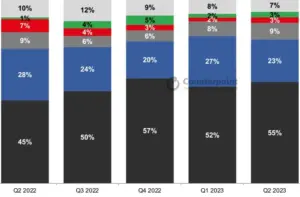

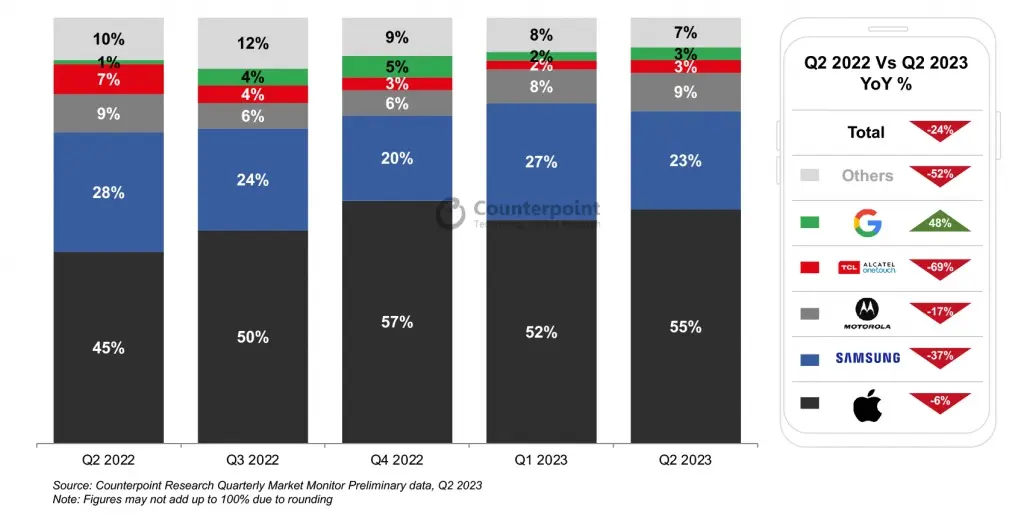

US smartphone shipments declined 24% year-over-year (YoY) in the second quarter of 2023, as reported by Counterpoint Research’s Market Monitor data. This marks the third consecutive quarter of YoY declines. Android brands such as Samsung, Motorola, and TCL-Alcatel experienced the steepest drops in shipments, while Apple’s shipments showed greater resilience, leading to an increase in its share of shipments compared to the previous year.

The tepid consumer demand for smartphones in Q2’23 led to an early summer slump in sales. Despite favorable inflation numbers and ongoing strength in the job market, consumers hesitated to upgrade their devices due to market uncertainty. Counterpoint expects this trend to persist throughout Q3’23. However, there are optimistic expectations regarding the upcoming iPhone 15, which is anticipated to boost demand.

In the midst of the overall decline in shipments, specific segments of the US smartphone market showed positive signs. Notably, the foldable market achieved important milestones during the quarter. Motorola launched its first foldable device in the US since 2021, called the Razr+, while Google introduced its first-ever foldable, the Pixel Fold, providing viable alternatives to Samsung’s Galaxy foldables. With the upcoming release of new Galaxy Z Flip and Z Fold devices from Samsung in Q3’23, the foldable market is expected to reach its highest shipment levels ever in the US.

Despite facing fewer shipments compared to the same quarter the previous year, Apple’s share of shipments increased by 10% YoY. This was primarily driven by strong promotions across postpaid and prepaid segments. Major carriers such as Verizon, AT&T, and T-Mobile offered generous promo credits, exceeding $800, for the iPhone 14. Older iPhone models were heavily discounted in the prepaid market. Trade-in credits also reached new highs, with Verizon offering up to $1,100 for the Pixel Fold. Google’s Pixel also made gains, especially with the launch of its older-generation Pixel 6a in the prepaid channel to compete with the iPhone 11.

Regarding carriers, both AT&T and T-Mobile reported positive net adds, while Verizon experienced negative net adds within its consumer segment for the second consecutive quarter. Although the net-add activity remained comparable to the previous year, lower upgrade rates contributed to overall demand weakness. Additionally, near-record low churn rates affected new device sales. It is expected that there will be a continuation of demand weakness at the start of Q3’23, but the expected strong demand for the iPhone 15 is likely to offset this weakness in the Android market.