The challenges facing makers of head-worn virtual and augmented reality devices are underlined in the latest forecast from technology analyst firm CCS Insight.

Despite early enthusiasm and a continued expectation of significant long-term potential for the technology, CCS Insight believes there is still significant work to be done to improve the user experience, software platforms and content availability. This sober yet positive message is the main conclusion of the company’s recently published global market report for VR and AR devices.

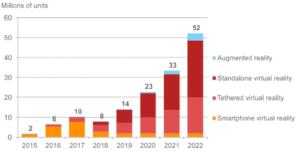

CCS Insight expects that slightly less than 8 million AR and VR devices will be sold in 2018, growing to 14 million in 2019 and to 52 million in 2022. CCS Insight’s chief of research, Ben Wood, comments, “We continue to believe that content is the key to unlocking adoption of VR. Although some games companies and adult content creators have embraced VR technology, much more needs to happen to persuade consumers that VR devices are a must-have item”.

Shipments of VR and AR devices, worldwide, 2015-2022

Source: CCS Insight VR and AR forecast (November 2018)>

The market for VR has gone through several phases, according to CCS Insight. Wood observes, “The first wave of consumers used basic cardboard viewers, which helped them understand the potential of the media, but the limited experience meant most people quickly lost interest. We don’t even include such devices in our forecast anymore”. He continues, “Attention then turned to smartphone-based devices such as the Samsung Gear VR and the Zeiss One Plus VR. These devices have played an important role in raising the awareness of the technology over the past three years, but interest in these devices has now waned”.

This is reflected in CCS Insight’s forecast, which shows a dramatic drop in sales of smartphone VR devices, from close to 8 million units in 2017 to fewer than 3 million this year. This steep decline has occurred despite heavy price cuts and extensive promotions over the past 12 months.

Wood notes, “We believe the device market has now shifted away from the early wave of cheaper, less-functional cardboard and plastic smartphone VR viewers. We expect the next wave of adoption to come from dedicated devices that offer a more compelling, wire-free experience”.

CCS Insight believes the advent of standalone VR headsets will help reinvigorate the product category. All-in-one devices overcome the inconvenience of being attached to a PC, smartphone or games console, and so deliver a better VR experience. The company believes devices such as Facebook’s Oculus Go and Oculus Quest, which are being offered at a retail prices of $200 and $400 respectively, are good examples of the future of VR. Wood notes: “The Chinese market is looking particularly promising and Facebook’s partnership with Xiaomi has certainly helped standalone VR headsets make a strong start in China”.

CCS Insight expects standalone devices to be the key driver of VR adoption in the next few years by both consumers and businesses. Its latest forecast shows demand will grow over 16 times between 2018 and 2022 when 29 million standalone VR headsets are forecast to be sold.

While there is much excitement about standalone devices, CCS Insight still believes there is an important role to be played by tethered devices like the Sony PlayStation VR, HTC Vive or Oculus Rift. These devices, which require additional computing equipment or a games console, will remain an important part of the market, especially as they become wireless.

CCS Insight forecasts that 5 million tethered VR headsets will be sold in 2019, growing to 18 million in 2022. These devices are well suited to meet the needs of the most dedicated gamers, who want a best-in-class experience. Sony, which CCS Insight considers as the most successful manufacturer of tethered VR headsets to date, looks set to continue with its strategy of offering its VR headset as an accessory to the large number of PlayStation owners.

CCS Insight’s latest forecast also assesses the market for AR smart glasses. These have seen significantly slower adoption than their VR cousins, but interest remains high. The main use for AR devices continues to be in business operations such as customer service, logistics, remote servicing, design and other related applications.

Businesses have taken a cautious approach to AR devices, initially focusing on pilot deployments, but CCS Insight believes there are signals of growth. Wood comments, “We are seeing a rising number of companies committing to deployments of tens or hundreds of augmented reality glasses as they start to see the clear benefits of head-worn technology in the workplace”. However, he cautions, “Despite this gathering momentum we still think it will take time for the AR device market to grow. We don’t expect cumulative sales to exceed 1 million worldwide before 2021”.

When thinking about AR glasses for consumers, Wood notes that these devices continue to be “more common in science fiction than in real life” with little evidence of a product with mass-market appeal any time soon. Nevertheless, CCS Insight’s long-range forecast does include a scenario of accelerated adoption if a major consumer brand like Apple decides to enter the market.