The global tablet market fell 7% YoY in Q2’15, says IDC, to 44.7 million units. With little hardware innovation and few new products, QoQ results were also down 3.9%.

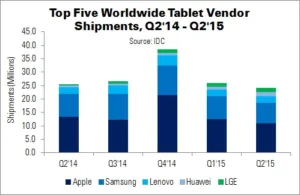

There is a “profound shift” ongoing in the vendor landscape today, says IDC’s Jean Philippe Bouchard. The major vendors – Apple and Samsung – are continuing to lose share. In Q1, these two vendors represented 45% of the worldwide tablet market, dropping to 41% in Q2 with the rise of companies including LG, Huawei and E Fun.

The rising vendors managed to address available niche markets, such as connected tablets (LG/Huawei) and affordable larger devices and 2-in-1s (E Fun). This trend is also reflected in on a larger scale, with the top five vendors’ combined market share falling from 58% in Q1 to 54% in Q2. Huawei entered the top five for the first time ever in Q2, while E Fun returned to the top 10 after more than a year.

Despite the fall, Apple remained at the top of the vendor rankings. The company shipped 10.9 million iPads in Q2’15. Samsung held on to second place, with 7.6 million units shipped and a 17% market share. Lenovo remained in third, with 2.5 million units and 5.7% of the market. LG and Huawei had a statistical tie (less than 0.1% difference) for fourth place, each shipping 1.6 million tablets.

Jitesh Ubrani of IDC listed some of the factors contributing to the declining tablet market. These included longer lifecycles; increased competition from large smartphones; and the ability for older tablets to accept new OS versions, keeping them relevant. However, “with newer form factors like 2-in-1s, and added productivity-enabling features like those highlighted in iOS9, vendors should be able to bring new vitality to a market that has lost its momentum”, he added.

| Top Five Worldwide Tablet Vendors – Preliminary Results, Q2’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share | YoY Change |

| Apple | 10.9 | 13.3 | 24.5% | 27.7% | -17.9% |

| Samsung | 7.6 | 8.6 | 17.0% | 18.0% | -12.0% |

| Lenovo | 2.5 | 2.4 | 5.7% | 4.9% | 6.8% |

| Huawei | 1.6 | 0.8 | 3.7% | 1.7% | 103.6% |

| LGE | 1.6 | 0.5 | 3.6% | 1.0% | 246.4% |

| Others | 20.4 | 22.4 | 45.6% | 46.7% | -9.3% |

| Total | 44.7 | 48.0 | 100.0% | 100.0% | -7.0% |

| Source: IDC | |||||