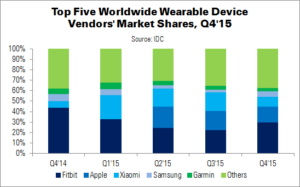

The worldwide wearable market jumped forward in Q4’15, says IDC, due to the rising popularity of fitness trackers and the Apple Watch. 27.4 million units were shipped in Q4, 126.9% higher than Q4’14. For the full year, vendors shipped 78.1 million units: an even more significant increase of 171.6% YoY.

“Triple-digit growth…shows that wearables are not just for the technophiles and early adopters”, said IDC research manager Ramon Llamas. “Wearables can exist and are welcome in the mass market”. He adds, “[S]ince wearables have yet to fully penetrate the mass market, there is still plenty of room for growth in multiple vectors: new vendors, form factors, applications, and use cases”.

However, Llamas warns that the industry can only get so far with “me too” and “copycat” devices. End users expect improvements from existing devices, and new applications to spur replacement and increased adoption. Historical data (steps taken, calories burned) has been a good start; prescriptive data, such as what else a user can do to live a healthier life, “will push wearables further”, Llamas said.

Top wearables market is not only smartwatches and fitness bands. Although the top five brands dominate with wrist-worn devices, there has been “an immense amount of growth” in other form factors, said IDC’s Jitesh Ubrani. These include clothing, footwear and eye wear.

| Top Five Wearable Vendors’ Shipments, Share and Growth, Q4’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q4’15 Unit Shipments | Q4’14 Unit Shipments | Q4’15 Share | Q4’14 Share | YoY Change |

| Fitbit | 8.1 | 5.3 | 29.5% | 43.9% | 52.8% |

| Apple | 4.1 | 0.0 | 15.0% | 0.0% | N/A |

| Xiaomi | 2.7 | 0.7 | 9.7% | 6.2% | 258.5% |

| Samsung | 1.3 | 0.8 | 4.9% | 6.7% | 65.0% |

| Garmin | 1.0 | 0.6 | 3.5% | 5.3% | 48.2% |

| Others | 10.3 | 4.6 | 37.4% | 38.0% | 123.7% |

| Total | 27.4 | 12.1 | 100.0% | 100.0% | 126.9% |

| Source: IDC | |||||

Market leader Fitbit remained the undisputed top vendor, with almost double the shipments of second-place Apple. Fitbit continues to benefit from a well-segmented product portfolio, a fast-growing corporate wellness programme and worldwide market reach. This year the company is holding on to its fitness-tracking experience, while also expanding into smartwatches (Fitbit Blaze) and fashion-oriented wristbands (Fitness Alta).

Apple’s Watch distribution rose, driving the company’s ‘Other Products’ revenue in Q4. However, volumes were up only slightly QoQ, and total revenues have not yet countered the company’s slowing growth and revenue declines in other categories. Expectations are higher for the product’s next generation.

Xiaomi was in third place, despite mainly selling its products in China (where its prices, as low as $11, are well below the competition). The vendor enjoyed the largest annual improvement of any top five vendor: 258.5%. However, although the company is satisfying several market segments, it has still not distinguished itself with product features.

Samsung came in fourth place, just ahead of Garmin. The Gear S2 smartwatch drove volumes, as well as legacy devices like the Gear S and Gear Fit. Samsung has also begun to experiment with new form factors, like a smart belt and NFC-connected suit, says IDC.

Garmin has a long history with wearables, keeping it in the top five. Like Fitbit, the company has a well-segmented portfolio of devices, addressing multiple markets. Recently, Garmin announced an augmented reality display that can be attached to a pair of sunglasses, for cyclists (we’ll have more on this in our MWC report, next week).

| Top Five Wearable Vendors’ Shipments, Share and Growth, 2015 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2014 Unit Shipments | 2015 Share | 2014 Share | YoY Change |

| Fitbit | 21.0 | 10.9 | 26.9% | 37.9% | 93.2% |

| Xiaomi | 12.0 | 1.1 | 15.4% | 4.0% | 951.8% |

| Apple | 11.6 | 0.0 | 14.9% | 0.0% | N/A |

| Garmin | 3.3 | 2.0 | 4.2% | 7.1% | 60.9% |

| Samsung | 3.1 | 2.7 | 4.0% | 9.2% | 18.5% |

| Others | 27.0 | 12.0 | 34.5% | 41.9% | 124.0% |

| Total | 78.1 | 28.8 | 100.0% | 100.0% | 171.6% |

| Source: IDC | |||||

Analyst Comment

Other research firms have released their own wearable data recently. Strategy Analytics, for example, notes that Q4’15 was the first time that smartwatches outsold traditional Swiss watches. (TA)