-quarter forecast in the history version with an additional four quarters and four years in the forecast version. The report also covers OLED fab utilisation by month for all OLED fabs in mass production and a two-month fab utilisation forecast. Furthermore, the report shows expanded detail of smartphone panel shipments by brand and model, as well as 32 separate smartphones with panels supplied by Samsung.

DSCC’s Yoshio Tamura r emarked:

emarked:

“OLED smartphone panel shipments will surge in the second half of the year with new model introductions by all of the leading brands. To recognise the importance of this critical sector, we’ve expanded the coverage of the report to capture more sizes and models. This will enable our clients to perform even more detailed analysis on the market”.

The report details the strong performance of OLED TV panel shipments by LG to 11 different TV brands. TV units grew 101% year-on-year to 1.33 million, paced by 116% growth year-on-year in 55″ TV panels. Shipments grew at near triple-digits for all major TV brands and LG added several new ones in 2018.

OLED panel revenues increased 14% year-on-year, with OLED TV panel revenue up 80% year-on-year as unit shipments surpassed modest price declines. Samsung continued to lead all panel makers with 86% of OLED panel shipment revenues but this represents a decline from 91% in the first half of 2017, as LG’s shipments of both TVs and smartphones have increased.

In addition, increased shipments from Chinese panel makers BOE, EDO, Tianma and Visionox have allowed these companies to gain a foothold in the market.

The full report can be purchased here.