According to WitsView, a division of TrendForce, global shipments of branded LCD TV sets for 2017 totalled 211 million units, a decrease of 4.1% compared with the previous year. This is the lowest result since 2014, indicating a bottleneck in the development of the TV industry. In 2018, TV brands will focus on large-size, high-resolution products and also develop high-end products like QLED and OLED TVs, hoping to push sales and regain profits via specifications upgrade.

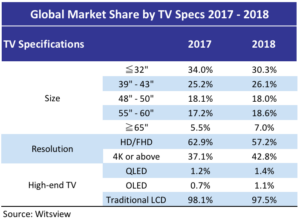

Large-size Ultra HD TV sets have built a strong presence in the market, while 8K TVs remain in the early stage of development. In terms of the product plans of major TV brands, Samsung, LG and Sony, etc. are now actively developing their product mix of large-size TV sets (65″, 75″ or greater). The proportion of 65″ TVs or greater will increase from 5.5% in 2017 to 7% this year. BOE’s 10.5G’s fab will offer 65″ and 75″ panels to the market after the first quarter of 2018, which may lower TV makers’ costs of purchasing large-size panels.

In terms of resolution development, the market share of high-resolution (UHD or higher) products is expected to reach 42.8% this year, up from 37.1% in 2017. In particular, more than 95% of 55″ or above products use UHD resolution. As the market share of large-size UHD TVs increases, TV vendors have shown a clear ambition to develop 8K resolution. However, as the supply chain for both hardware and software, such as image processing chip, signal interface, 8K signal source and content, etc., has not yet been completely developed, WitsView estimates that the penetration rate of 8K products in global TV shipments will be only 0.2-0.3% in 2018. Penetration is expected to increase to 1.5% in 2020, due to the influence of the Tokyo Olympics, and to 5% in 2022.

In the high-end market, OLED and QLED TVs remain two competing camps. Led by Samsung Electronics, QLED maintains an overall higher market share than OLED. On the other hand, the market share of OLED TVs is expected to rise to 1.1% in 2018 when LGD expands its production capacity, gradually closing the gap with QLED.

As for the future development of high-end TV, QD Pixel, a QLED spinoff, is expected to reduce QLED’s high costs, but its current development remains slow and solutions will be not available until 2019. On the other hand, 10.5G fabs have accelerated the production expansion of large-size LCD panels, lowering prices as a result. However, the cost of OLED panels remains high and the development of 8K OLED panels remains slow, making OLED TV less competitive in the market. In addition, LGD’s 8.5G OLED fab in Guangzhou will be ready for mass production in 2019, and will face higher depreciation costs.

With increasingly fierce competition, the TV market is faced with homogeneous products and squeezed profits, so spec upgrade has become the key to driving new purchases and ensuring profitability. Therefore, China’s 10.5G-and-above advanced fabs will play an important role in promoting the upgrade of TV size and resolution. In addition, QLED and OLED TVs will also create product differentiation in the high-end market.