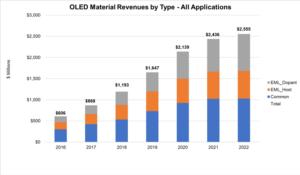

DSCC has a new report on OLED materials that forecasts that material values will grow to $2.5 billion in 2022 from $868 million last year, which was 43% up on 2016. That represents a CAGR of 24%.

OLED Material – Data and Image DSCC/OLED A

The revenue growth will be driven by even faster growth for revenues of Emitting Layer (EML) Dopant materials, expected to grow at a 34% CAGR from $205 million in 2017 to $872 million in 2022, and to increase their share of total OLED stack material revenue from 24% to 34%.

- Small/Medium applications are expected to continue to be the largest source of demand for OLED stack materials, with growth at a 24% CAGR from $513 million in 2017 to $1.52 billion in 2022, holding at 59% of the total OLED stack materials market.

- Revenues for TV applications will grow slightly slower than the overall market at 23% CAGR from $344 million to $963 million. This forecast anticipates the arrival of inkjet printing technologies that will enable RGB OLED structures at a relatively lower material cost.

- Material sales for OLED Lighting will grow at a 43% CAGR from $11 million in 2017 to $69 million in 2022, growing from 1.2% to 2.7% of the total OLED material market.

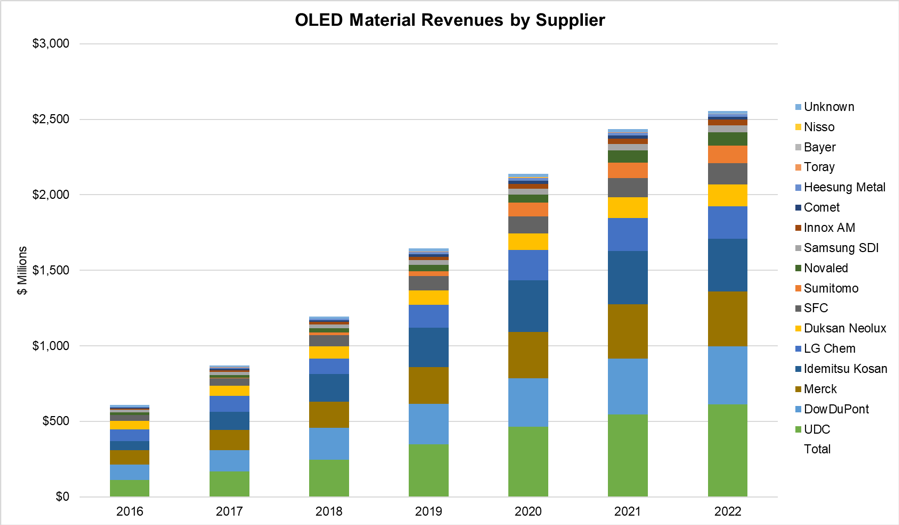

Turning to companies, the firm sees UDC as the main winner as it receives the highest revenues from OLED material sales, with their material sales expected to grow at a 30% CAGR through 2022 to more than $600 million, and their share of the overall material market to grow from 19% in 2017 to 24% in 2022. Dow Dupont and Merck will continue to hold the #2 and #3 positions among OLED material suppliers, with 15% and 14% of the market in 2022, respectively.

Analyst Comment

DSCC also said that it has taken into account a new stack for WOLED this time. (BR)