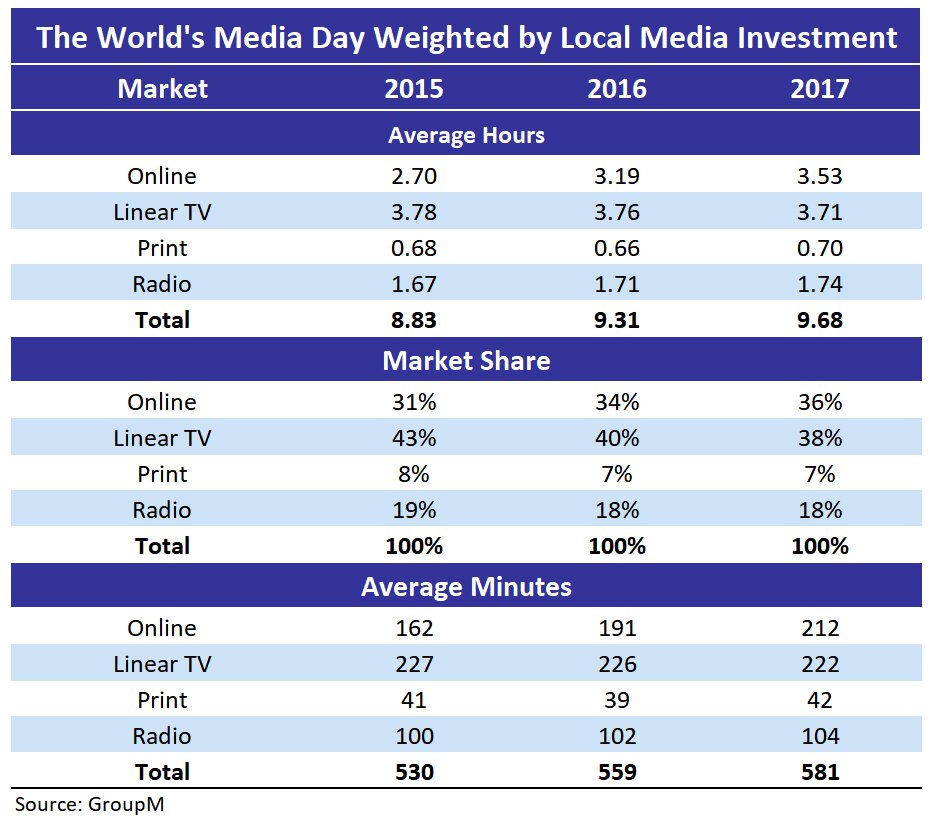

GroupM has released a new report examining consumer media consumption and advertising investment trends worldwide, focusing on the impact of technology and digital capabilities on consumers and advertisers. The company tabulated consumers’ time spent with each media format and calculated average time spent with media overall. In 2018, consumers will spend an average 9.73 hours with media, up from 9.68 hours in 2017. Additionally, GroupM predicts time spent with online media will overtake time spent with linear TV for the first time in 2018. Online will have a 38% share and TV 37%.

Increased time spent with online media supports ongoing e-commerce escalation. Thirty-five countries supplied 2017 e-commerce data to GroupM, revealing cumulative transactions worth $2.105 trillion, a growth of 17% over the prior year. The company predicts 15% growth in 2018 to $2.442 trillion, or about 10% of all retail.

The report also examines programmatic ad investment trends. On average, across reporting countries, 44% of online display investment was transacted programmatically in 2017 versus 31% in 2016. This will rise to 47% in 2018. For online video investment, programmatic is smaller — 22% in 2017 versus 17% in 2016 — and predicted to rise to 24% this year. The company also surveyed its parent organisation WPP’s vast network to better examine industry hot topics.

Blockchain: So far, there is scant evidence of practical application. Futures director Adam Smith said:

Blockchain: So far, there is scant evidence of practical application. Futures director Adam Smith said:

“Blockchain’s main attraction is its distributed ledger which tells everyone everything and thus presents the opportunity to reduce inefficiency or cheating. However, its Achilles’ heel is the need to keep every participating computer updated with everything all the time, and that’s too slow for a real-time world”.

AI: Conversely, respondents reported ample development and scaled deployments with AI. Smith also commented:

“Arguably, today’s most advanced marketing tools are the advanced algorithms helping brands analyse which creative or media placement is performing the best, at scale and speed. Among many future applications, we expect AI to helpfully emerge in fighting fraud that evades conventional, rules-based solutions”.

Data: Regarding marketer application of data to media investment, respondents cited ample room for improvement. Clients are increasingly aware of the value of owned or acquired data, but are often risk-averse to harvesting, storing and distributing it. In many smaller countries, available data is poor. Most US clients are using first-party data to activate digital media and they’ve frequently invested in enterprise data management platforms. Other markets are not so far along for varying reasons. Marketers most often using first-party data are performance-oriented, e-commerce driven and typically in auto, travel, hospitality, banking or sometimes supermarkets with well-managed end-point-of-sale systems.

Digital video competition: Because measurement of premium video audiences across platforms is woefully inadequate in every market, GroupM asked respondents to simply estimate the share of TV incumbents versus digital insurgents. Legacy TV players are believed to hold three-quarters of all video hours but less than a third (29%) of online video hours.

Metrics and viewability: The company believes that effective advertising must be in view and/or in hearing, and takes a leading position in setting industry and commercial viewability practices. Constituents reported some industry works-in-progress to enhance measurement of omni-platform video audiences. As this progresses, viewability continues to be debated, with some contrarians suggesting 100% in-view ads in mobile environments can sometimes be intrusive and negative to the consumer experience — and thus, brands.

In-housing: Respondents said this is more often talked about than done, but several countries reported hybrid arrangements — typically, clients taking on strategy but leaving execution to agencies. Most in-housing involved the biggest clients doing the simplest programmatic functions.

Price inflation: Respondents cited two inflation drivers — high demand for premium, brand-safe content and poor measurement of OTT and mobile platforms. The scarcity of measurable inventory drives up prices.

The “duopoly”: Google and Facebook continue to be the key growth drivers. Google’s search engine is critical to clients and YouTube is increasingly important for scaled, “premium” video. Concerns over the quality of programmatic inventory in the Google Display Network persist, but remedies are being pursued. Facebook’s success is partly due to the delivery of younger audiences via Instagram. The surge in large-advertiser investment in 2016-2017 also helped double Facebook’s share of digital investment. GroupM Global CEO Kelly Clark concluded:

“Automation and talent are the big themes in advertising’s current revolution. One of the downsides of specialisation is the increase in specialists who know more and more about less and less.

We have to use automation to liberate brain-power, so talented people can look across the entire media ecosystem to help clients optimise short-term results and create long-term brand value.”