The Wearable-Flexible Market Focus Conference organized by IHS at SID’s 2015 Display Week included a presentation by IHS analysts that touched on What are Wearables for Anyway and a Wearable-Flexible Display Market Update. Coming before the market update provided by Paul Gray, Jack Kent, Senior Manager, Analysis and Research, IHS, tackled a question that really needed some illumination. In addressing a definition for Wearables, Jack first addressed wearable devices in context and the market opportunity for wearable apps before trying to answer the question, “So what are wearables actually for?”

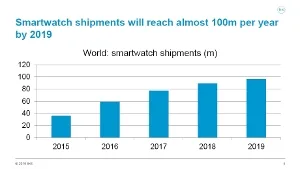

Right off, Kent pointed to his forecast that smartwatch shipments will reach almost 100 million per year by 2019 as shown by his market forecast below.

Source: IHS

Source: IHS

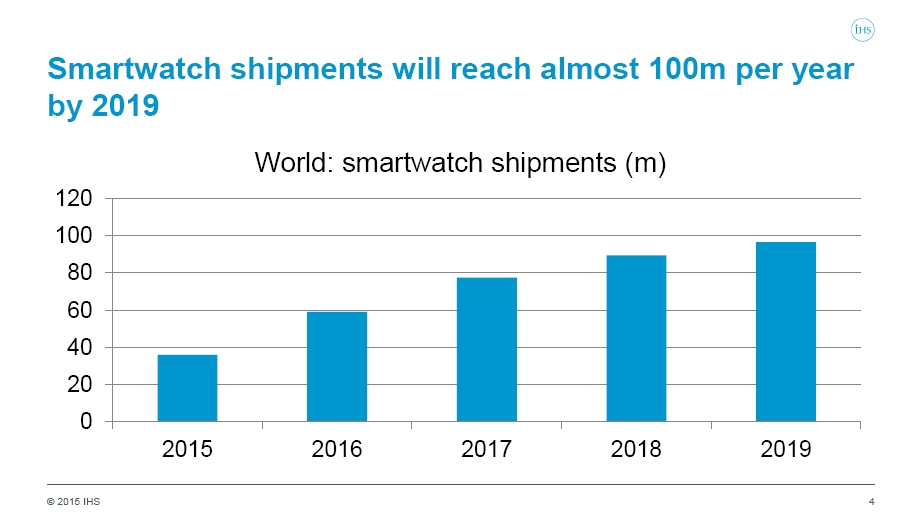

While 100 million smartwatch unit shipments is not large compared to devices such as smartphones, IHS placed the smartwatch addressable market in context in its next slide.

Source: IHS

Source: IHS

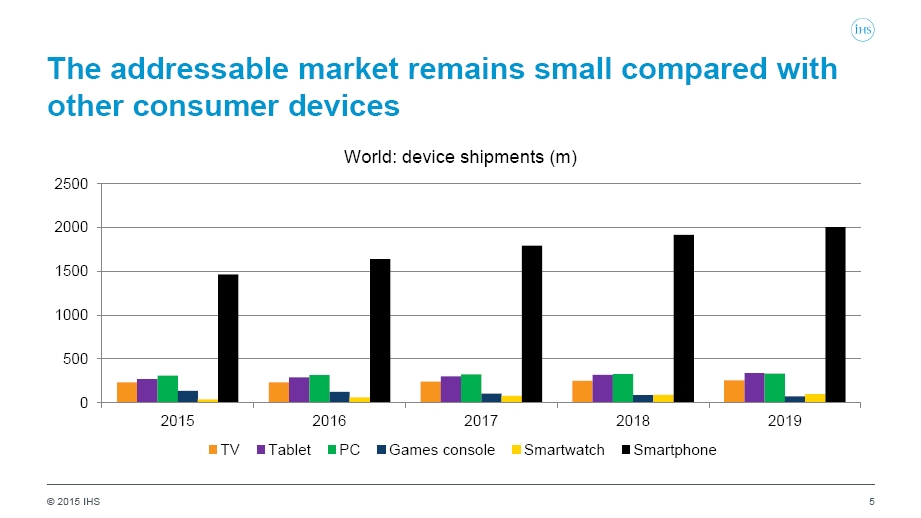

Yes, smartwatch forecasts are forecast to be relatively small compared to popular consumer electronic product categories including TVs, tablets, PCs, and game consoles. However, market growth during the 2015-2019 period is relatively strong with smartwatch shipments forecast to perhaps exceed game console shipments by the end of the forecast period (2019). More interesting is IHS’ forecast of which supply ecosystem(s) will prevail during the period. Kent’s next chart showed his expectation that Apple and Google will dominate the smartwatch environment with a total share of about 60% in 2020. .

Source: IHS

Source: IHS

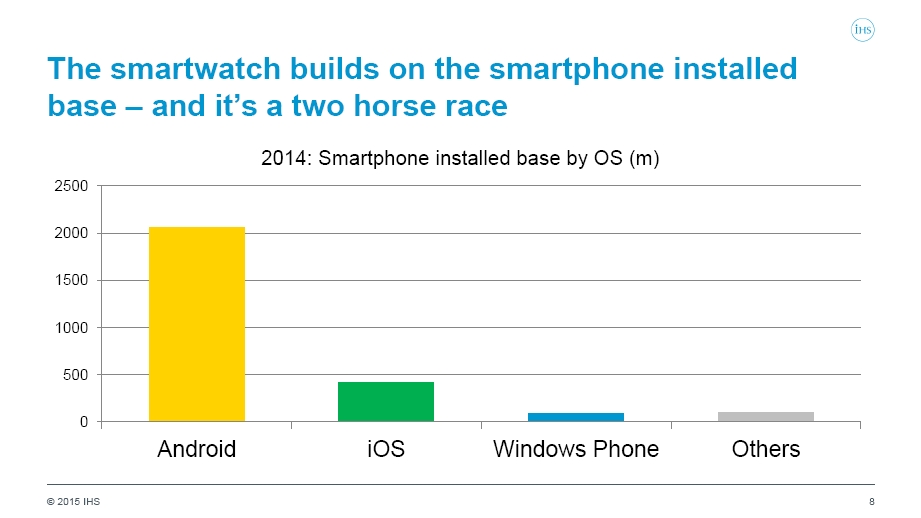

Kent makes the case that smartwatch market adoption “builds on the smartphone installed base”, which as we know is dominated by iOS and Android. In comparing the iOS and Android market shares in 2020 as illustrated in the forecast above, it’s clear, from the 2014 installed base graphic (below) with Android smart phones exceeding iOS smartphone installed base by more than 4 to 1, that IHS believes that Apple will gain a disproportionately large share of smartwatch shipments going forward. To my mind, this seems excessive given the large number of smartwatch developers having access to Android compared to the number of smartwatch designs that Apple is likely to launch during a comparable period. Just as for Android smartphones, I expect that the multitude of Android supporting watch makers will likely dominate smartwatch unit shipments while Apple may perhaps, if it executes well, maintain its traditional role of being a preferred smart-product by consumers and remaining the most profitable in the industry.

Source: IHS

Source: IHS

Kent next went on to assess the state of play in the wearable device and ecosystem space encompassing the many players. These players include not only the iOS and Android operating systems and their sponsors Google and Apple, but Microsoft, One Touch, Pebble, TIzen and many more players. As Kent said, “This can get complicated.”

Rather than comment further on the wide range of plays and players, Kent next went on to look at the opportunity for wearable device apps. He made the point that wearable technology is not a new phenomenon and we know that it’s the applications that “make smart devices smart”. While worldwide spending on apps will surpass $45 billion by 2019, he does not expect the wearable apps market to match the games-dominated smartphone and tablet apps business. While pointing out that wearable remain part of a wider smartphone and cloud-centric ecosystem, wearable devices and apps enable new forms of engagement and drive new media categories”, including mass media, user-generated media, social media and contextual media. Noting that Android Wear and Apple Watch now “extend rather than replace the smartphone app experience”, Kent pointed out that wearables must tie into new mobile content and services ecosystems to succeed.

Kent concluded his talk by again asking, “So what are wearables actually for?” He sees health, fitness and activity tracking devices dominating the wearables market in the upcoming period. ‘Better life’ concerns are a key issue for smartwatch use cases. The final market opportunity for wearable apps foreseen by Kent is advertising. Global mobile advertising revenues are forecast to climb to more than $50 billion in 2018. He concludes that wearables are important for advertising and it’s all about the data collected from users. The key ad market issues he foresees are: 1. Data collection not ad delivery; 2. Privacy & Security; 3. Monetization; 4. Retargeting; and 5. Targeting content as well as ads. Kent concluded by noting that “Wearable app opportunities are still emerging”. He enumerated several key conclusions including:

- Wearable apps are mainly extensions of smartphone experiences.

- Device, service, OS, app, and business model compatibility are crucial.

- Wearable apps won’t match the smartphone revenue success story.

- But they will create new forms of content and engagement.

- Health & Fitness services lead; more content categories are needed to reach a mass market opportunity.

- Advertising will play a role – with the right data strategy.

As the 2015 SID Display Week Market Focus Conference on Wearables revealed to me, wearables is an important consumer electronics market area that is only just emerging, but as Kent’s presentation pointed out, the way forward is now pretty clear. – Phil Wright