5G is coming, there is no doubt about that. When it comes, however, what will it look like? Who will pay for it?Strategy Analytics released a report titled “LG Uplus Looks for 5G Differentiation Through AR and VR Service Portfolio.”

This report was released September 12th, distributed free by Strategy Analytics and paid for by LG U+ (AKA LG Uplus), the number three cellular service provider in Korea, behind SK Telecom and KT. Since Korea is often on the leading edge of this sort of innovation, by looking at the Korean market, possibly we can get an idea of the future shape of the 5G market in the US, Europe and other countries.

Samsung’s Galaxy S10 5G (Left) and LG’s V50 ThinQ 5G (Right) were both available for the introduction of 5G NR in Korea. (Credit: Samsung, LG)

Samsung’s Galaxy S10 5G (Left) and LG’s V50 ThinQ 5G (Right) were both available for the introduction of 5G NR in Korea. (Credit: Samsung, LG)

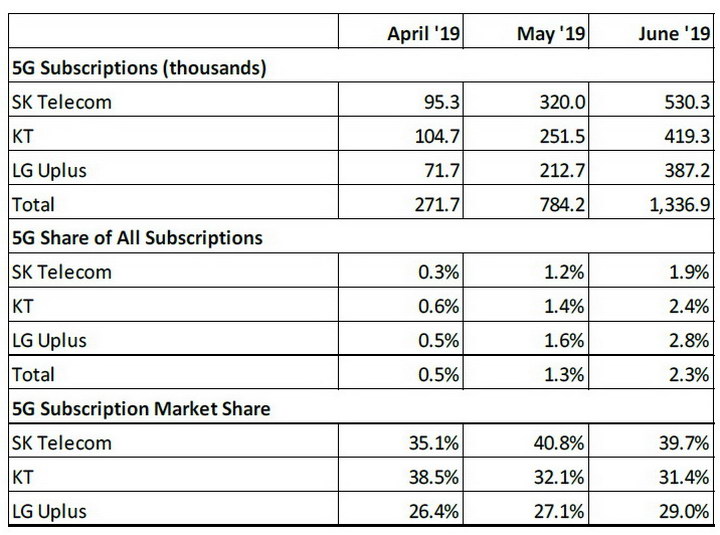

All three cellular service providers started their 5G NR service in early April. Available smartphones in Korea at the 5G launch were the Samsung’s Galaxy S10 5G and LG’s V50 ThinQ 5G. South Korea’s Ministry of Science and IT (MSIT) reported 1.34 million 5G subscriptions by the end of June 2019, which represents 2.3% of all cellular subscriptions. By August, independent estimates put 5G penetration at 2 million subscriptions.

At the urging of the MSIT, all three companies offered a very basic 5G plan for KRW55,000 per month ($47.70), only slightly above each company’s basic 4G plan. The 5G plans included 8 – 9GB of data, compared to 3 – 4GB for basic 4G plans. All three companies offered a variety of plans with higher or unlimited data, at higher prices, of course. The top plan at the 5G introduction for SK Telecom, “Platinum”, was KRW125,000 ($108.50), for KT, the “Super Plan Premium” was KRW130,000 ($112.90) and the top LG U+ plan, “Premium”, was KRW66,000 ($57.30) in April, going to KRW95,000 ($82.50) for purchases after June. Additional plans, at still higher prices with still higher data limits, have been offered since then. All these plans had monthly data limits and download speed limits (but no extra charges) after the consumption of the initial data allowance. These restrictions, plus bonuses and discounts, makes it difficult to compare the three companies directly.

5G Subscription Evolution in South Korea (Credit: Strategy Analytics)

5G Subscription Evolution in South Korea (Credit: Strategy Analytics)

Apparently, Koreans could compare the plans with little problem and found the LG U+ plans attractive – while LG U+ has about 20% of the overall cellular service market in Korea, it had achieved about a 29% market share in the 5G market by June.

The installation of 4G LTE networks went very quickly after 4G LTE service began in July, 2011 in Korea, with about 95% of the population covered by each of the service providers within the first year after the introduction of 4G LTE. 5G appears to be on track for a similar coverage of 5G in the C-band (4 – 8GHz), AKA 5G NR AKA 5G Sub-6. LG U+ had 18,000 5G base stations at launch, with coverage in the traffic-intensive areas in 85 cities and towns.

It plans to have installed 80,000 base stations by the end of 2019, covering 90% of the population. Coverage of the whole country by 5G NR for all three networks is expected by 2022. The three service providers have agreed to collaborate on network infrastructure for public locations including KTX and SRT trains, subway stations, airports, hotels and retail locations, beginning in the second half of 2019, accelerating the availability of 5G NR, particularly for indoor locations.

Deployment of 5G mmWave is expected to begin in late 2019 or 2020 and LG U+ has acquired the band 27.3-28.1 GHz to use in its 5G mmWave network. Due to the density of mmWave cell sites required, one every 150 – 200m, I would expect mmWave coverage only in major cities such as Seoul, Suwon and Busan. LG U+ expects to install 15,000 mmWave sites by the end of 2022. The focus will be on areas where 5G NR sites are not able to support capacity needs and for B2B use cases, in particular for smart factories. Because of the very high penetration of fiber-to-the-home in Korea, none of the three service providers is planning on using mmWave for fixed wireless access (FWA) to individual homes, as planned by Verizon and other US providers.

Strategy Analytics ran speed tests on 4G LTE and 5G NR networks and said, “Differentiation between 4G and 5G is hard due to the already strong performance of 4G networks.” This is understandable because the speeds of 4G LTE and 5G NR (Sub-6) operating on similar frequency bands are similar, at least for the individual user. The ability of 5G NR to handle more individual users than 4G LTE, all downloading large amounts of data, is one of the technical advantages of 5G over 4G. Until a 4G LTE network is overloaded and all users see a slowing of service, the advantage of 5G NR over 4G LTE will not be visible to the end user.

I’m sure LG U+. SK Telecom and KT are all hoping enough users switch to 5G to avoid overloading their 4G networks anytime soon. As mentioned, however, in some locations LG U+ will be installing 5G mmWave because they expect both the 4G LTE and 5G NR networks to be locally overloaded, at least at peak usage times. This is a particularly acute problem in large convention centers. During major, technology centric trade shows, it is virtually impossible to have enough 4G LTE bandwidth to satisfy all show exhibitors and attendees. Think CES, for example.

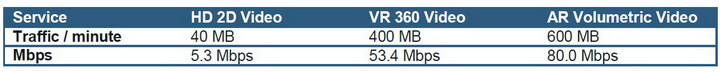

Data Usage of VR & AR Services compared to 2D video (Credit: Strategy Analytics)

Data Usage of VR & AR Services compared to 2D video (Credit: Strategy Analytics)

So why are Augmented Reality (AR) and Virtual Reality (VR) mentioned in the title of this article? Because LG U+ is using AR and VR to drive its 5G NR customer base and the strategy appears to be working. According to Strategy Analytics, a user of 2D video switching from 4G to 5G will see little or no improvement in performance, except, perhaps, at times of peak usage. Latency will be reduced by many milliseconds, but the user is not likely to notice that compared to the need to watch a 20 – 30 second advertisement before the desired video. However, 2D 360° VR video consumes about 10× as much data as conventional 2D video and AR Volumetric Video, i.e. 3D 360° VR video, consumes 50% more data than that.

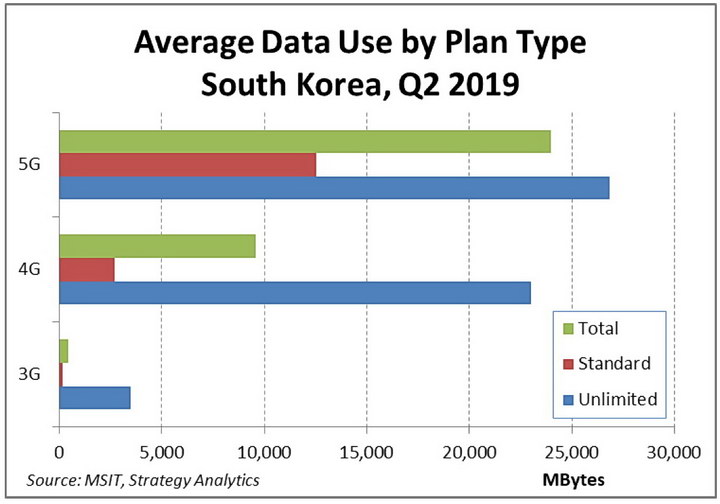

End user data usage per day by service provider plan type in South Korea (Credit: Strategy Analytics)

End user data usage per day by service provider plan type in South Korea (Credit: Strategy Analytics)

The LG U+ strategy is to encourage the use of these applications that require very high data rates. According to LG U+ CTO Lee Sangmin, 5G usage was averaging 1.3GB per day, up from 400MB with LTE by May 28th, less than two months after the introduction of 5G NR. He added that new services featuring AR and VR functions already accounted for 20% of 5G NR traffic, compared with just 5% for 4G LTE.

One of the ways LG U+ encourages this data usage is by giving away or selling at a discount VR HMDs to people that sign up for 5G plans. The two available HMDs are the Samsung Gear VR headsets (list price KRW149,000, $129.33), which is only compatible with the Samsung phone, or the Pico headset (KRW40,000, $34.72) which can be used with either the Samsung or LG 5G phone. Of course, the price you pay for the HMD is dependent on the plan you select and the rules were different during the 5G introductory period through August 23rd from what they were after that.

VR and AR content available to users of the LG U+ 5G plans (Credit: Strategy Analytics)

A 5G plan and a VR HMD don’t have much value to an end user unless there is VR content available. To satisfy this need, LG U+ has created five apps with VR and AR content, with all five apps available for free to all LG U+ 5G subscribers, regardless of their plan type. Presumably, users with one of the plans with lower data limits will quickly run into those limits – and then upgrade to a higher priced plan with higher limits. By the end of 2019, LG U+ plans on introducing VR cloud gaming as well.

Each of these apps targets a different demographic. The U+ Idol Live app, which premiered on 4G in November, 2018 and focuses on K-Pop stars, targets younger users. It has been especially popular with females who represent 68% of the app’s users. The U+ AR channel targets the same demographics. It works on a smartphone, not a HMD, and allows users seen by the phone’s camera to dance live with avatars of K-Pop idols on the phone’s screen. The U+ Pro Baseball and U+ Golf are intended to appeal to an older demographic, with baseball appealing most strongly to users in their 30s and 40s and golf appealing more strongly to those in their 50s and 60s. This sports content can be watched on a HMD, on the phone’s screen or streamed to a TV. According to Strategy Analytics:

“Perhaps the most innovative feature is the replays of the swings of either the baseball batter or the golf players. By using multiple cameras around a single point of action (either the batter’s plate in baseball, or the tee in golf) LG Uplus and its broadcast partners are able to offer an equivalent experience to volumetric video. The viewer can spin the view around the player and see the swing from any angle, giving a fascinating insight into both that individual moment but also the technique of the player.”

The U+ VR app is intended to appeal to a broad demographic. Strategy Analytics says about it:

“Uplus’ VR video app includes a broad range of content, over 400 videos, including some exclusive video. Again, K-Pop stars provide some of the exclusive content, along with Cirque du Soleil. Alongside these are a range of other content such as documentaries, nature, comedy and “Stardate”. Virtual dating is a genre of VR video which has gained some traction in Asian markets, and here Uplus has some exclusive video allowing fans to go on a virtual date with some of their favourite stars.”

Not surprisingly, both SK Telecom and KT offer AR/VR content to their customers as well, with SK Telecom offering its Oksusu OTT streaming video service and KT offering Giga Live TV and Super VR services. Unlike LG U+ 5G, even 5G subscribers need to pay a modest monthly fee for these services.

One of the questions about 5G has been how the service providers will pay for the 5G network buildout? Service provider revenue has been relatively stable and Average Revenue Per User (ARPU) has been declining. This situation does not encourage investors to spend billions of dollars on a new network buildout.

Perhaps the experience of LG U+ can be a guide? So far, users of LG U+ unlimited 5G data plans have consumed about 10× as much data as users of the basic 5G plans. On the other hand, the unlimited users are paying about 3× the monthly fee of the basic users. Since 5G is designed to deliver large amounts of data to end users economically, LG U+ has probably found the benefit of the higher fees outweighs the problems of delivering the additional data. -Matthew Brennesholtzt