I had thought about writing a review of 2015 and the display stories that we had covered (and I still might), but the more I thought about developments in the year, the more one stood out. At CES, we heard, and exclusively reported, that Samsung would make an acquisition in the LED market in the CES report of our weekly and online newsletter, Large Display Monitor (No More Plasma for Samsung, But LED is New Category – subscription required).

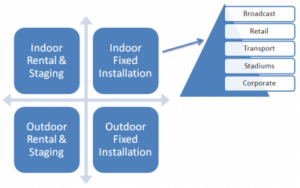

As we reported later in the year, Samsung bought Yesco of the US as it had judged that the level of knowledge and experience to enter the outdoor market for LEDs would take too much time and money to develop internally. That highlighted one of the challenges of entering the LED market. It’s not one market, it is several. There’s an obvious split between indoor and outdoor applications, and there is another big one between fixed installations and rental and staging.

Even within a classification such as “indoor fixed”, there are applications with a range of very different requirements – from advertising and retailing, through transport, control rooms, broadcasting, corporate and sports stadiums. Each market needs a different range of skills and technologies. Outdoor also has a wide range of applications, but if you want to get involved in installing big outside LED displays, you’d better get to know the rules about closing roads, crane hire and building regulations. That means that this is not like other markets which tend to become commodities surprisingly quickly.

The opportunities for “added value” have made the market look very attractive as a source of profit for the companies (especially Japanese and Korean) that have been bruised and battered in the consumer electronics markets and are looking to B2B business for the future. So pretty well anyone in the A/V, TV or Public Display market has announced in the last year, if it wasn’t in the market already, that it was now in the LED market.

Now, the market was not short of potential suppliers. There have been system integrators and specialist suppliers for many years. They include the high end visual product companies such as Barco as well as specialists such as Daktronics, Lighthouse, Silicon Core and Hibino. (I always remember meeting Hibino, a high end Japanese specialist supplier, at ISE. “Can you tell me what is special about Hibino?”, I asked. “We’re so good, we’re more expensive than Barco”, I heard!).

Science, Technology, Economics and Politics

However, the LED display industry used to be labour-intensive, and so much of it developed in China, where assembly operations were subcontracted and joint ventures formed. Out of those investments and supply chains, a complete industry has developed. As well as OEM suppliers and contractors, a range of companies including genuinely competitive branded companies such as Absen, Aoto, Leyard, Topvision and Unilumin. I mentioned to one company at ISE that there are “dozens of companies” in China in this industry and he said “No, not dozens, hundreds. On second thoughts, thousands!”.

The Chinese companies see the LED industry as not just a business opportunity, but also as “the first display industry that China can dominate”. That’s dangerous. As Bruce Berkoff has said over the years, “Engineering beats science, economics beats engineering, but politics beats economics”. When companies and countries see an industry in this kind of way, economics can (at least in the short to medium term) take a back seat. That can make it hard to make a profit.

Those Chinese companies have been getting more international, as was shown when Leyard bought US display pioneer, Planar, this year (Planar to be Acquired by Leyard – subscription required).

Falling Prices

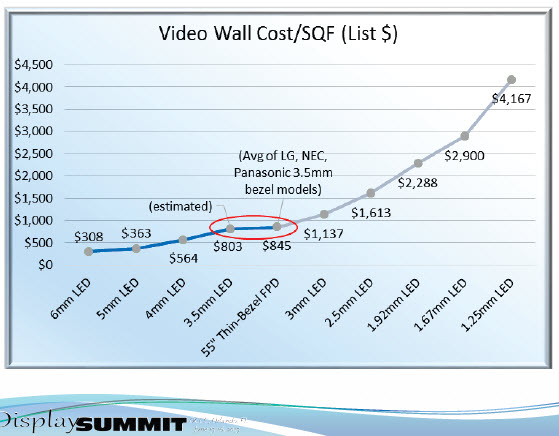

During the Display Summit before Infocomm this year, Jim Noecker of Panasonic presented this chart. It shows how the cost of small pitch LED is now the same as a good quality video wall LCD, once the pitch gets down to 3.5mm.

If you were looking for a single reason why everybody has been trying to get into LEDs this year, that’s it. At the Display Summit, NEC and Panasonic contrasted an LCD video wall with an LED. There was general agreement that at longer distances – more than a few metres, when the individual pixels were no longer visible – the LED won.

Of particular interest is the situation of Taiwanese companies. They will want to compete in LED, but unlike the situation with the LCD industry, the country doesn’t have real advantages in the supply chain. Unusually, they will be undercut by mainland Chinese companies and few have developed anything close to a “value added” or systems integration business. It’s hard to see where they can find an opportunity.

As I said in our Infocomm report, “Many are called, but few are chosen”. In 2016, I suspect that there will be a huge amount of activity in small pitch LED again. However, by 2017, we may start to see some serious fallout and industry re-structuring as those that have not been able to get volume or find a niche get squeezed out or acquired.

CES, this year, may yield more pointers, although I suspect that ISE in February will really show where we are up to. Bob Raikes