In 2023, worldwide shipments of wearable devices are predicted to recover after experiencing their first decline in 2022. New data from the International Data Corporation (IDC) suggests a 2.4% year-over-year growth, totaling 504.1 million units. This resurgence is mainly credited to ongoing demand for existings products, specifically earwear and smartwatches.

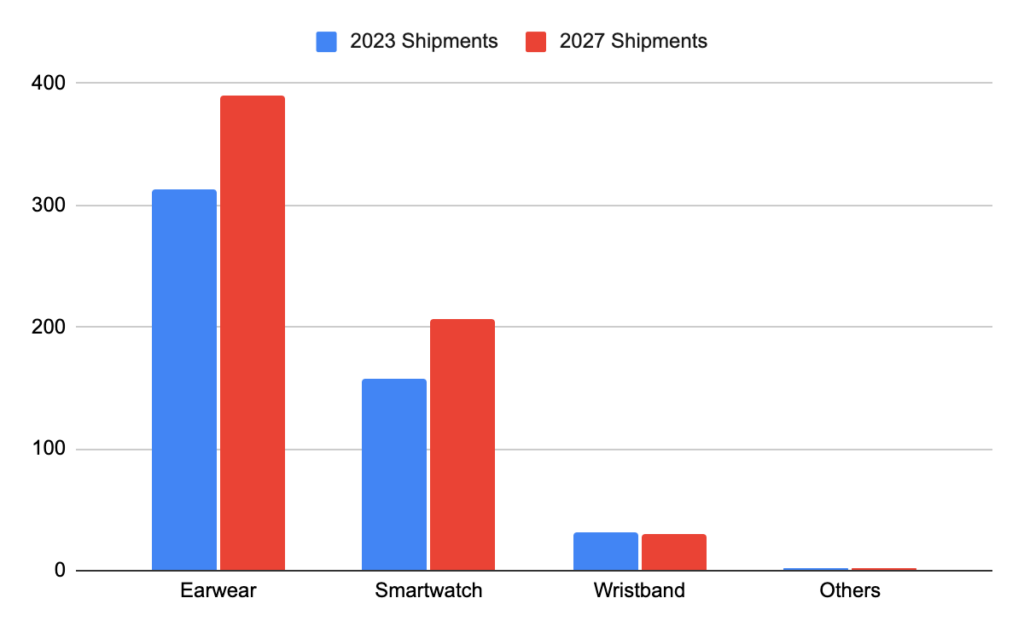

Earwear is predicted to dominate the market for the forecast period as new and current users continue to show interest. Demand for smartwatches is also anticipated to rise as users transition from wristbands to more advanced timepieces. However, wristbands are unlikely to vanish entirely from the market due to their appeal for simpler solutions. Other wearable categories like clothing, rings, and non-AR/VR glasses are expected to witness a slight uptick, albeit from a smaller base.

The mature markets like North America and Europe will majorly rely on replacement purchases, while the growth in emerging markets is likely to be driven by first-time buyers. India has already surpassed the United States and China in market size and will maintain its position thanks to an array of affordable, feature-packed devices from local vendors.

Apart from India, other Asian countries, along with regions in the Middle East and Africa, are expected to lead in shipment growth. China and the United States are projected to remain the second and third largest markets, respectively. As the wearable technology market recovers and continues to expand, it indicates an exciting time for the tech industry, with growth opportunities particularly prominent in emerging markets.

| Product | 2023 Shipments | 2023 Market Share | 2027 Shipments | 2027 Market Share | 2022-2027 CAGR |

| Earwear | 313 | 62.10% | 390.6 | 62.10% | 4.90% |

| Smartwatch | 157.3 | 31.20% | 206.2 | 32.80% | 6.80% |

| Wristband | 32.1 | 6.40% | 30.1 | 4.80% | -3.00% |

| Others | 1.7 | 0.30% | 2.5 | 0.40% | 8.40% |

| Total | 504.1 | 100.00% | 629.4 | 100.00% | 5.00% |