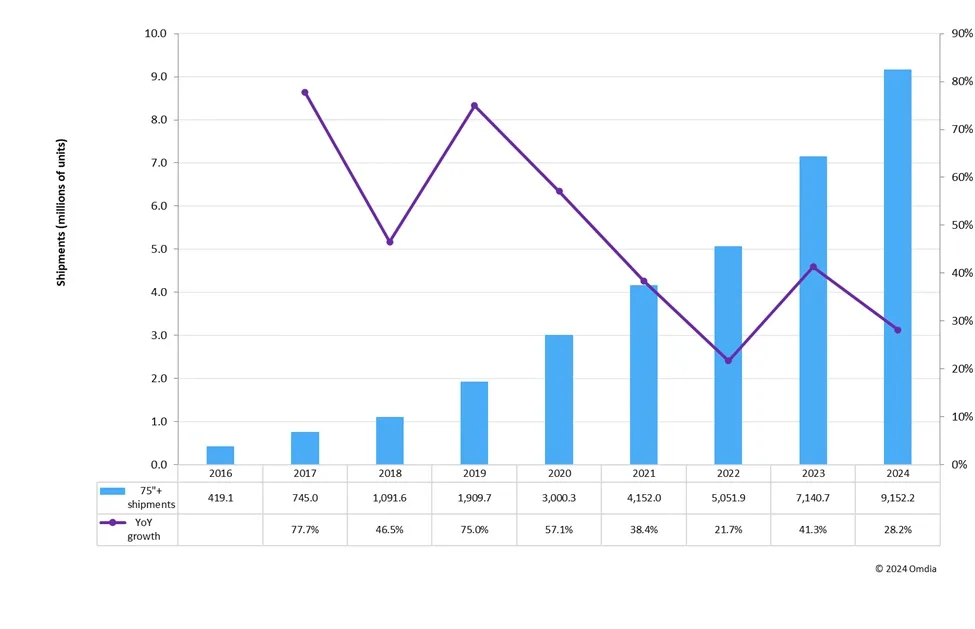

In a recent market analysis, Richard Wu at Omdia forecasts that shipments of ultra-large TFT LCD panels, measuring 75 inches and above, will experience a significant 28.2% year-on-year growth in 2024. This surge follows an already impressive 41.3% increase in 2023, with shipments reaching 7.1 million units, up from 5.1 million in 2022.

The ultra-large display market is dominated by four key sizes: 85, 86, 98, and 100 inches. These sizes accounted for 97% of all ultra-large display shipments in 2023, and their share is expected to climb to 99% in 2024. Among these, the 98- and 100-inch panels are witnessing the most rapid growth, with shipments soaring by 144.5% year-on-year to 0.64 million units in 2023. Omdia projects that this momentum will continue, with a further 76.5% increase in 2024, reaching 1.13 million units.

Panel manufacturers are strategically focusing on ultra-large displays for several reasons. Firstly, producing larger panels allows for more efficient capacity utilization in their Gen 8.5 and Gen 8.6 fabs. Secondly, these larger panels generate higher revenue compared to smaller mainstream sizes like 32, 50, and 55 inches. Furthermore, Chinese panel makers, lacking high-generation OLED fab capacities, are leveraging ultra-large TFT LCD panels to compete with South Korean manufacturers in the high-end TV display market.

The production of ultra-large panels is not limited to Gen 8.5 and Gen 8.6 fabs; panel makers are also utilizing their Gen 10.5 fabs to expand their offerings. Recent examples include Hisense’s 110-inch LCD TV showcased at CES 2024 and TCL’s 115-inch LCD TV sets released in the Chinese market during the Double 12 sales event.

On the demand side, TV brands are attracted to the higher average selling prices and revenue potential of ultra-large-sized TV products, particularly in the face of intense competition in the mainstream size market.