LG Display (LGD) had just closed another year of financial losses—the fourth in a row—and its outlook seemed bleak:

- Its core capital investment, 90K Gen 8.5 OLED fabs, was operating at only 50% utilization. TV sales were flat, while TCL and Hisense, leveraging MiniLEDs, dominated the one growing segment: TVs 65 inches and larger.

- LGD had limited capital to compete in the emerging IT OLED market, which was already crowded by $4–5 billion in investments from Samsung Display Co. (SDC), BOE, and Visionox.

- BOE had made inroads as a third competitor for Apple’s iPhone business and was awarded the primary shipments for the new low-end iPhone 17.

- Meanwhile, SDC rapidly gained a 2:1 lead in the only fast-growing OLED sector—gaming monitors—which are expected to reach 3.5 million units by 2025.

Despite its roughly $10 billion in negative assets, OLED Info, the Israeli publisher, continued to promote the idea of Samsung acquiring LGD, as if SDC needed more OLED TV capacity.

However, LGD’s fortunes began to change in early Q2 2024. The company closed a $1.2 billion deal with TCL for the sale of its under-utilized Gen 8.5 LCD fab in Guangzhou. Simultaneously, BOE failed to qualify for the top four iPhone 17 models, increasing LGD’s share of iPhone panel supply. Apple also began to slow its conversion of iPads and MacBooks to OLED—a consequence of having overestimated the iPad Pro OLED market size by a factor of two.

With new capital and more time to address the OLED IT market, LGD has received what appears to be a lifeline. The company quickly devised a plan to repurpose excess Gen 8.5 capacity, avoiding the need to replicate Canon/Tokki’s ~$1 billion fine metal mask (FMM) and vacuum thermal evaporation (VTE) tools required to manufacture hybrid OLEDs.

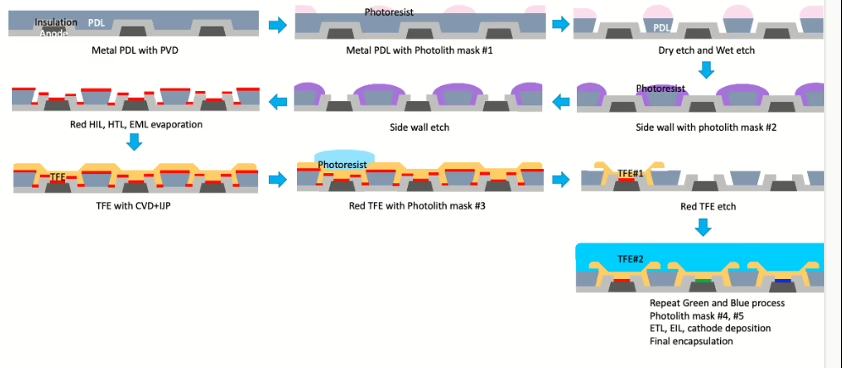

LGD is currently evaluating the nearly defunct Japan Display Inc. (JDI)’s eLEAP technology, which uses photolithographic patterning instead of FMMs to define subpixels—a similar method to Visionox’s ViP system, which utilizes Applied Materials’ Max OLED tool. Though full details remain unavailable, LGD is expected to convert some of its Gen 8.5 capacity in Paju into an oxide backplane, possibly aligning with JDI’s unoccupied half Gen 5 eLEAP pilot line or purchasing a pilot tool from Applied Materials, as SDC has done.

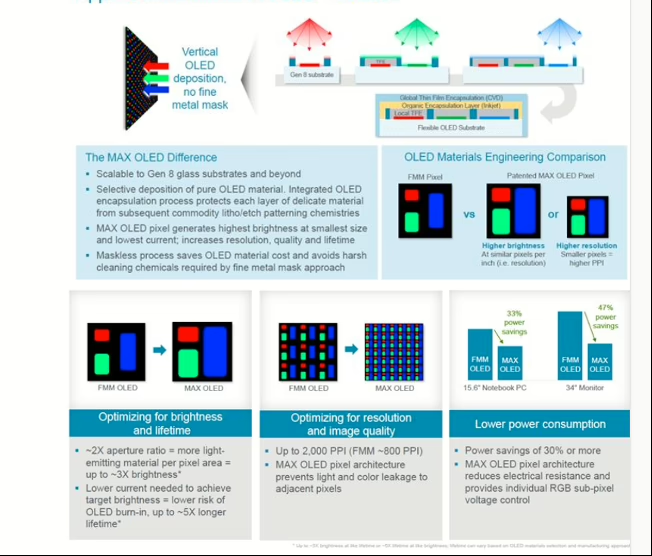

By eliminating FMMs and FMM-VTE equipment, LGD can achieve a larger OLED aperture ratio, increasing brightness, efficiency, and lifespan while reducing pixel crosstalk through more precise patterning. Color performance is also enhanced due to the absence of a highly conductive common layer between adjacent pixels—typical in FMM designs.

Applied Materials, JDI, and Visionox claim the following performance improvements:

- Brightness: up to 3× increase

- Lifetime: up to 5× longer

- Power consumption: ~30% reduction

- Material efficiency: 60–80% (versus 10–20% for FMMs), potentially doubling if a tandem OLED structure is not required.

Applied Materials also claims that the Max OLED tool can be used across all display applications—from 1-inch micro OLEDs to large-screen televisions.

In 2023, Apple announced plans to convert iPads and MacBooks to OLEDs, having already adopted OLED for its iPhones. This announcement triggered a rush among OLED manufacturers to secure a share of the new market. SDC, BOE, and Visionox began funding Gen 8.6 and Gen 7 fabs, while LGD, JDI, and CSOT lagged due to limited capital and commitment.

Currently, Apple sources hybrid OLED panels from both SDC and LGD for the iPad Pro. A second OLED iPad is expected in 2025, with an OLED MacBook anticipated in 2026, using displays manufactured at Samsung’s new Gen 8.6 OLED fab. This diversity raises the question: will Apple—known for demanding consistent performance—accept OLED panels built with two different manufacturing methods (FMM vs. photopatterning) for its IT devices?

If LGD succeeds, the future OLED Gen 8.x supply chain may look as follows:

- LGD and SDC: Gen 6 hybrid OLEDs using LTPS or LTPO backplanes and Canon/Tokki FMM patterning

- SDC: Gen 8.6 hybrid OLEDs with oxide backplanes and Canon/Tokki FMM patterning

- BOE: Gen 8.6 hybrid OLEDs using LTPS or LTPO backplanes and Sunic FMM patterning

- Visionox: Gen 8.6 OLEDs with oxide backplanes and AMAT photopatterning

- LGD: Repurposed Gen 8.5 OLEDs with oxide backplanes and AMAT photopatterning

In this evolving landscape, it’s the panel makers doing the heavy pulling—often in different directions—but Apple remains in the driver’s seat, comfortably guiding the sled.

Barry Young has been a notable presence in the display world since 1997, when he helped grow DisplaySearch, a research firm that quickly became the go-to source for display market information. As one of the most influential analysts in the flat-panel display industry, Barry continued his impact after the NPD Group acquired DisplaySearch in 2005. He is the managing director of the OLED Association (OLED-A), an industry organization that aims to promote, market, and accelerate the development of OLED technology and products.