The Western European PC market saw a significant decline in the first quarter of 2023, with shipments of desktops, notebooks, and workstations dropping 37% compared to the same period in 2022. This amounts to 10.0 million units. Both notebook and desktop sectors experienced a similar rate of decline. Tablets performed slightly better, but still saw a 20% decrease in shipments to 5.2 million units.

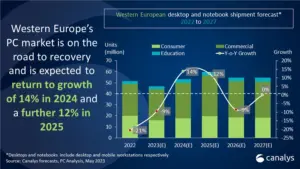

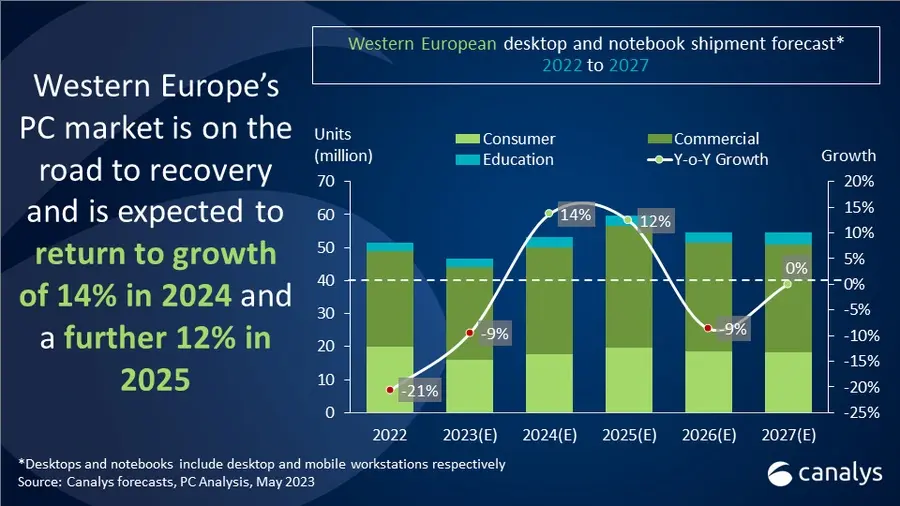

However, Canalys, the market research firm that reported these numbers, is optimistic about recovery for the remainder of 2023, despite the expected overall decline in PC and tablet shipments for the year being 9% and 12% respectively. They expect sequential growth for the rest of the year and into 2024.

On the consumer front, even though there was a significant decline compared to last year, the decrease was less severe compared to the drop after the holiday season in recent years. Consumer confidence is reportedly increasing in the EU, but spending on PCs is currently slowed down due to inflation. A rebound is expected by the year’s end, driven by inventory adjustments and promotional activities.

For businesses, economic constraints have reduced immediate willingness to invest in new PCs. The European Central Bank’s expected interest rate hikes compound this. However, companies need to equip their employees with suitable PCs to maintain productivity, especially in the era of remote and hybrid work. As a result, many companies are considering device-as-a-service (DaaS) models to keep IT investments flexible, which could support long-term shipment volumes as it promotes regular device upgrades and added value from associated services. A majority of EMEA channel partners polled by Canalys anticipate their DaaS revenues to grow in 2023.

| Vendor | Q1’23 Shipments (000’s) | Q1’23 Market Share (%) | Q1’22 Shipments (000’s) | Q1’22 Market Share (%) | Annual Growth (%) |

|---|---|---|---|---|---|

| Lenovo | 2,632 | 26.4 | 4,119 | 26.0 | -36.1 |

| HP | 2,540 | 25.4 | 3,924 | 24.8 | -35.3 |

| Apple | 1,456 | 14.6 | 1,791 | 11.3 | -18.8 |

| Dell | 1,313 | 13.1 | 2,213 | 14.0 | -40.7 |

| Asus | 659 | 6.6 | 974 | 6.1 | -32.4 |

| Others | 1,389 | 13.9 | 2,823 | 17.8 | -50.8 |

| Total | 9,989 | 100.0 | 15,844 | 100.0 | -37.0 |

Looking to the future, Canalys expects the PC market to recover and exhibit sequential growth for the rest of 2023. By 2024, each segment is predicted to see double-digit growth due to demand recovery and postponed purchases. Additionally, as the end-of-life for Windows 10 approaches in late 2025, the transition to Windows 11 will likely be a key factor driving device upgrades, particularly for businesses. As of Q1’23, over a third of EMEA channel partners reported that Windows 11 is a major factor boosting their PC sales.