The global PC market, according to the latest report from IDC, showed a better-than-expected performance in the third quarter of 2023. Shipments reached 68.5 million units, surpassing initial forecasts. However, this figure represents a 7.2% decrease compared to the same quarter in 2022.

| Segment | 2023 Shipments (Million Units) | 2023/2022 Growth (%) | 2027 Shipments (Million Units) | 2027/2026 Growth (%) | 2023-2027 CAGR (%) |

|---|---|---|---|---|---|

| Consumer | 113.9 | -14.8% | 125.5 | 1.4% | 2.4% |

| Education | 29.6 | -15.4% | 35.0 | 0.8% | 4.2% |

| Commercial (ex. Edu) | 108.3 | -12.2% | 124.6 | 2.6% | 3.6% |

| Total | 251.8 | -13.8% | 285.0 | 1.8% | 3.1% |

Several factors contributed to this performance. A significant portion of the increased volume was due to inventory restocking, primarily on the consumer side. Additionally, there were efforts to mitigate anticipated cost escalations, such as expected rises in India’s import duties. Although these duties were later suspended, the anticipation led to an over-absorption of units in the market. On the other hand, tightened IT budgets caused business PC units to fall short of conservative commercial forecasts.

In light of the current situation and a challenging macroeconomic environment, IDC has revised its 2023 forecast for the worldwide PC market, now expecting a 13.8% decline compared to 2022. This follows a 16.6% decline the previous year, marking two consecutive years of significant YoY drops— two consecutive years of double-digit drops is a first in the PC market’s history. However, this trend is anticipated to set the stage for a recovery.

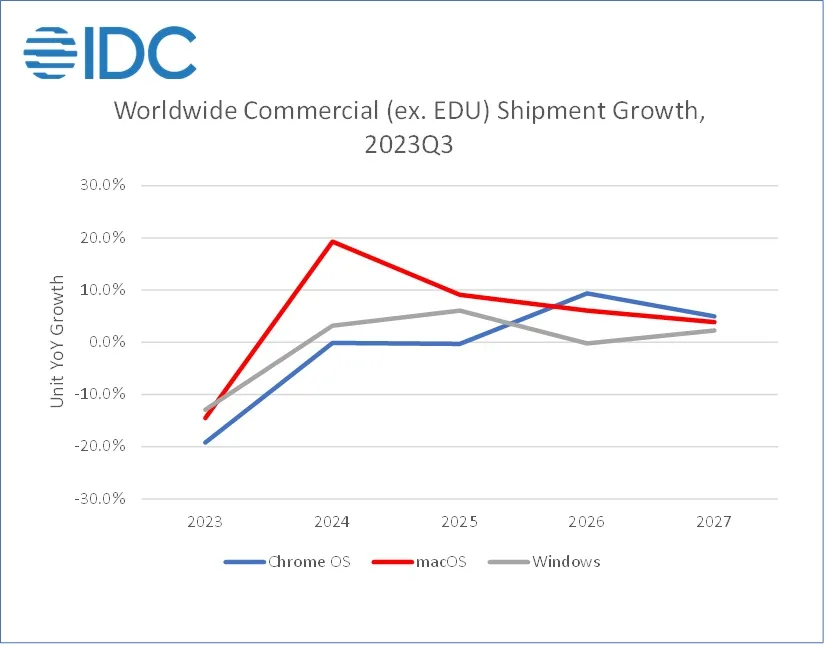

Looking ahead to 2024 and beyond, IDC predicts a rebound in the PC market, driven by several key factors. One of these is the PC refresh cycle, where a large number of commercial PCs exceeding four years in use by 2024 will likely require updating, especially with the transition to Windows 11. This is expected to contribute to a 3.4% growth in the total PC market in 2024 compared to 2023.

Another driving force is the integration of AI capabilities into PCs, initially targeting certain segments of the enterprise PC market in 2024. This innovation is expected to encourage upgrades and eventually extend to the broader market as use cases expand and costs decrease. Additionally, the consumer installed base is projected to continue evolving and recovering.

The cumulative impact of these elements is poised to make 2024 a crucial year for the PC market, offering a break from recent setbacks. Post-2024, the market is expected to exceed pre-pandemic shipment levels, potentially reaching 285 million units by 2027.

The PC ecosystem has experienced similar situations in the past. For example, there was a period from Q2’12 to Q4’16 when the PC market saw 19 consecutive quarters of YoY declines. In comparison, the current forecast of eight consecutive quarters of decline from Q1’22 through Q4’23 seems less severe. It’s also worth pointing out that notebook sales are currently higher than in 2019, indicating a significant expansion of the notebook market post-COVID. Factors such as hybrid work, commercial refresh, and growth in premium PCs are expected to contribute to a compound annual growth rate of 3.1% from 2023 through 2027.