Semiconductor company Magnachip reported its third quarter 2023 financial results today, highlighting progress in its display business despite macroeconomic challenges.

| Magnachip Revenues ($ thousands) | Q3’23 | Q2’23 | Q/Q Change | Q3’22 | Y/Y Change |

|---|---|---|---|---|---|

| Standard Products Business | |||||

| Display Solutions | $6,404 | $9,657 | Down 33.7% | $6,355 | Up 0.8% |

| Power Solutions | $45,215 | $41,718 | Up 8.4% | $56,416 | Down 19.9% |

| Transitional Fab 3 foundry services | $9,626 | $9,604 | Up 0.2% | $8,428 | Up 14.2% |

| Gross Profit Margin | 23.6% | 22.2% | Up 1.4%pts | 24.2% | Down 0.6%pts |

| Operating Loss | ($9,235) | ($10,656) | Up n/a | ($10,008) | Up n/a |

| Net Loss | ($5,165) | ($3,947) | Down n/a | ($17,195) | Up n/a |

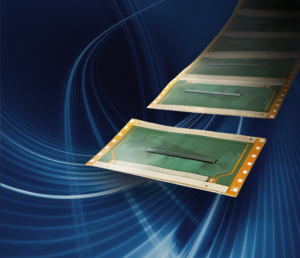

The company’s CEO YJ Kim noted that Magnachip has completed the qualification of two driver IC chips at a new tier 1 panel maker and is currently going through the qualification process with two smartphone makers. He said these new driver ICs target premium smartphone models initially but that Magnachip is now working on additional display driver ICs to address the mass market smartphone segment as well.

Kim expressed confidence that Magnachip’s display products offer competitive advantages that position the company for success in the rapidly expanding OLED display market in Asia. He pointed to strong long-term growth potential for the company’s display business, despite some near-term market challenges.

The earnings report comes amid a period of heightened economic uncertainty globally. However, Magnachip sees ongoing momentum for its display driver ICs thanks to OLED adoption. The company is focused on rolling out next-generation display products to maintain and expand its footprint.

While macroeconomic conditions have impacted demand currently, Magnachip remains confident in the long-term outlook for its display business. The company is continuing R&D and qualification efforts for new display products targeting both premium and mass market consumer devices.

Reality Bytes

A more sober assessment of Magnachip’s fortunes would show that the company is bleeding cash and has since consistent declines in sales (18.4% decline per year, on averge, for the last three years). It is, after all, a semiconductor company, and the display driver business is a smaller part of its overall business, significant though it may be.