IDC record the eighth consecutive quarter of steady growth for the global wearable market in Q1’15 – before the debut of the Apple Watch. Shipments grew 200% YoY, to 11.4 million units (from 3.8 million).

Wearables performed against the first-quarter decline seen in most markets. IDC analyst Ramon Llamas said that this, “demonstrates growing end-user interest and the vendors’ ability to deliver a diversity of devices and experiences. In addition, demand from emerging markets is on the rise and vendors are eager to meet these new opportunities”.

How the market will change with Apple’s entry remains to be seen. IDC expects that the Apple Watch will become the device that other wearables are measured against – fairly or not.

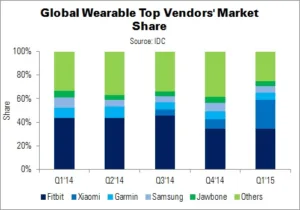

Price erosion has been “quite drastic”, IDC’s Jitesh Ubrani said, as with any young market. More than 40% of devices now cost under $100: one of the factors in the top five vendors increasing their combined share from two-thirds of the market in Q4’14 to three-quarters in Q1’15. Apple’s entry will test consumers’ willingness to pay a premium.

Vendors in the market are very different from those that we normally cover in Display Monitor. Fitbit was the clear leader, with shipments driven by three devices: (the Charge, Charge HR and Surge), as well as continued demand for older models. Fitbit’s products address multiple market segments.

| Top Five Wearable Vendors’ Shipments, Market Share and Growth, Q1’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Change |

| Fitbit | 3.9 | 1.7 | 34.2% | 44.7% | 129.4% |

| Xiaomi | 2.8 | 0.0 | 24.6% | 0.0% | N/A |

| Garmin | 0.7 | 0.3 | 6.1% | 7.9% | 133.3% |

| Samsung | 0.6 | 0.3 | 5.3% | 7.9% | 100.0% |

| Jawbone | 0.5 | 0.2 | 4.4% | 5.3% | 150.0% |

| Others | 2.9 | 1.3 | 25.4% | 34.2% | 123.1% |

| Total | 11.4 | 3.8 | 100.0% | 100.0% | 200.0% |

| Source: IDC | |||||

Xiaomi came in second place, passing the 1 million unit mark with its Mi Band – which only began shipping in Q2’14. Shipments were primarily in China, but Xiaomi is seeking to grow worldwide.

Third place belonged to Garmin, whose portfolio spans multiple areas. Samsung was in fourth, thanks to worldwide demand for the Gear smartwatches. The Gear portfolio has diversified since it was launched in 2013, spanning six devices. However, the products are limited as they can only connect to high-end Samsung smartphones.

Jawbone came in fifth place, beating Pebble and Sony. Jawbone is expected to release two new devices in Q2’15: the UP2 and UP3. The company continued to produce products without a display.