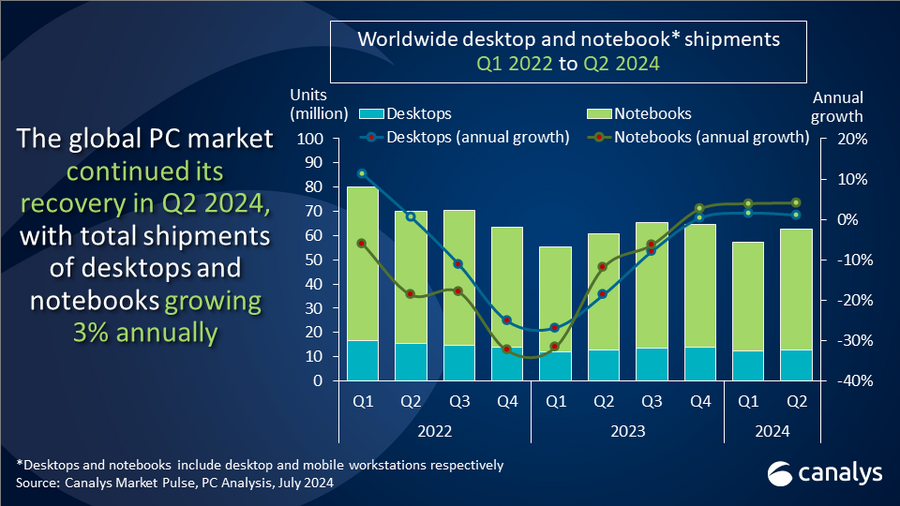

According to Canalys, in the second quarter of 2024, the PC market experienced a resurgence with a 3.4% increase in year-on-year shipments, totaling 62.8 million units worldwide. Notebooks, including mobile workstations, led the growth with a 4% rise, reaching 50 million units. Desktops, including desktop workstations, saw a modest 1% increase, bringing their total to 12.8 million units. This positive momentum is anticipated to continue as the Windows 11 refresh cycle and the adoption of AI PCs gain traction over the next year.

Lenovo maintained its leadership position in the global PC market by shipping 14.7 million units, marking a 4% annual growth. HP followed closely behind, shipping 13.7 million units. Dell, in third place, experienced a 2% year-on-year decline, with shipments totaling 10.1 million units. This decline was mainly attributed to reduced shipments in the US market, where other top vendors saw growth. Apple secured the fourth spot by shipping 5.5 million units, capturing a 9% market share, and marking a 6% increase compared to the same period last year. Asus, benefitting from the success of its gaming PCs, rounded out the top five with 4.5 million units shipped and a significant 17% annual growth, overtaking Acer.

| Vendor | Q2 2024 shipments | Q2 2024 market share | Q2 2023 shipments | Q2 2023 market share | Annual growth |

| Lenovo | 14,724 | 23.40% | 14,230 | 23.40% | 3.50% |

| HP | 13,681 | 21.80% | 13,444 | 22.10% | 1.80% |

| Dell | 10,078 | 16.00% | 10,329 | 17.00% | -2.40% |

| Apple | 5,510 | 8.80% | 5,198 | 8.60% | 6.00% |

| Asus | 4,535 | 7.20% | 3,865 | 6.40% | 17.30% |

| Others | 14,280 | 22.70% | 13,669 | 22.50% | 4.50% |

| Total | 62,809 | 100.00% | 60,736 | 100.00% | 3.40% |

The market turnaround is further buoyed by significant announcements from vendors and chipset manufacturers as their AI PC roadmaps become a reality. The quarter saw the launch of the first Copilot+ PCs powered by Snapdragon processors and more clarity on Apple’s AI strategy with the introduction of the Apple Intelligence suite of features for Mac, iPad, and iPhone. These innovations, combined with the impending end-of-life for Windows 10, are expected to drive substantial PC demand and shipment growth in the coming quarters. Channel partners surveyed by Canalys in June indicated that the Windows 10 end-of-life will likely influence customer refresh plans significantly in the latter half of 2024 or the first half of 2025, suggesting an even stronger growth trajectory ahead.

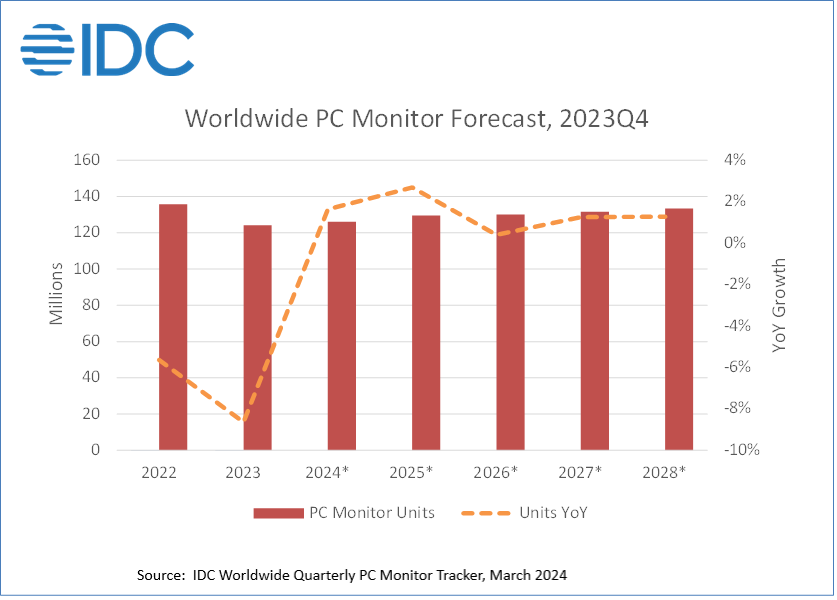

The most recent public data on monitor sales from IDC seems to suggest that monitor sales will track with this growth in PC sales, but maybe not to the same degree. The major vendors of PC monitors worldwide are companies like Lenovo, HP, Dell, and Samsung. In 2023, gaming monitors accounted for 16% of sales, but post-pandemic the industry had gone through a surge of activity only for it to dissipate once the world opened up.

It’s going to be hard to predict how closely monitor sales track with PC sales going forward, but it certainly seems like the PC upgrade cycle is going to have an immediate impact. Overall, however, the PC market may just be experiencing a small surge as a result of Windows upgrades but whether that growth is sustainable beyond that, only time will tell. A lot of analysts are betting on the addition of AI-enabled PCs, and that may have an impact, but judging by early reviews, AI PCs still have a little way to go before they justify their value and ROI. It could very well be that AI PCs will change the very nature of computing and that the market will see much bigger upgrade cycles to come based on AI alone, but that seems to be a little further out into the future than we can anticipate.