In 2023, the Advanced TV market has witnessed notable shifts, according to market research firm DSCC. To be clear, the research firm defines advanced TV technologies as WOLED, QD-OLED, QDEF, and MiniLED, available in both 4K and 8K resolutions.

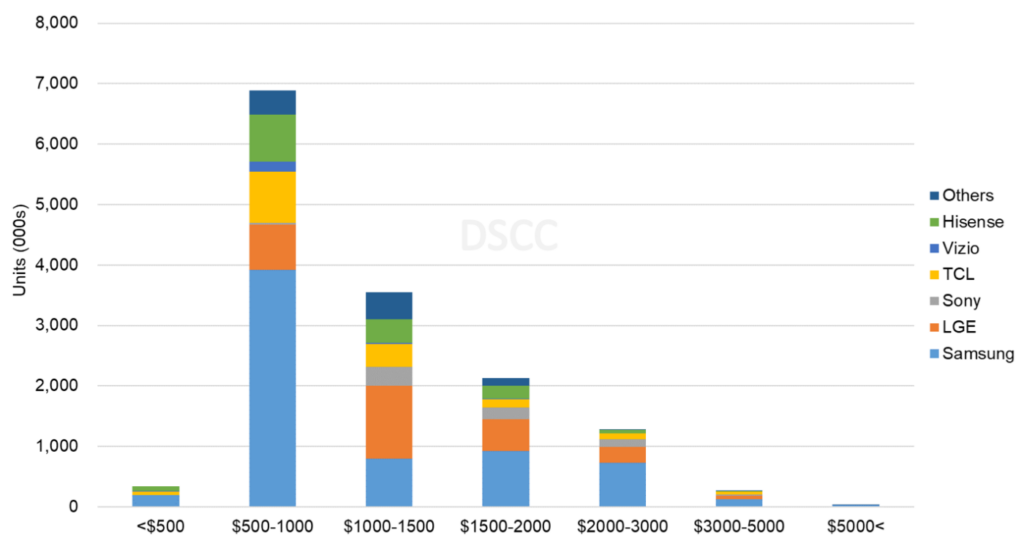

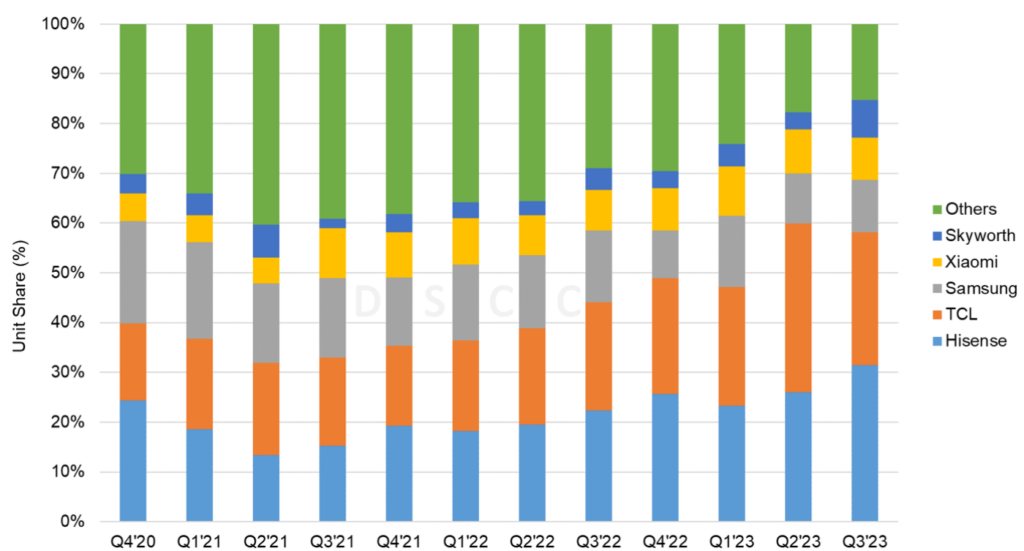

Chinese brands like TCL and Hisense are gaining market share, both in China and through exports. This contrasts with the performance of leading brands outside of China, such as Samsung, LG, and Sony, which have experienced a decline in the same period.

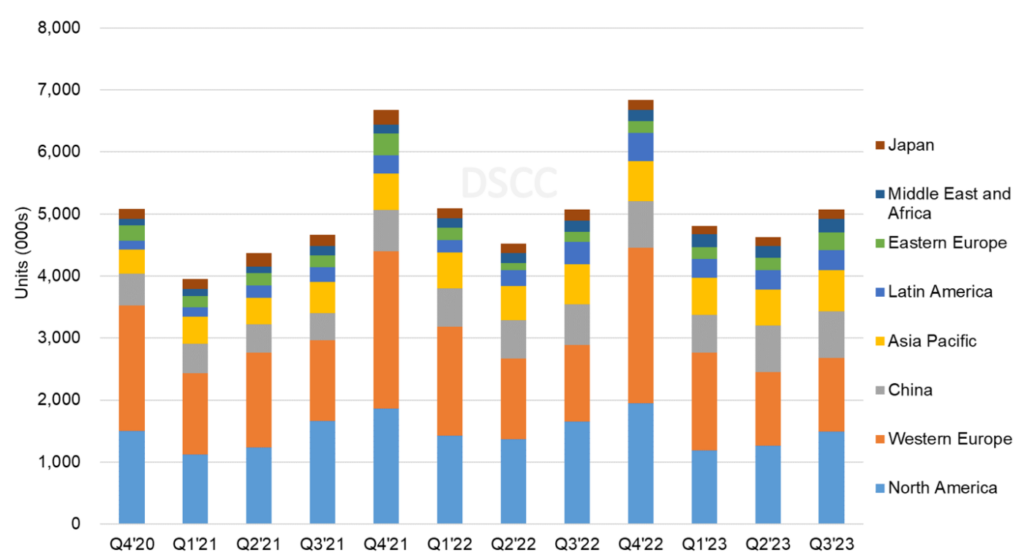

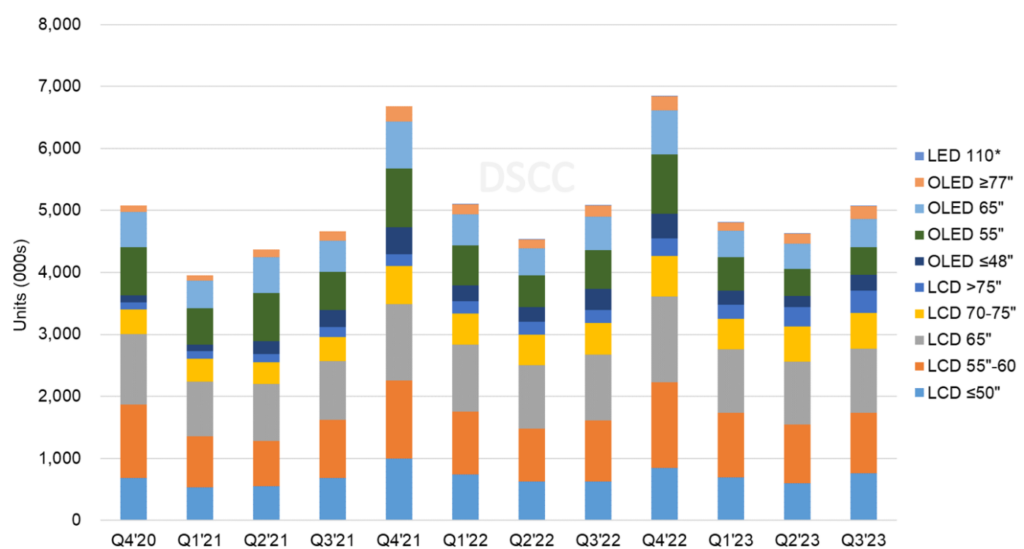

In Q3’23, DSCC notes a flat YoY trend in shipments at 5.1M units. OLED shipments saw a 19% YoY decrease, while LCD TV shipments increased by 9%. In terms of revenue, there was a 5% YoY decrease to $6.1B, with OLED revenues falling by 16% and LCD TV revenues increasing by 3%.

Regionally, Western Europe and North America witnessed declines in shipments and revenues, whereas China and the Asia Pacific region saw increases.

Samsung maintained its top position in both units and revenue, gaining revenue share despite a loss in unit share. Conversely, LG saw decreases in shipments, unit share, and revenues. Hisense and TCL, on the other hand, recorded significant gains in both units and revenues, indicating their rising influence in the market. 2023 marked a year of growth for MiniLED TVs, led by TCL and Hisense, challenging the previously dominant OLED segment.