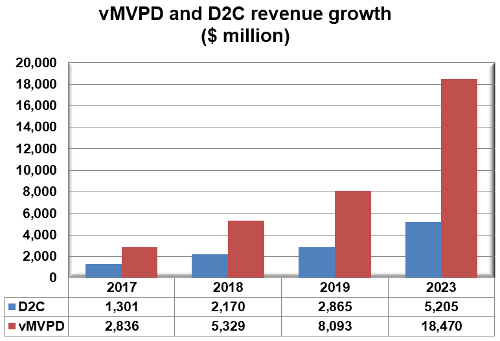

vMVPD and D2C revenues will reach $24 billion by 2023 – eight times the $3 billion recorded in 2017, according to the vMVPD and D2C TV Forecasts report.

vMVPD will overshadow D2C with its revenues more than triple the D2C total by 2023 in the 17 countries covered in the report. vMVPD and D2C are not mutually exclusive. Many vMVPD platforms provide access to D2C platforms for an additional fee.

The US will supply $12.34 billion in vMVPD revenues by 2023 – or two-thirds of the total. The only other country to earn more than $1 billion by 2023 will be the UK.

Simon Murray, Principal Analyst at Digital TV Research, said: “We forecast 77 million vMVPD subscribers by 2023, up from 21 million at end-2017. The US will contribute 28 million to the 2023 total, with India supplying 16 million.”

Digital TV Research forecasts 44 million D2C subscribers by 2023; up from 14 million at end-2017. The US will account for 25 million D2C subs by 2023.

Different types of SVOD platforms

| vMVPD | Virtual multichannel video programming distributor. A platform that provides linear channels and on-demand content from multiple sources. Standalone subscription platform. |

| Direct-to-consumer | Where a single content owner provides a subscription platform straight to the home. |

| Aggregator | Where an operator provides its pay TV subs with access to a choice of SVOD platforms without charging a subscription. Popular in Latin America. Sometimes offer D2C platforms cheaper than elsewhere |

| On-demand |

No linear channels – just on-demand titles. Therefore, no threat to traditional pay TV operators. Examples include Netflix. |

Source: Digital TV Research