According to the latest report by WitsView, a division of TrendForce, shipments of gaming monitor (with a frame rate above 100Hz) reached about 2.5 million units in 2017, an annual growth of 80%. TrendForce forecasts that shipments will increase by another 1 million units this year, totalling around 3.5 to 3.7 million units in 2018.

Anita Wang, Senior Research Manager of WitsView, points out that the traditional LCD monitor market has shrunk year-on-year since 2010. Vendors have turned to more profitable niche products to maintain or increase overall revenue. In particular, gaming monitors have become a niche product with a high gross margin. With the continuing expansion of video game market and the presence of curved gaming monitors with high performance-price ratios, many LCD monitor makers entered the gaming monitor market.

In 2018, due to the continuing expansion of the video game market, sales of first-person shooter games, growing investments from brands and the emergence of curved gaming monitors, manufacturers have set positive goals for their gaming monitor shipments. In particular, those with small shipments in 2017 are targeting double shipments this year.

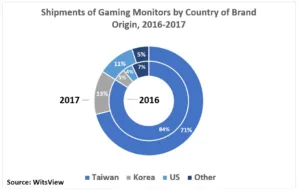

WitsView Shipments of Gaming Monitors by brand country. Image:Meko

Asus remains the leader in the gaming monitor market, with a share of nearly 30%. At present, the gaming monitor market is dominated by Taiwanese brands, which account for more than 70% of global shipments in 2017. The top five gaming monitor makers by shipments are Asus, Acer, BenQ, AOC/Philips and Samsung, four of which are based in Taiwan.

Taiwan’s video game industry has been developing for a long time, with Asus, BenQ, etc. dedicating to the industry for many years. Together with Taiwan’s strengths in computer hardware manufacturing and AU Optronics’ leading role in high frame-rate panel supply for LCD monitors, Taiwanese makers remain competitive in the industry.

As for Korean makers, Samsung recorded significant shipment growth of gaming monitors in 2017. The main momentum came from curved gaming monitors with high performance-price ratios, pushing up the market share of Korean-branded gaming monitors from 5% in 2016 to 13% in 2017.

It is worth noting that Micro-Star International turned out to be a dark horse in the 2017 gaming monitor market. The company is known for its gaming laptops, with a very complete product line of gaming hardware, except for monitors. MSI has gradually improved the product acceptance of its gaming monitors in 2017 and is expected to show strong growth momentum in the future.

Analyst Comment

We hadn’t spotted that MSI was now in monitors, so missed them at CES, but will catch up with the firm when we can. (BR)