Ultraslim convertible and detachable products enjoyed significant growth in the Q1’16 PC and tablet market in Western Europe, says IDC. These products took 18.4% of total consumer PC and tablet shipments and 21.9% of commercial shipments (from 9.2% and 16.3%, respectively, in Q1’15). YoY growth stood at 44.1%.

Significantly, the Western Europe PC and tablet market is shrinking; IDC believes that it shrank by 13.7% YoY in Q1’16, reaching 18.2 million units. The decline was softer in the commercial segments (down 5.2%), but higher in consumer shipments (down 18.6%).

Overall, detachable shipments rose 190.4% YoY, from about 500,000 to 1.5 million units. Convertible notebooks – despite a 12.9% decline in the Western European PC market – rose 12% YoY, thanks to rising consumer demand. Detachables also rose in consumer tablets, increasing almost 400% to just under 1 million units. IDC says that this performance highlights the fact that purchases are driven by the need for portable and functional solutions. Although the uptake of these products has been limited so far, rising brand and price choices are winning over new consumers.

Detachable penetration is also rising in the commercial space. 500,000 such units were shipped in Q1’16, rising 92.9% YoY. IDC expects this adoption to accelerate in the coming months, as companies evaluate new designs. In some countries, detachables are also being deployed in the public sector.

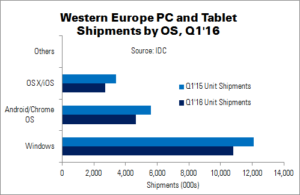

| Western Europe PC and Tablet Shipments by OS, Q1’16 (000s) | |||||

|---|---|---|---|---|---|

| OS | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Windows | 10,793 | 12,074 | 59.4% | 57.4% | -10.6% |

| Android/Chrome OS | 4,663 | 5,582 | 25.7% | 26.5% | -16.5% |

| OS X/iOS | 2,706 | 3,389 | 14.9% | 16.1% | -20.2% |

| Others | 2 | 4 | 0.0% | 0.0% | -50.7% |

| Total | 18,164 | 21,049 | 100.0% | 100.0% | -13.7% |

| Source: IDC | |||||

The trend towards these new form factors is being reflected in the evolution of ecosystems and operating systems. Windows continues to dominate, representing half of the PC and tablet market. Its position has been strengthened by Microsoft’s detachable devices and OEM support, which have increased its tablet market share to 13%. In PCs, the OS performed slightly below average; consumers have been slow to upgrade their old hardware to Windows 10, despite high awareness. In the commercial segment, many users have only recently renewed their old XP machines.

Android/Chrome OS came second, with Android remaining ahead in the tablet market (60%+ share), despite falling volumes due to market saturation. Chrome is still marginal in volume terms, but is gaining ground in certain countries, and specifically in education.

Apple continues to play a ‘significant’ role in the market, especially the premium segment. The iPad Pro only began to be shipped in the final days of Q1, and so did not have much of an impact. In the PC market, OS X’s market share rose from last year, thanks to the continued success of the Macbook Pro line. The new Macbooks, launched in April, will sustain portable shipments through 2016.