According to a new research report from leading analyst firm Jon Peddie Research (JPR), unit shipments in the add-in board (AIB) market decreased in Q1’24 from last quarter, yet increased year over year. Nvidia increased its market share from Q1’24, with AMD increasing its market share year over year. Graphics card shipments decreased by -7.9% quarter to quarter and increased by 39.2% year over year.

In Q1’24, 8.7 million units shipped, down from 9.5 million units last quarter.

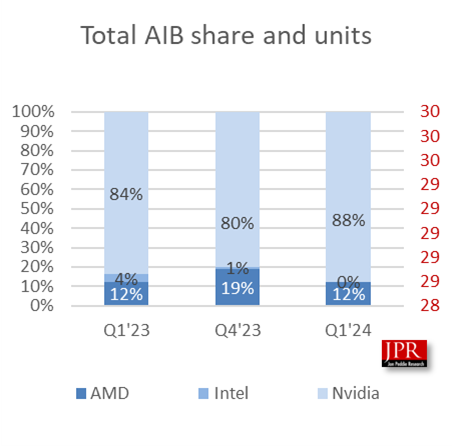

The market shares for the desktop discrete GPU suppliers shifted in the quarter, as Nvidia’s market share increased from last quarter by 8%, and AMD’s share decreased by -7%. Intel, which entered the AIB market in Q3’22 with the Arc A770 and A750, remained flat, as the company has yet to gain significant traction in the add-in board market. Nvidia continues to hold a dominant market share position at 88%.

Quick highlights

- JPR found that AIB shipments during the quarter decreased from the last quarter by -7.9%, which is above the 10-year average of -10.9% for the first quarter.

- Total AIB shipments increased by 39% this quarter from last year to 8.7 million units and were down from 9.5 million units last quarter.

- AMD’s quarter-to-quarter total desktop AIB unit shipments decreased -41% and increased 39% from last year.

- Nvidia’s quarter-to-quarter unit shipments increased 0.9% and increased 45.6% from last year. Nvidia continues to hold a dominant market share position at 88%.

- AIB shipments from year to year increased by 39% compared to last year.

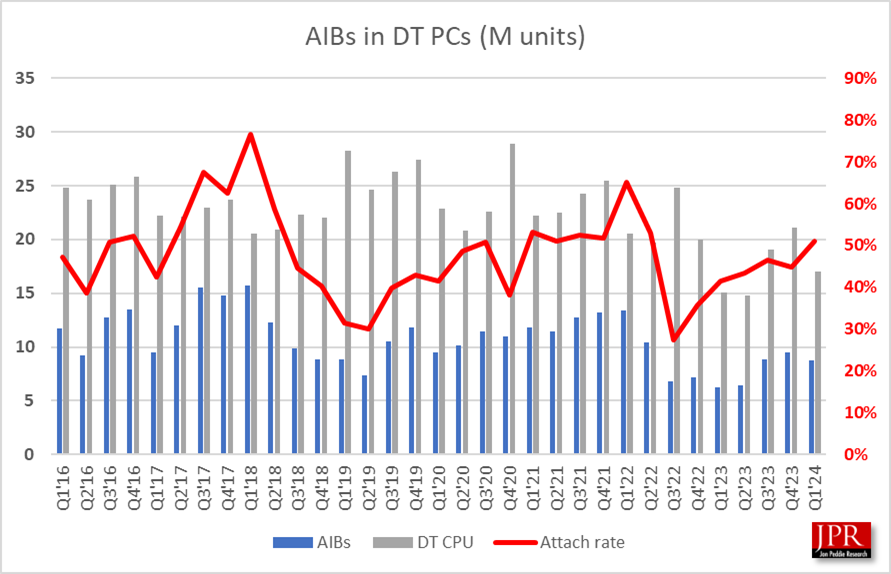

The first quarter is typically flat to down compared to the previous quarter. This quarter, shipments were down by -7.9. This slip in shipments was predicted and shows that after a few turbulent years due to the pandemic, the graphics card market is seeing a return to seasonality.

“We and the industry have been hoping for a return to seasonality, which was the hallmark of the PC industry for so many decades. It got disrupted with the 2007–2008 recession and had barely recovered when the crypto craze hit, then along came Covid, followed by the Ukraine war, and it looked like stability was just a faint memory,” said Dr. Jon Peddie, president of Jon Peddie Research. “In 2023, we saw four quarters of welcomed growth, and when Q1’24 was down a bit, no one panicked, as it looked like a return to seasonality—Q1 always used to be flat to down. Therefore, one would expect Q2’24, a traditional quarter, to also be down. But, all the vendors are predicting a growth quarter, mostly driven by AI training systems in hyperscalers. Whereas AI trainers use a GPU, the demand for them can steal parts from the gaming segment. So, for Q2, we expect to see a flat to low gaming AIB result and another increase in AI trainer GPU shipments. The new normality is no normality.”

C. Robert Dow, analyst for Jon Peddie Research, added: “There were some positive signs for the AIB market in Q1, as the attach rate rose by 6% from Q4’23 and 10% year over year. Prices also remained steady over the quarter, which is good for consumers.”

JPR also publishes a series of reports on the total shipments of iGPUs and dGPUs and the PC gaming hardware market. The latter covers the total market, including systems and accessories, and examines 31 countries.