The Q1 global workstation market was seasonally down, but Jon Peddie Research (JPR) reports that the decline was ‘substantially deeper’ than normal.

Around 912,400 workstations were shipped in Q1’15, equal to an 11.7% QoQ and 3.5% YoY fall. Professional GPU shipments were similarly down, with shipments of just over 1 million units: the lowest industry output since Q3’09.

Reassuringly, JPR does not believe that these numbers are indicative of a long-term trend. Although the figures were worse than expected, analyst Alex Herrera believes that they are the result of a stronger Q4’14. Q4 was up thanks to end-of-year spending and the introduction of new models based on Intel’s Grantley platform.

Workstations are not under the same pressures as the mainstream consumer and professional PC markets. Corporate sales are suffering from long replacement cycles, as many PCs are seen as ‘good enough’ for work-related applications. “[T]he fact that Windows 8 is more a detriment than stimulus for new purchases isn’t helping either”, Herrera added. Consumer PCs are hindered by the same factors, as well as continued competition from other devices.

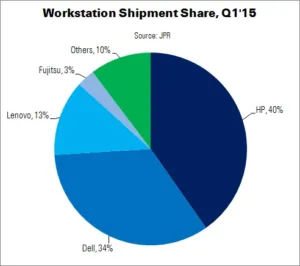

HP and Nvidia continued to lead the Q1 workstation and professional GPU markets, respectively. HP was responsible for over 40% of workstations shipped in the period, followed by Dell (33.8%), Lenovo (12.7%) and Fujitsu (3%). The remainder was shipped by smaller OEMs and system integrators.

Nvidia led professional GPUs with a share approaching 80%. AMD took the rest of the market.