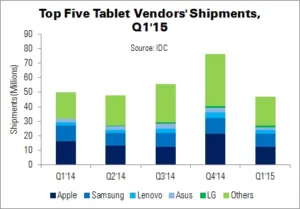

Q1’15 was the second consecutive quarter in which the worldwide tablet market declined says IDC. Competition from alternative devices, such as phablets, drove shipments of tablets and hybrids to 47.1 million units, down 5.9% YoY.

Some growth areas are starting to materialise, said IDC’s Jean Philippe Bouchard, in particular tablets with cellular connections. These models provide an additional revenue stream to OEMs and mobile operators. They also help to position the segment as true mobile solutions, rather than stay-at-home products like Wi-Fi units.

Another bright spot was hybrid devices, aka detachables. They are a small portion of the overall market, but growth has been “stunning”, said IDC senior research analyst Jitesh Ubrani. Vendors such as Asus, Acer and E-Fun are offering products at very low prices, while Microsoft and other companies drive growth at the high end.

As a result of the falling market, IDC recommends that OEMs continue to focus on these growth areas. The commercial market is a sector to watch for both cellular and hybrid devices, although uptake has been slow to-date.

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q1’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| Apple | 12.6 | 16.4 | 26.8% | 32.7% | -22.9% |

| Samsung | 9 | 10.8 | 19.1% | 21.6% | -16.5% |

| Lenovo | 2.5 | 2 | 5.3% | 4.1% | 23.0% |

| Asus | 1.8 | 2.6 | 3.8% | 5.2% | -30.6% |

| LG | 1.4 | 0.1 | 3.1% | 0.2% | 1423.7% |

| Others | 19.7 | 18.1 | 41.8% | 36.3% | 8.6% |

| Total | 47.1 | 50 | 100.0% | 100.0% | -5.9% |

| Source: IDC | |||||

Apple still leads the tablet market, despite five consecutive quarters of shipment declines. The company shipped 12.6 million iPads in Q1’15 – down 22.9% YoY and taking 26.8% of the market.

The new, larger iPhone 6 and 6 Plus ate into the iPad – and, to a lesser extent, so did the Mac product line. Until the iPad portfolio undergoes a significant refresh, IDC expects it to continue to fall. A dedicated tablet version of iOS, or an increase in screen sizes (expected to be announced at WWDC in June) may do this.

Samsung (19.1% share) fell 16.5%, but retained its second place spot. The shift to connected tablets is likely to benefit Samsung, which can leverage its mobile expertise and carrier relationships.

Lenovo (5.3% share) was one of the few tablet vendors to exhibit growth. Its wide range of products are proving popular in a growing number of regions.

Asus (3.8% share) refreshed its Transformer line-up in mid-February, but this performed worse than expected. However, the new ‘Chi’ devices have done well in emerging markets. The Fonepad 7 is also performed well in these regions. Finally, LG (3.1% share) rounded out the top five. LG’s growth (over 1,400%) has been particularly noticeable, as it is benefiting from US carriers’ strategies of bundling connected tablets in deals to existing customers.