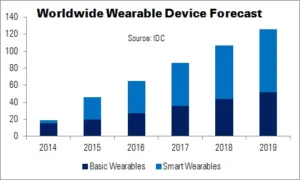

New vendors, new devices and greater end-user awareness will drive the 2015 worldwide wearable market to new heights, says IDC. 45.7 million units will be shipped this year, says the firm, rising 133.4% from 2014’s 19.6 million. IDC expects shipments to reach 126.1 million units by 2016, at a CAGR of 45.1%.

An increased focus on ‘smart’ wearables – such as smartwatches – will push the market higher. Smart wearable shipments will reach 25.7 million units this year: a 510.9% YoY increase, from 4.2 million units in 2014. Meanwhile ,’basic’ wearables will grow 30% (from 15.4 million to 20 million).

The Apple Watch will be responsible for pushing smart wearables into the public consciousness, says IDC’s Ramon Llamas. Wrist-worn wearables – both smart and basic – will have a wearable market share of more than 80% throughout the forecast period. Modular wearables, which can be worn anywhere on the body with a clip or strap, are behind wrist-worn devices. These products are traditionally much simpler to produce.

Clothing is the third category, followed by the (smaller) eyewear segment. Eyewear wearables will be adopted by enterprise users in select vertical markets first. Finally, IDC expects earwear to comprise a small part of the overall market.

“The explosion of wearable devices was clearly led by fitness bands”, said IDC’s Ryan Reith, “[but] the prices of these fitness bands have come down so significantly in some markets that smartphone OEMs are now bundling them with smartphones at little cost. Meanwhile, the market is quickly shifting toward higher-priced devices that offer greater functionality. While Apple’s entry into the market is symbolic, the key to success will be to create compelling use cases for the average consumer. Many users will need a good reason to replace a traditional watch or accessory with a wrist-worn device or some other form of wearable that will likely require daily charging and occasional software upgrades”.

| Worldwide Wearable Device Shipments, Share and YoY Growth by Product, 2014-2019 (Units in Millions) | ||||||

|---|---|---|---|---|---|---|

| Product | 2014 Volumes | 2015 Volumes | 2019 Volumes | 2014 Market Share | 2015 Market Share | 2019 Market Share |

| Wristwear | 17.7 | 40.7 | 101.4 | 90.4% | 89.2% | 80.4% |

| Modular | 1.6 | 2.6 | 6.7 | 8.3% | 5.7% | 5.3% |

| Clothing | 0.0 | 0.2 | 5.6 | 0.1% | 0.4% | 4.5% |

| Eyewear | 0.1 | 1.0 | 4.5 | 0.3% | 2.2% | 3.5% |

| Earwear | 0.0 | 0.1 | 0.6 | 0.0% | 0.1% | 0.5% |

| Other | 0.2 | 1.1 | 7.3 | 0.9% | 2.4% | 5.8% |

| Total | 19.6 | 45.7 | 126.1 | 100.0% | 100.0% | 100.0% |

| Source: IDC | ||||||