The EMEA PC market declined in-line with worldwide totals in Q1’16, with clear splits between the consumer/commercial and regional markets. Shipments were down 10% YoY to 19.5 million units, compared to a 9.6% fall in global results.

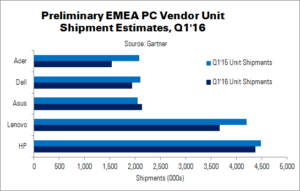

Some vendors were affected more than others. HP performed better in EMEA than it did worldwide, increasing its market share by 1.7 percentage points, despite a 2.5% shipment decline. Second-place Lenovo lost share, while Asus (in third) was the only top five vendor to increase its shipments (up 3.9%).

Demand was low for all mainstream professional PCs in Q1. However, demand continued to rise for thin and light detachable notebooks, in both business and consumer segments. Gaming notebook sales also grew in developed European markets. The rise of these two segments, however, was not enough to counter the steep professional PC decline. Major professional deployments are expected to have been delayed until the end of 2016.

Consumer shipments were stable in the UK and Germany, which benefited HP. However, spending in France was more focused on HD TVs and media centre peripherals for the same, than on PCs. “These various trends in major Western European markets reveal that vendors are failing to give consumers and businesses a compelling reason to upgrade their existing PC hardware,” said Gartner analyst Isabelle Durand.

PC demand in Eastern Europe and Eurasia was affected by extended Christmas and New Year holidays and ‘significant’ economic challenges in Russia and Ukraine. Falling oil prices impacted the ruble/US dollar exchange rate even more than other currencies, as well as affecting economic and political stability in the Middle East.

Gartner expects the caution of PC buyers in EMEA to continue in to Q2. Durand said, “PC vendors must react quickly to varied trends among the professional and consumer segments, and fast-changing market conditions. The structure of the devices market and user purchasing behavior has fundamentally changed the dynamics of the PC market.”

| Preliminary EMEA PC Vendor Unit Shipment Estimates, Q1’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Unit Shipments | Q1’15 Unit Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| HP | 4,372 | 4,482 | 22.4% | 20.7% | -2.5% |

| Lenovo | 3,671 | 4,199 | 18.8% | 19.4% | -12.6% |

| Asus | 2,130 | 2,050 | 10.9% | 9.5% | 3.9% |

| Dell | 1,938 | 2,097 | 9.9% | 9.7% | -7.6% |

| Acer | 1,532 | 2,080 | 7.8% | 9.6% | -26.4% |

| Others | 5,875 | 6,776 | 30.1% | 31.2% | -13.3% |

| Total | 19,517 | 21,684 | 100.0% | 100.0% | -10.0% |

| Source: Gartner | |||||

Analyst Comment

Once again, IDC released its data at the same time as Gartner. The firm was less optimistic, citing a 14.6% YoY decline to 17.2 million units in the EMEA market. Commercial notebooks performed well, but consumer units suffered from a poor annual comparison as 2015 was supported by Bing promotions.

While it is not unusual to see variance between countries, Q1’16 showed variations between segments and product categories in the same country.

Shipments in Western Europe declined 12.1% (slightly better than expected) and Eastern Europe was down 10.8%. MEA declined 25.1%. Commercial notebooks posted 1.3% growth in Western Europe (and reached double digits in Germany). On the whole most countries were in decline, except Finland and Norway. (TA)