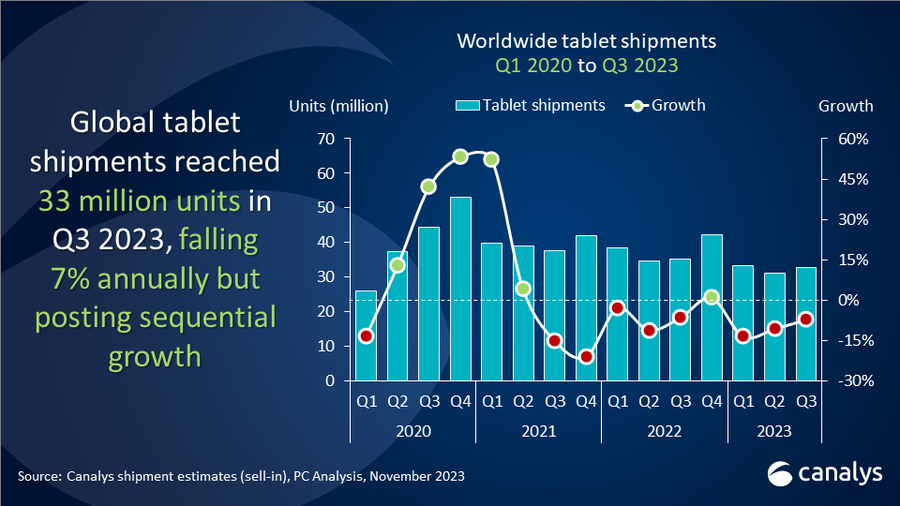

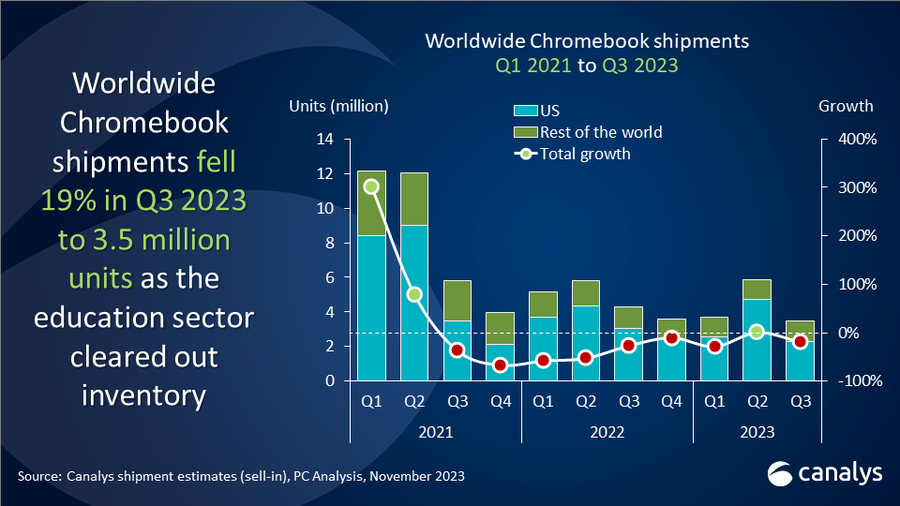

The tablet and Chromebook markets witnessed contrasting fortunes in Q3′ 20’23, as revealed by the latest data from Canalys. Tablet shipments globally hit 33 million, marking a 7% annual decline but an 8% sequential increase—a sign of rejuvenation ahead of the holiday season. In contrast, Chromebook shipments dipped to 3.5 million, a 19% fall attributed to clearing back-to-school inventory.

| Vendor | Q3’23 Shipments | Q3’23 Market Share (%) | Q3’22 Shipments | Q3’22 Market Share (%) | Annual Growth (%) |

|---|---|---|---|---|---|

| Apple | 12,542 | 38.3 | 14,381 | 40.8 | -12.8 |

| Samsung | 6,219 | 19.0 | 6,610 | 18.8 | -5.9 |

| Lenovo | 2,600 | 8.0 | 2,712 | 7.7 | -4.1 |

| Huawei | 1,872 | 5.7 | 1,461 | 4.1 | 28.2 |

| Xiaomi | 1,618 | 4.9 | 736 | 2.1 | 119.7 |

| Others | 7,853 | 24.0 | 9,328 | 26.5 | -15.8 |

| Total | 32,705 | 100.0 | 35,228 | 100.0 | -7.2 |

Apple continues to lead the tablet market, albeit with a 12.8% decline in shipments. Samsung follows, with a slighter decline of 5.9%. The real surprise comes from Xiaomi, making a grand entry into the top five with an impressive 119.7% growth. Huawei also outperformed, surpassing Amazon in vendor rankings.

The shift towards premium, large-screen tablets reflects changing consumer needs for productivity and content consumption. Experts like Himani Mukka from Canalys highlight the critical role of generative AI capabilities in maintaining a competitive edge in the tablet market. Apple and Samsung are already integrating AI into their hardware portfolios, setting a trend that others must follow to stay relevant.

In the Chromebook space, Acer reclaimed the top spot despite a 17.3% year-over-year drop in shipments. HP and Dell followed, but the overall market saw a significant downturn, partly due to the saturation of the education sector and the looming challenge of AI-enabled devices in the PC industry. The Chromebook Plus series, with enhanced performance and AI-focused features, is Google’s latest attempt to revive interest, particularly in the small business segment.

| Vendor | Q3’23 Shipments | Q3’23 Market Share (%) | Q3’22 Shipments | Q3’22 Market Share (%) | Annual Growth (%) |

|---|---|---|---|---|---|

| Acer | 884 | 25.3 | 1,069 | 24.9 | -17.3 |

| HP | 674 | 19.3 | 802 | 18.7 | -16.0 |

| Dell | 672 | 19.3 | 934 | 21.8 | -28.0 |

| Lenovo | 644 | 18.5 | 768 | 17.9 | -16.1 |

| Asus | 387 | 11.1 | 397 | 9.2 | -2.4 |

| Others | 229 | 6.6 | 323 | 7.5 | -29.2 |

| Total | 3,489 | 100.0 | 4,292 | 100.0 | -18.7 |