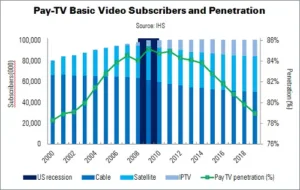

IHS’ data regarding the US pay-TV market shows that cable operators cut their subscriber losses in Q1’15, while IPTV and satellite growth slowed. Cable companies lost 132,900 subscribers QoQ in Q1.

Erik Brannon, TV media analyst at IHS, writes that cable’s strong performance shows that the maturation of the US pay-TV market is almost complete. Significant gains for telco IPTV players are ending and cable companies are reducing churn. The cable industry is offering high-speed data and bundles, but better execution and technological developments are also playing their role in lowering subscriber losses.

Despite cable’s performance, cord-cutting is expected to continue in the USA. The number of TV households in the country without a pay-TV subscription will grow from 18.6 million in 2008 to 26.7 million in 2019. Pay-TV households will fall from 101 million in 2014 to 100.3 million in 2019.

“This decline does not signal the death of the pay TV business, as gains in average revenue per user are likely to keep video revenue on a slow-growth trajectory”, said Brannon. “Even so, the number of pay TV households in the United States is forecast to remain fairly flat, as pay TV OTT solutions become more attractive”.