The PC market in 2024 is a bit of a rollercoaster, depending on who’s telling the story. According to IDC, global PC shipments dropped 2.4% YoY in the third quarter, down to 68.8 million units. It’s not a nosedive, but after a strong run, the market is clearly taking a pause. IDC points to rising costs and a replenished inventory from previous quarters as the main culprits for the slowdown. On the flip side, my colleague covered Canalys’ PC market forecast yesterday and it is offering a more upbeat take, reporting a 1.3% YoY increase in shipments, reaching 66.4 million units. Canalys is saying the market recovery is in full swing, albeit at a modest pace.

So what’s driving these mixed results? IDC sees both consumer and commercial demand coming back, especially for entry-level machines. A recovering economy and the back-to-school rush in North America have certainly helped. But the real buzz is around AI-powered PCs. IDC highlights products like Qualcomm’s Copilot+ PCs and new AI-focused chips from Intel and AMD as future growth drivers. Apple’s highly anticipated M4-based Macs are also expected to shake things up in the premium segment. Canalys, meanwhile, is more focused on the business side of things. They see a major boost from companies upgrading their systems ahead of Windows 10’s end-of-support in 2025. For them, this isn’t about luxury; it’s about necessity.

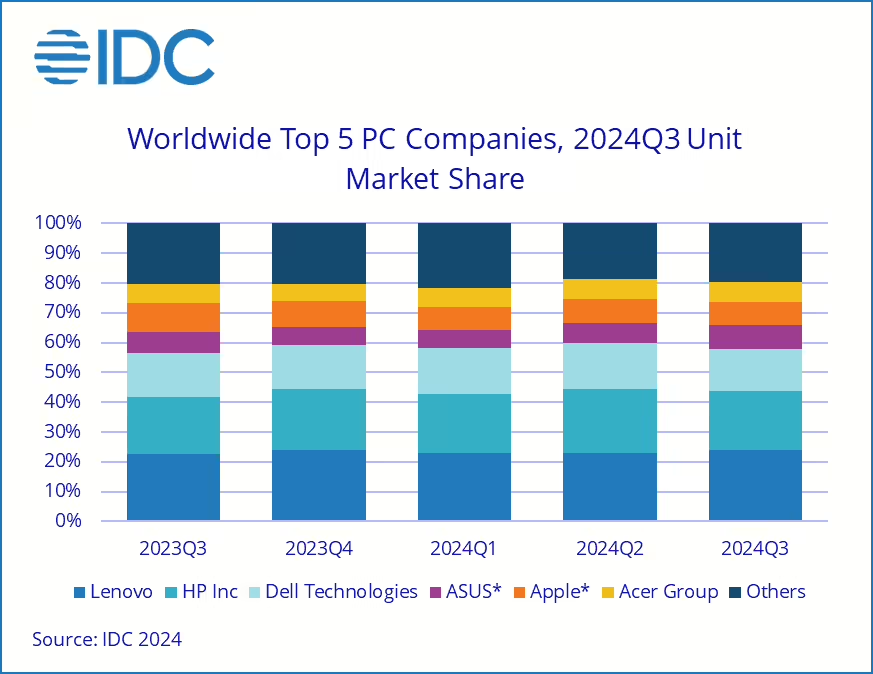

When it comes to the top players, both reports agree Lenovo is still king, shipping 16.5 million units in Q3, with a 3% YoY growth. HP remains steady, not really gaining or losing ground, while Dell saw a 4% drop in shipments. Then there’s Asus, which is having a stellar quarter, posting a YoY growth of 10% according to IDC and an even higher 16% per Canalys. Apple, on the other hand, is on the decline. Shipments are down by a whopping 24%, though that’s partly because they had such a strong showing earlier in the year. Canalys had Apple’s drop at around 15%. It makes you wonder if the anticipation for M4-based Macs may have turned the market cold for the company.

Looking ahead, both IDC and Canalys see AI PCs as the next big thing. But IDC tempers the excitement a bit, predicting that mass adoption won’t hit until 2026. Canalys is more optimistic about the short-term, with expectations that the holiday season’s promotional pushes will give the market a boost.

One clear trend from both reports is that commercial demand is outpacing consumer interest. Businesses are in a rush to upgrade before the Windows 10 deadline, with markets like Japan leading the charge with double-digit growth. Meanwhile, consumer demand, while not dead, is slower. Most buyers are sticking to entry-level models unless they’re ready to splurge on AI-powered devices.

The risks aren’t completely off the table, though. Both IDC and Canalys mention the current geopolitical environment as a potential hurdle. But they also see enough potential upside to predict modest growth next year. The market isn’t on fire like it was during the pandemic-fueled boom, but it’s steady enough to avoid any major crashes—at least for now.

Is that good or bad for the display industry? Will commercial and business buyers splurge on OLED displays or will they be price conscious as they look the make sweeping upgrades to their existing PC inventory? This is no doubt a major upgrade cycle for the PC industry but without consumer enthusiasm it may be a bit of a letdown for the display industry. Commercial customers don’t have the same eye for bright shiny things that consumers do, and if our boss is anything to by, business owners are not going to be looking at the best display technology for their next purchase, just the best bang for their buck. I know I would work much more productively if I had an OLED laptop, but who cares what I think.

| Company | 3Q24 Shipments | 3Q24 Market Share | 3Q23 Shipments | 3Q23 Market Share | 3Q24/3Q23 Growth |

| 1. Lenovo | 16.5 | 24.00% | 16 | 22.70% | 3.00% |

| 2. HP | 13.6 | 19.70% | 13.5 | 19.20% | 0.40% |

| 3. Dell | 9.8 | 14.30% | 10.3 | 14.50% | -4.00% |

| 4. Asus | 5.5 | 7.90% | 5 | 7.00% | 10.00% |

| 4. Apple | 5.3 | 7.80% | 7 | 10.00% | -24.20% |

| 5. Acer | 4.5 | 6.60% | 4.3 | 6.10% | 4.40% |

| Others | 13.6 | 19.70% | 14.4 | 20.40% | -5.60% |

| Total | 68.8 | 100.00% | 70.5 | 100.00% | -2.40% |