Indium is the key ingredient in Indium-Tin Oxide (ITO), a transparent conductive coating found in virtually all displays, including both LCDs and OLEDs. It is also used in many types of touch screens. The high price of indium and not always certain supply has driven multiple research programs to find an alternative material. The most recent alternative materials being considered are perovskite materials such as strontium vanadate. (See the separate article Perovskites As A Transparent Conductor)

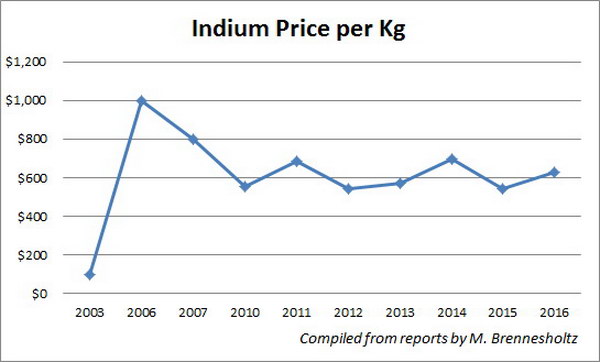

Last time I took a detailed look at the price of indium was in 2007 when the price was about $800/Kg, which was a dramatic increase from the price of $100/Kg just 4 years earlier. As part of that price increase, there had been a brief spike in the price to about $1000/Kg, fueled by fears for the supply. More recently, prices have been mostly stable, varying in the $540 – $695/ Kg range, as shown in the figure.

While the demand for indium has increased, so has the supply. In the 2003 – 2007 time frame, indium was mostly a byproduct of zinc and lead production. In fact, early in the 2003 – 2007 time frame, zinc and lead producers didn’t always bother to refine the indium because of low price and low demand.

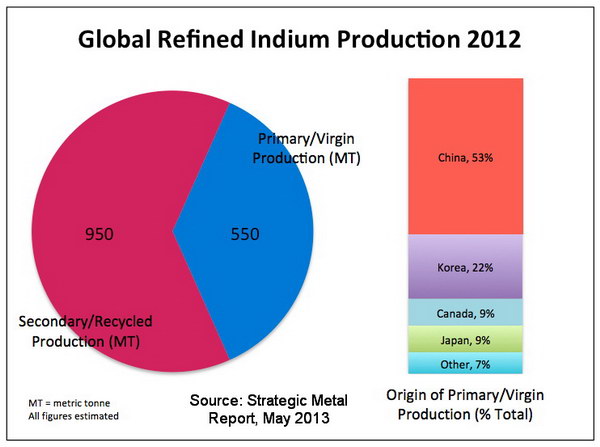

The supply is much more assured now. One of the main sources of indium is now recycling, representing more than 63% of total indium usage of 1500 tons in 2012, according to a study by Strategic Metal Report, as shown in the figure. According to a US government estimate from 2014, refining capacity for virgin indium had risen to 820 tons per year from 550 tonnes per year since 2012. This will be further augmented by two major refinery additions in China in 2015. One of these refinery is expected to have a capacity of 200 tons per year. Capacity for the other refinery was not available.

Most of the recycling is done in, not surprisingly, China and Korea. China represents a majority of the supply of virgin material, followed by Korea. Canada, Japan and France run distant third, fourth and fifth, according to the 2014 data. Another factor in relatively stable prices is the large inventory of indium in warehouses. Reportedly, China’s Fanya Metal Exchange has 3600 metric ton of indium sitting in warehouses. Fanya is currently being investigated by the Yunnan provincial government for irregularities, so this figure should not be taken as gospel.

Even if perovskites or other ITO replacement materials take over the conductive coating market in LCD and OLED displays and touch screens, there are still plenty of other growing markets for indium. These include InGaN- and InGaAlP-based laser diodes and LEDs, RoHS-compliant, lead free solders, thermal control coatings on window glass and in solar cells. –Matthew Brennesholtz

Analyst Comment

There was a lot of interest in developing ITO replacements based on materials including graphene when the pricing was rising rapidly in 2003-2006, but the relatively stable pricing in the last few years has made life much harder for those new materials, especially as they often need investment in new processes and depositing and patterning them. (BR)