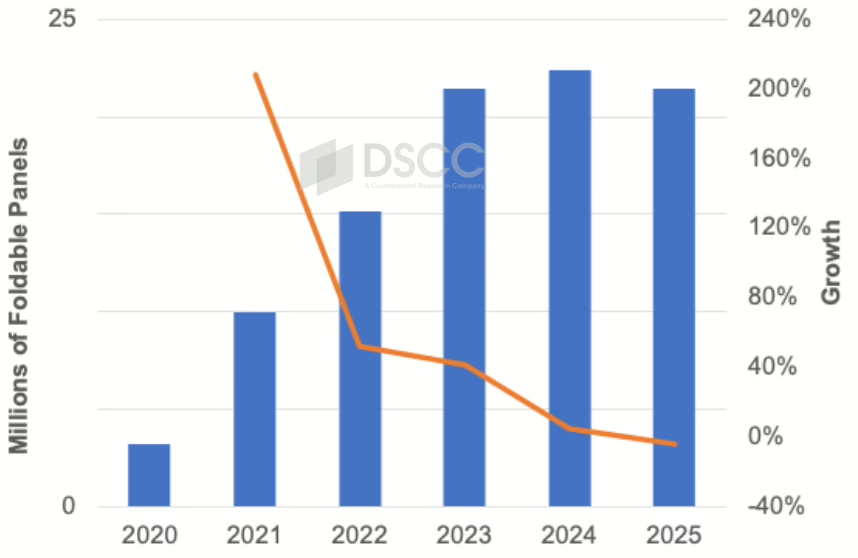

The foldable smartphone market is experiencing its first significant slowdown since its inception, with growth stalling at approximately 22 million panel shipments according to new data from DSCC. The market is projected to grow by only 5% in 2024, a stark contrast to the consistent 40% growth rates seen from 2019 to 2023. This deceleration is particularly evident in the third quarter of 2024, which witnessed a dramatic 38% YoY decline in panel shipments, with similar declines expected in four of the next five quarters.

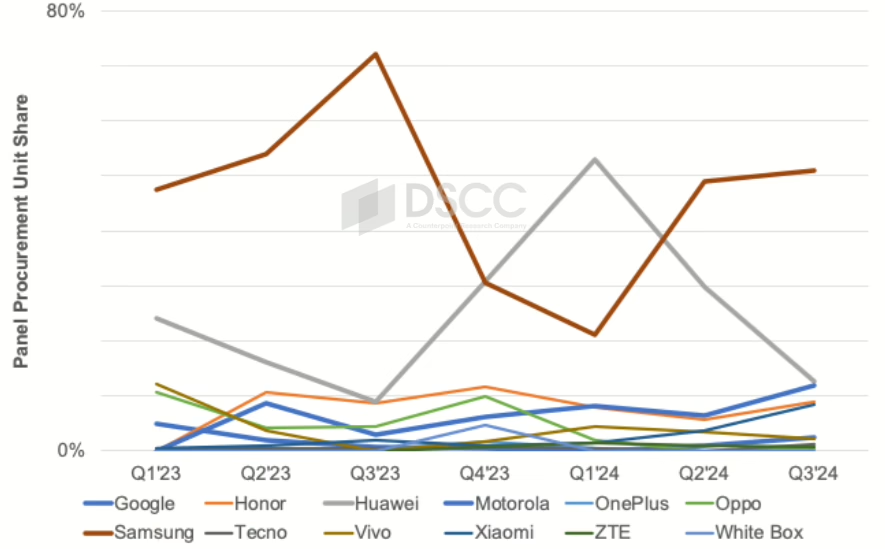

Samsung continues to lead the market but faces mounting challenges. The company’s market share has declined significantly from 52% to 40% in 2024, primarily due to slower-than-expected adoption of its Galaxy Z Flip 6 clamshell smartphone. Panel shipments for the Z Flip 6 are tracking more than 10% below its predecessor’s performance, with demand heavily concentrated in Korea and Europe while struggling to gain traction in the United States and China. Samsung’s overall foldable panel procurement has dropped to its lowest level since 2021, marking a decline of over 20%.

Huawei has emerged as the second major player, achieving remarkable growth despite operational challenges. The company’s market share rose from 18% to 33% in 2024, representing over 90% growth in foldable panel procurement. However, Huawei’s performance has been inconsistent, with its market share dropping from 30% to 13% in Q3 2024 due to delayed product launches. The company faces significant headwinds due to Chinese semiconductor restrictions, which limit its access to advanced processors and manufacturing equipment.

The market remains heavily concentrated, with Samsung and Huawei collectively accounting for 70% of panel procurement. Other manufacturers, including Motorola and Honor, maintain high single-digit market shares but have failed to emerge as significant challengers to the dominant players. Several Chinese brands are scaling back their foldable efforts, with some discontinuing their clamshell models due to challenges with price elasticity, margins, and technical issues.

Looking ahead to 2025, the market is expected to experience its first decline in panel procurement. Samsung is projected to reclaim market share, rising above 50% with over 20% growth, though volumes will remain below 2022-2023 levels. The company plans to diversify its portfolio with a more affordable clamshell model and a larger infolding device. Huawei is expected to reduce its model lineup and lose market share. DSCC anticipates the overall market will see fewer models, dropping from 41 in 2024 to 32 in 2025.

Despite these near-term challenges, the long-term outlook remains optimistic. Apple’s anticipated entry into the foldable market in the second half of 2026 could drive significant growth given the company’s dominant position in flagship smartphones, according to DSCC. The market is projected to rebound strongly with over 30% growth in 2026, followed by sustained growth exceeding 20% in both 2027 and 2028. Additionally, the market is expected to diversify with the introduction of new form factors, including at least one new tri-fold device in 2026 and the first slidable laptop in 2025.