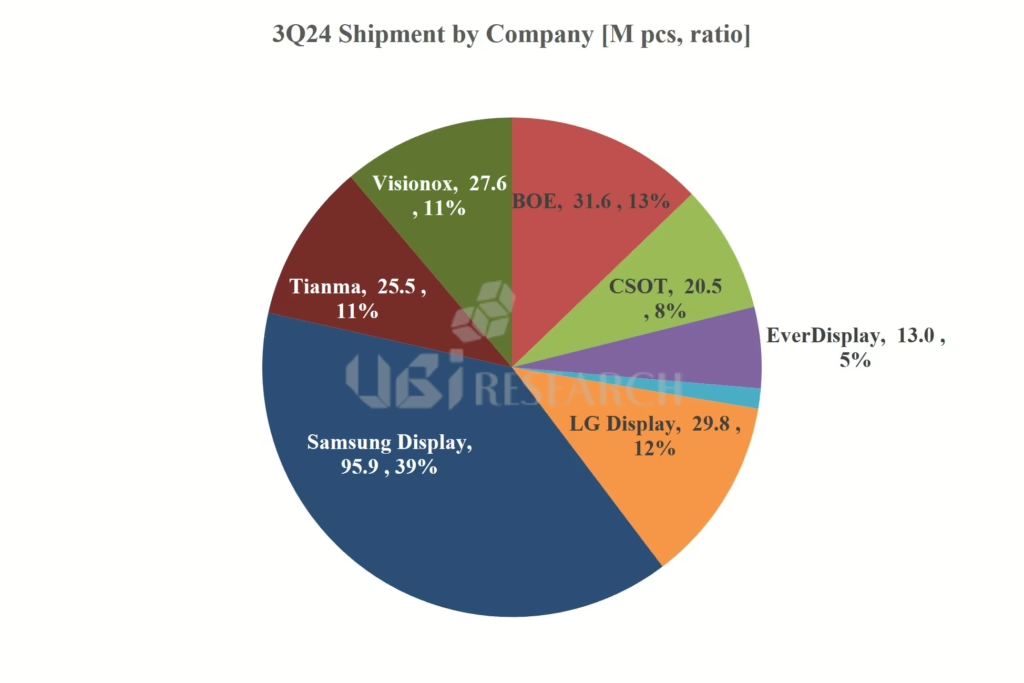

The small OLED market had an impressive third quarter, with shipments surging 7.8% compared to the previous quarter and a stunning 32.6% YoY. A total of 247 million units were shipped, driven largely by standout performances from LG Display and China’s Everdisplay, according to Korea’s UBI Research.

LG Display took the lead in the small OLED market, shipping an impressive 17.6 million panels for the iPhone 16 series—a 64% jump from Q2. The company’s smartwatch panel shipments soared even higher, climbing 147% to 12.2 million units. That’s a remarkable 74% boost compared to the previous quarter and a 115% increase from the same period last year.

Looking ahead, LG Display is gearing up for more growth, especially with the iPhone 17 series slated for release in 2025. UBI is saying that industry insiders suggest that supply chain challenges for BOE, a key competitor, could push more demand to LG Display. However, with production already at near-full capacity, LG may need to expand its 6G production lines to meet the rising demand.

China’s Everdisplay also made a significant impact in Q3, more than doubling its shipments to 13 million units. This marks a strong comeback for the company and reinforces its role as a key player in the small OLED segment. Tianma, another Chinese manufacturer, recorded modest shipment growth, contributing to the market’s overall upward momentum.

Samsung Display experienced a slight dip in shipments, but its sales remained steady, matching Q2 levels. BOE, meanwhile, kept its shipment volumes stable but managed to post a 15% sales increase, reflecting stronger pricing or product mix improvements.

As the holiday season approaches, the small OLED market is bracing for its biggest quarter yet, says UBI. Smartphone shipments typically peak in Q4, and experts predict global OLED shipments for smartphones will exceed 800 million units in 2024. With LG Display, Samsung, and BOE all poised to increase shipments, the small OLED market is on track for a banner year.