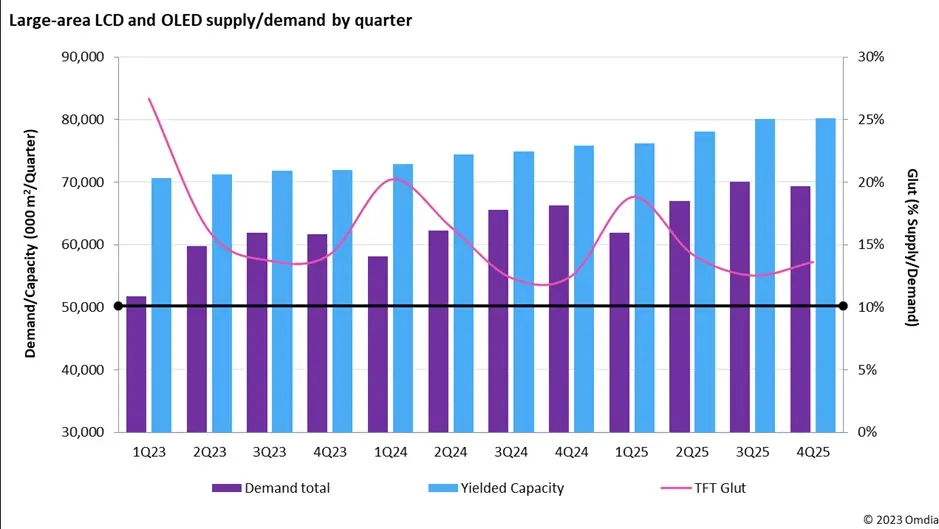

The supply-demand imbalance that has plagued the market for large LCD and OLED panels over the past few years is making a comeback. According to market research firm Omdia, after making significant progress in the first half of 2023 to reduce excess capacity, the industry is now poised to slide back into oversupply in the second half of the year and into early 2024.

The glut ratio, which compares production capacity to actual shipments, declined to 13.7% in the third quarter from 26.7% in the first quarter, thanks to a nearly 20% jump in demand against modest capacity growth. This long-awaited rebalancing enabled panel manufacturers to raise LCD TV panel prices by 31% on average and improve profitability.

However, demand is softening while production capacity remains abundant. As a result, the glut ratio will likely rise again starting in the fourth quarter, exacerbated by TV makers’ reluctance to build inventories amid weak end-market demand. In response, panel makers are once again restricting production by reducing glass input. Some Chinese manufacturers are even considering extending Lunar New Year shutdowns in February to curb output. But with panel prices still relatively high, TV brands are pushing back through tighter inventory controls of their own.

This tug-of-war between panel makers trying to restrict supply and set makers limiting purchases reflects an industry still struggling to align production with demand after years of over-expansion. With panel manufacturers and TV brands both lacking profitability, a sustained recovery remains elusive until end-market demand rebounds more meaningfully.