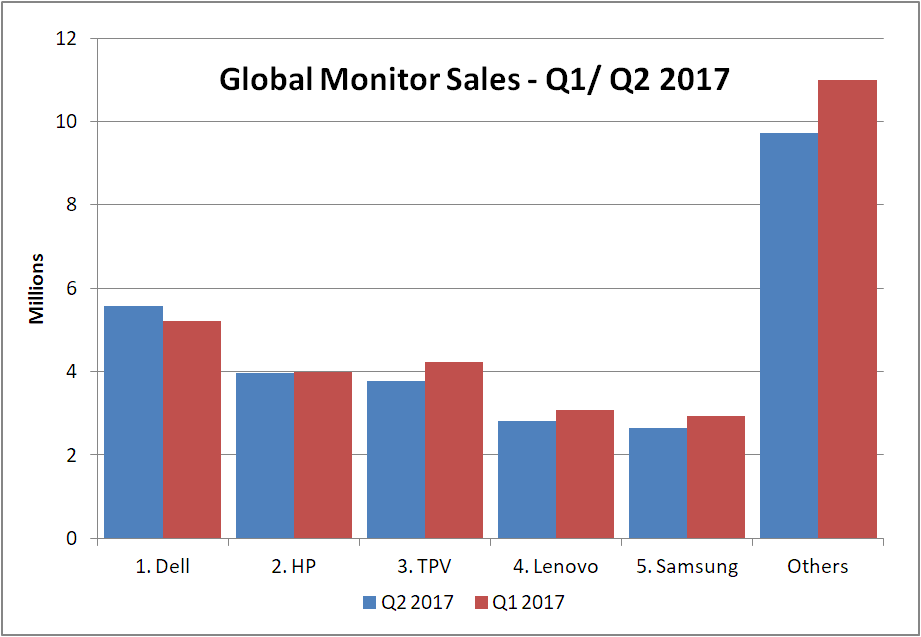

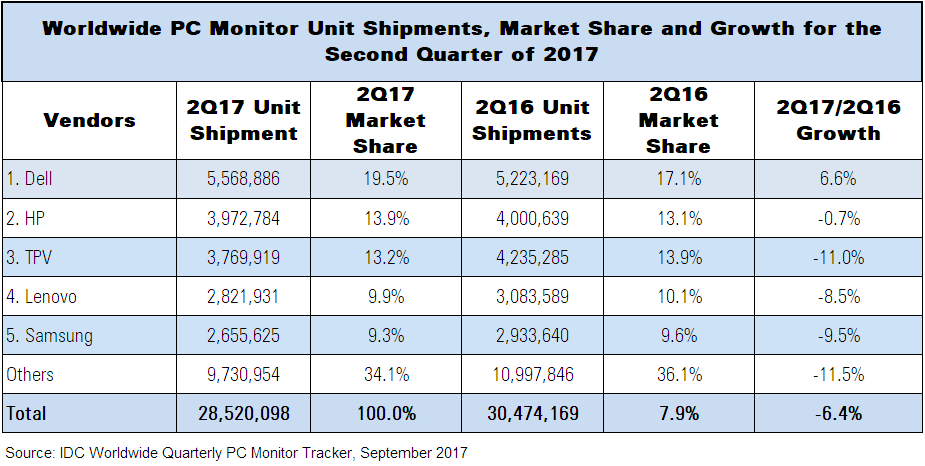

The IDC Worldwide Quarterly PC Monitor Tracker shows worldwide PC monitor shipments totalling 28.5 million units in the second quarter of this year. While the shipment total represented a decline of 6.4% over 2016, some of the market softness can be attributed to a strong second quarter last year, presenting the most recently closed quarter with a challenging comparison.

The 28.5 million units shipped represents a decline of 1.2% compared to the first quarter, and represents the first sequential decline for a second calendar quarter since 2014. Strong back-to-school and holiday seasons should prop the market up, and as such, IDC has revised its forecast for the second half of 2017 from a drop of 2.8% to a lesser drop of 1.7%.

According to Maura Fitzgerald, senior research analyst for the tracker, IDC expects the global PC monitor market will continue to decline at rates around 2% compared to previous years from 2018 through to 2020. However, Japan, Western Europe, and Central & Eastern Europe recorded strong growth compared to 2016 for the quarter.

IDC currently forecasts 117 million PC monitor units will be shipped for the full year 2017 and expects to see a decline of 2.2% in worldwide shipments compared to the same quarter last year, to total 27.8 million units in the second quarter of 2018. By 2020, worldwide shipments are expected to be less than 112 million units as the adoption of mobile devices at lower price points is expected to continue.

Other highlights from the report, are as follows:

- Curved monitors continue to rise, with 3.8% market share in 2Q17 and a 52.5% growth compared to the same quarter last year.

- 19.5” and 21.5” wide screens continue to dominate the worldwide market, with 11.6% and 22.2% market share respectively. Of the top ten screen sizes, 23.8” wide and 27” wide saw the largest growth, posting 75.1% and 19.5%, respectively, compared to the same quarter last year.

- Monitors with TV tuners are expected to have 4.4% market share in 2Q18, which up from 4.1% in 2Q17, led by LG and Samsung with a combined market share of 99.0% in this category.

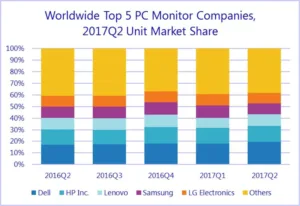

- Dell stayed in the top position in 2Q17 with worldwide market share of 19.5% on shipments of over 5.5 million units. The vendor posted strong growth compared to the same quarter last year, in Central & Eastern Europe (21.3%), Canada (35.8%), and Western Europe (20.0%). The largest growing screen sizes year-over-year included 42.5” wide, 23” wide and 34” wide.

- HP saw nearly 4 million units shipped, resulting in 13.9% share in 2Q17. Compared to the same quarter last year, unit decreases of 8.7% in the US and 1.3% in Asia/Pacific (excluding Japan) contributed to a total decrease of 0.7%.

- TPV saw its share decline from 13.9% last year, to 13.2% this time.

- Lenovo achieved fourth position with a quarter growth of 11% with more than 2.8 million units shipped. This was largely due to significant quarter growth in the US (31.9%) and Asia/Pacific (excluding Japan)(17.5%). In terms of screen-size growth, 23.8” wide dominated with 87% quarterly growth.

- Samsung moved down to the number five position with 2.6 million units shipped. The vendor witnessed gains in the US, Western Europe, and Canada compared to the same quarter last year

- LG rounded out the Top 6 in the second quarter with 9.1% market share in the worldwide market. The vendor logged gains in the US and Central & Eastern Europe, compared to the same quarter last year.

Worldwide PC monitor shipments totalling 28.5 million units in the second quarter of this year

Worldwide PC monitor shipments totalling 28.5 million units in the second quarter of this year

Analyst Comment

It seems that the numbers put out initially by IDC were wrong. Our staff spotted that the numbers didn’t add up, so we reported it. However, by the time IDC’s analyst had a look, it had been fixed, so you can trust these numbers more than any you saw in the original press release! (BR)